Answered step by step

Verified Expert Solution

Question

1 Approved Answer

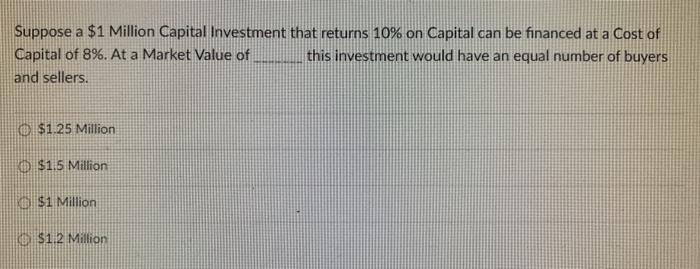

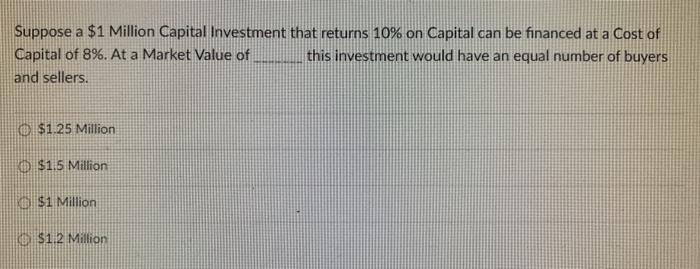

Don't have to show work Suppose a $1 Million Capital Investment that returns 10% on Capital can be financed at a cost of Capital of

Don't have to show work

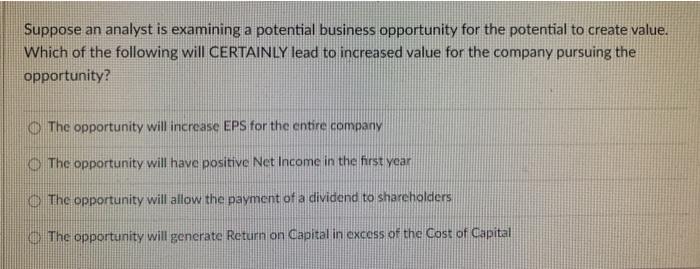

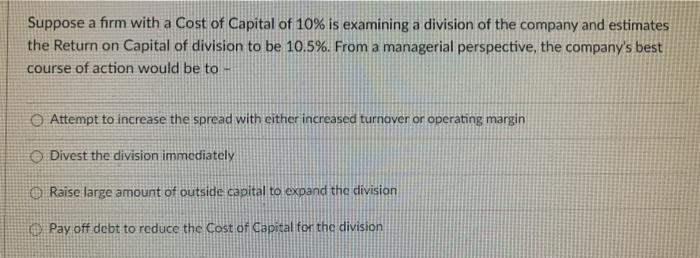

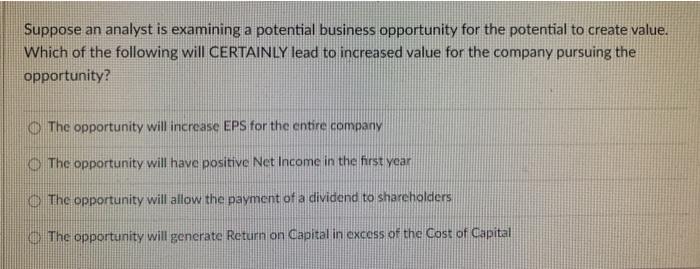

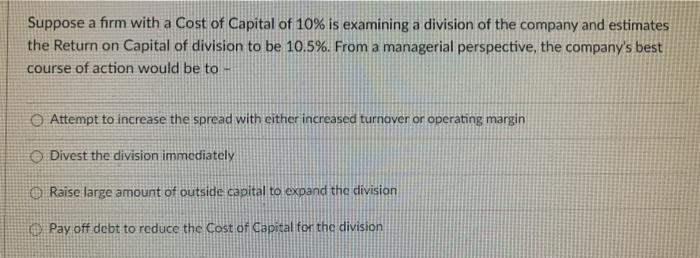

Suppose a $1 Million Capital Investment that returns 10% on Capital can be financed at a cost of Capital of 8%. At a Market Value of this investment would have an equal number of buyers and sellers. $1.25 Million KD $1.5 Million $1 Million $112 Million Suppose an analyst is examining a potential business opportunity for the potential to create value. Which of the following will CERTAINLY lead to increased value for the company pursuing the opportunity? The opportunity will increase EPS for the entire company The opportunity will have positive Net Income in the first year The opportunity will allow the payment of a dividend to shareholders @ The opportunity will generate Return on Capital in excess of the Cost of Capital Suppose a firm with a Cost of Capital of 10% is examining a division of the company and estimates the Return on Capital of division to be 10.5%. From a managerial perspective, the company's best course of action would be to Attempt to increase the spread with either increased turnover or operating margin Divest the division immediately Raise large amount of outside capital to expand the division TO Pay off debt to reduce the cost of Capital for the division

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started