Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dont need to show work, if answer is correct, I will give a like. 1 You are a manager at Northern Fibro, which is considering

Dont need to show work, if answer is correct, I will give a like.

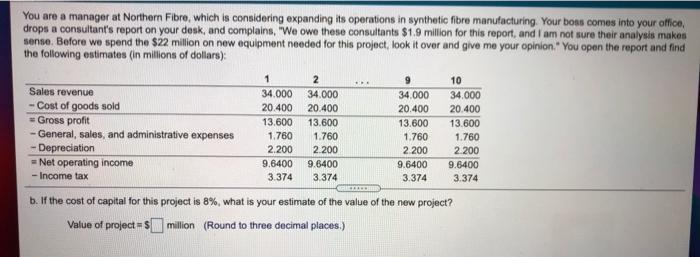

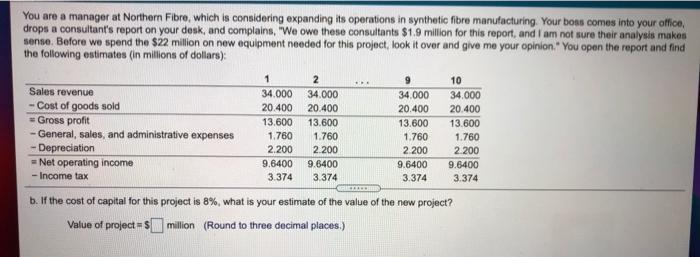

1 You are a manager at Northern Fibro, which is considering expanding its operations in synthetic fibre manufacturing Your bons comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.9 million for this report, and I am not sure their analysis makes sense. Before we spend the $22 million on new equipment needed for this project, look it over and give me your opinion. You open the report and find the following estimates (in millions of dollars) 2 10 Sales revenue 34.000 34.000 34.000 34.000 - Cost of goods sold 20.400 20.400 20.400 20.400 Gross profit 13.600 13.600 13.600 13.600 - General, sales, and administrative expenses 1.760 1.760 1.760 1.760 - Depreciation 2.200 2.200 2 200 2 200 = Net operating income 9.6400 9.6400 9.6400 9.6400 - Income tax 3.374 3.374 3.374 3.374 b. If the cost of capital for this project is 8%, what is your estimate of the value of the new project? Value of project = $ million (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started