Answered step by step

Verified Expert Solution

Question

1 Approved Answer

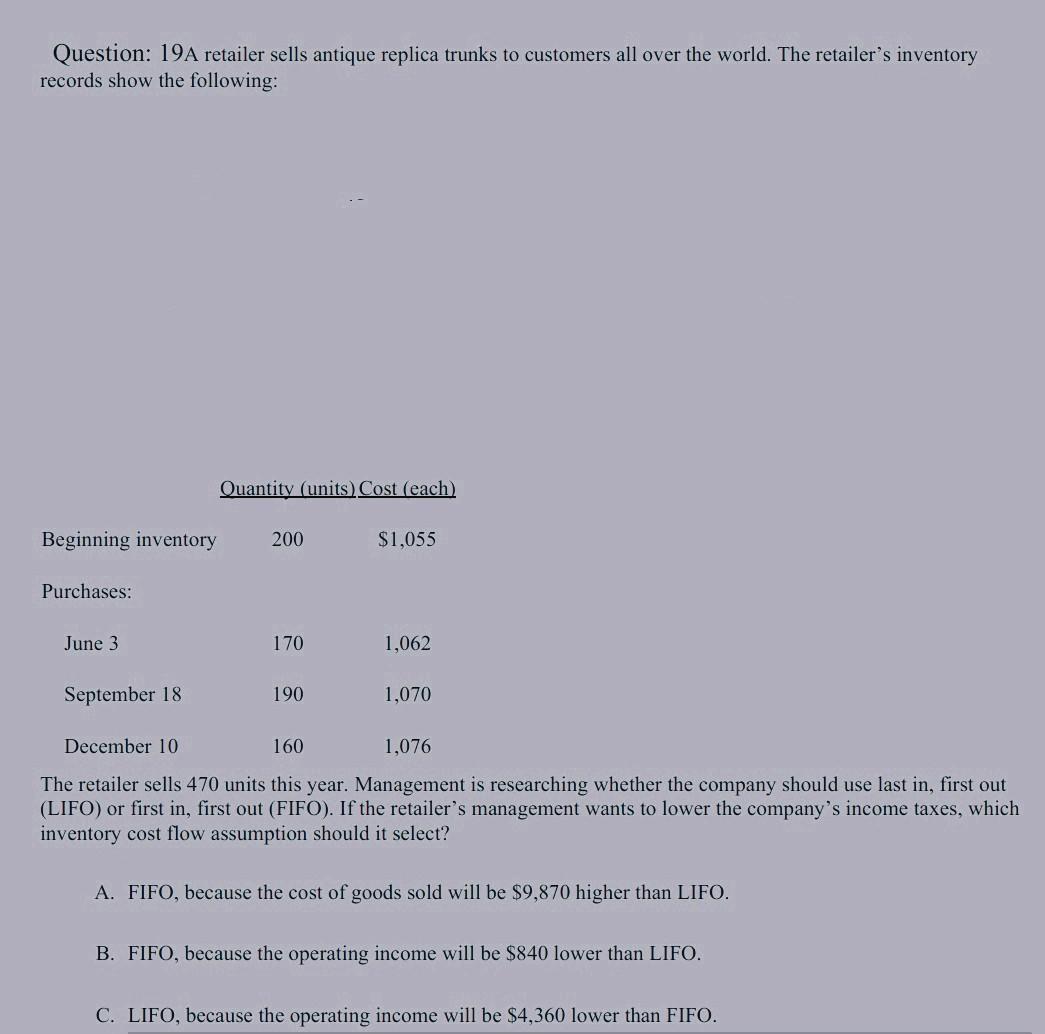

don't copy from other sources already checked that. Question: 19A retailer sells antique replica trunks to customers all over the world. The retailer's inventory records

don't copy from other sources already checked that.

Question: 19A retailer sells antique replica trunks to customers all over the world. The retailer's inventory records show the following: Quantity (units) Cost (each) Beginning inventory 200 $1,055 Purchases: June 3 170 1,062 September 18 190 1,070 December 10 160 1,076 The retailer sells 470 units this year. Management is researching whether the company should use last in, first out (LIFO) or first in, first out (FIFO). If the retailer's management wants to lower the company's income taxes, which inventory cost flow assumption should it select? A. FIFO, because the cost of goods sold will be $9,870 higher than LIFO. B. FIFO, because the operating income will be $840 lower than LIFO. C. LIFO, because the operating income will be $4,360 lower than FIFOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started