Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Donna turned 72 on January 7th of Year 2 (which is before the year 2020). Her profit-sharing account balance was $100,000 at the end

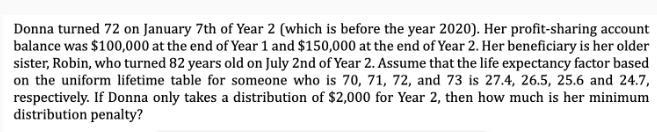

Donna turned 72 on January 7th of Year 2 (which is before the year 2020). Her profit-sharing account balance was $100,000 at the end of Year 1 and $150,000 at the end of Year 2. Her beneficiary is her older sister, Robin, who turned 82 years old on July 2nd of Year 2. Assume that the life expectancy factor based on the uniform lifetime table for someone who is 70, 71, 72, and 73 is 27.4, 26.5, 25.6 and 24.7, respectively. If Donna only takes a distribution of $2,000 for Year 2, then how much is her minimum distribution penalty?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Given Here is account balance beginning is 150000 and l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started