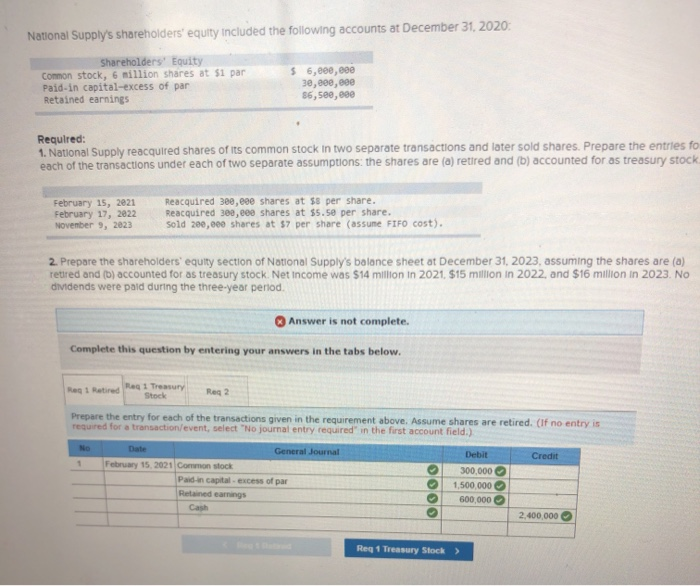

Don't know why it is saying " Answer is not complete"

