Answered step by step

Verified Expert Solution

Question

1 Approved Answer

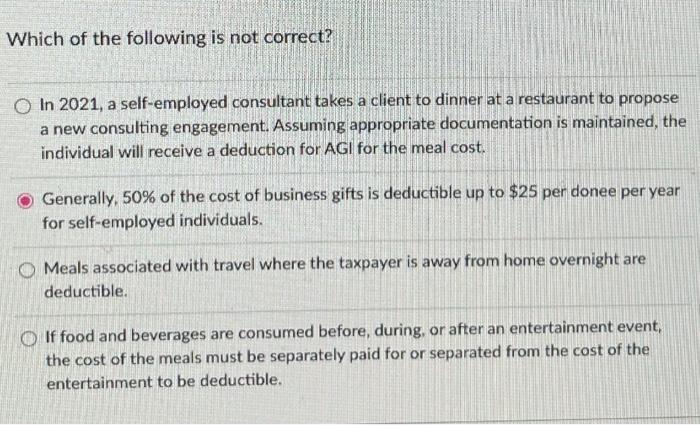

dont know please help Which of the following is not correct? O In 2021, a self-employed consultant takes a client to dinner at a restaurant

dont know please help

Which of the following is not correct? O In 2021, a self-employed consultant takes a client to dinner at a restaurant to propose a new consulting engagement. Assuming appropriate documentation is maintained, the individual will receive a deduction for AGI for the meal cost. Generally, 50% of the cost of business gifts is deductible up to $25 per donee per year for self-employed individuals, O Meals associated with travel where the taxpayer is away from home overnight are deductible. If food and beverages are consumed before, during, or after an entertainment event, the cost of the meals must be separately paid for or separated from the cost of the entertainment to be deductible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started