Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Don't copy and paste from other people's answer for a thumbs up LO.2, 3,4,5,7,8 Bart and Elizabeth Forrest are married and have no dependents. They

Don't copy and paste from other people's answer for a thumbs up

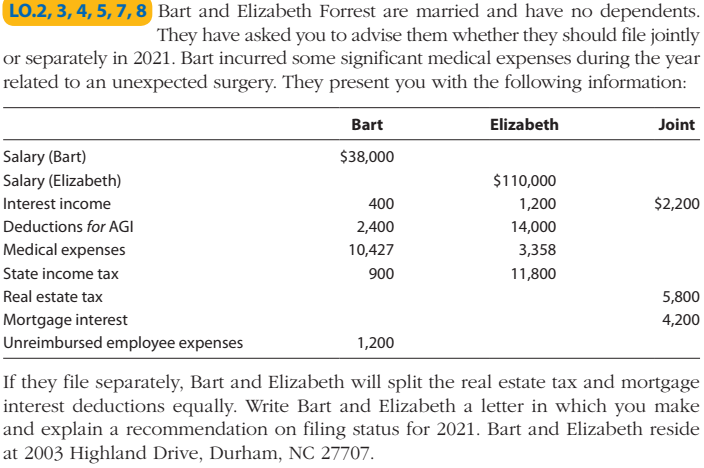

LO.2, 3,4,5,7,8 Bart and Elizabeth Forrest are married and have no dependents. They have asked you to advise them whether they should file jointly or separately in 2021. Bart incurred some significant medical expenses during the year related to an unexpected surgery. They present you with the following information: If they file separately, Bart and Elizabeth will split the real estate tax and mortgage interest deductions equally. Write Bart and Elizabeth a letter in which you make and explain a recommendation on filing status for 2021. Bart and Elizabeth reside at 2003 Highland Drive, Durham, NC 27707Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started