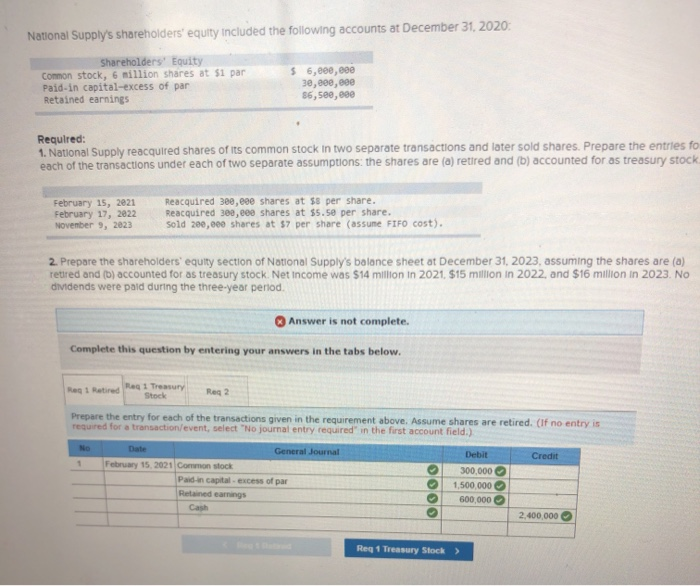

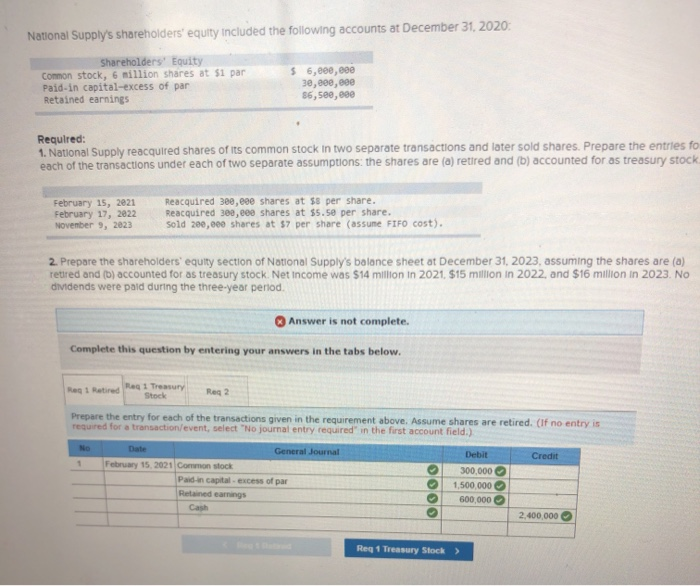

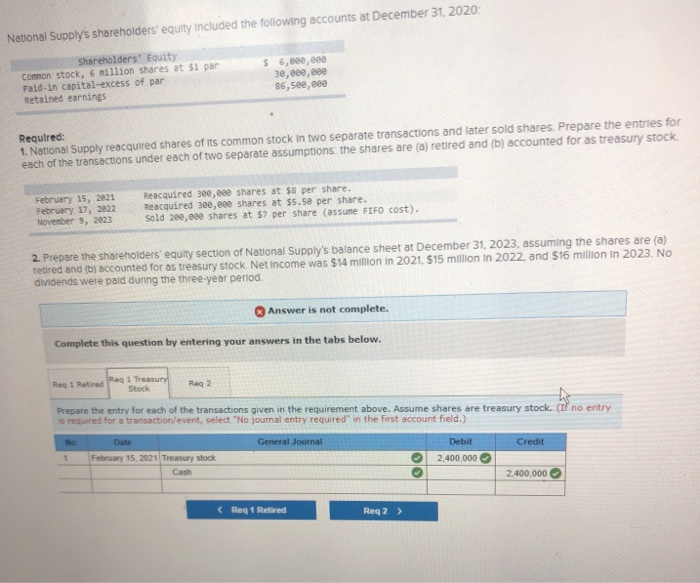

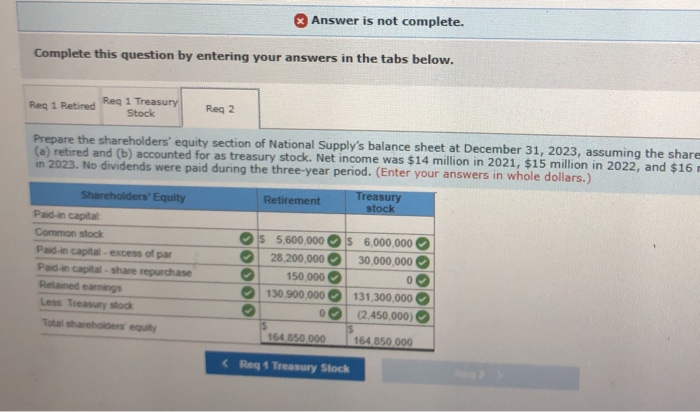

National Supply's shareholders' equity included the following accounts at December 31, 2020: $ Shareholders' Equity Common stock, 6 million shares at $1 par Paid-in capital-excess of par Retained earnings 6,eee, 600 30, see, eee 86,500,eee Required: 1. National Supply reacquired shares of its common stock in two separate transactions and later sold shares. Prepare the entries fo each of the transactions under each of two separate assumptions: the shares are (a) retired and (b) accounted for as treasury stock February 15, 2021 February 17, 2022 November 9, 2023 Reacquired 300,eee shares at $8 per share. Reacquired 300, eee shares at $5.50 per share. Sold 200,000 shares at 57 per share (assume FIFO cost). 2. Prepare the shareholders' equity section of National Supply's balance sheet at December 31, 2023. assuming the shares are (a) retired and (b) accounted for as treasury stock. Net Income was $14 million in 2021. $15 million in 2022, and $16 million in 2023. No dividends were paid during the three-year period Answer is not complete. Complete this question by entering your answers in the tabs below. R R R 1 Treasury Stock Prepare the entry for each of the transactions given in the requirement above. Assume shares are retired. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) General Journal Credit 1 February 15, 2021 common stock Paid in capital excess of par Debit 300,000 1,500,000 600,000 Reted earnings 2,400,000 Reg 1 Treasury Stock > National Supply's shareholders' equity included the following accounts at December 31, 2020: $ Shareholders' Equity Common stock, 6 million shares at $1 par Paid in capital-excess of par Retained earnings 5,000, eee 3e, eee, see 86,50e, see Required: 1. National Supply reacquired shares of its common stock in two separate transactions and later sold shares. Prepare the entries for each of the transactions under each of two separate assumptions: the shares are (a) retired and (b) accounted for as treasury stock February 15, 2021 February 17, 2022 November 9, 2023 Reacquired 3ee,eee shares at sa per share. Reacquired 300,600 shares at $5.50 per share. Sold 20,00 shares at 57 per share (assume FIFO cost). 2. Prepare the shareholders' equity section of National Supply's balance sheet at December 31, 2023, assuming the shares are (a) retired and (b) accounted for as treasury stock. Net Income was $14 million in 2021, $15 million in 2022, and $16 million in 2023. No dividends were paid during the three-year period. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1 Retired Reg 1 Treasury Stock Reg 2 Prepare the entry for each of the transactions given in the requirement above. Assume shares are treasury stock. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) No Date General Journal Debit Credit February 15, 2021 Treasury stock 2,400,000 2.400,000 ( Req 1 Retired Reg 2 > Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1 Retired Reg 1 Treasury Stock Reg 2 Prepare the shareholders' equity section of National Supply's balance sheet at December 31, 2023, assuming the share (a) retired and (b) accounted for as treasury stock. Net income was $14 million in 2021, $15 million in 2022, and $16 in 2023. No dividends were paid during the three-year period. (Enter your answers in whole dollars.) Retirement Treasury stock Shareholders' Equity Paid in capital Common stock Paid in capital excess of par Pada capital share repurchase Reted earnings Less Treasury stock Total shareholders equity s 5,600,000 28,200,000 150.000 130.900.000 0 $ 6,000,000 30,000,000 0 131.300.000 (2.450,000) 164 850 000 164 850.000