Don't understand why this is incorrect, work attached

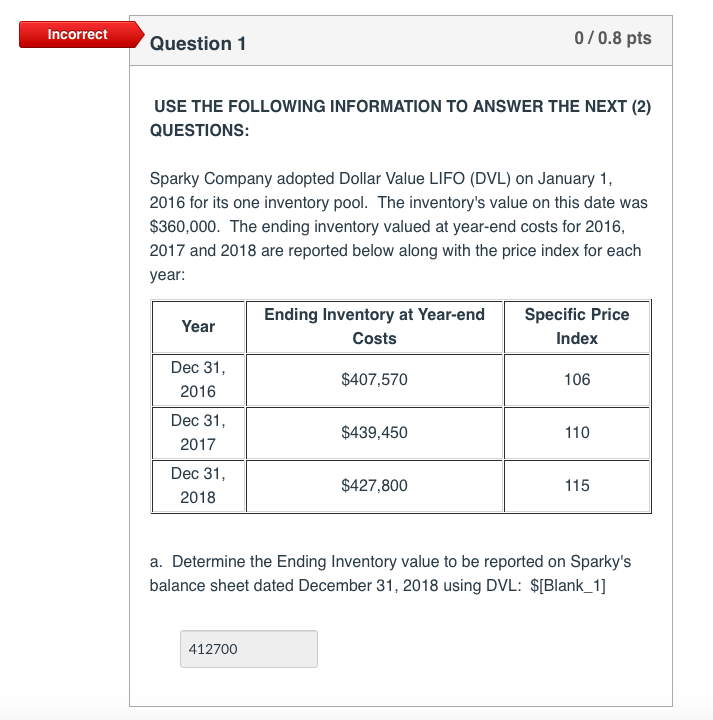

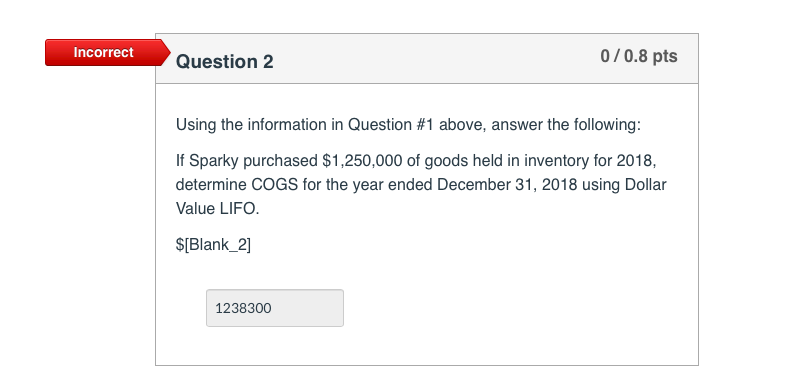

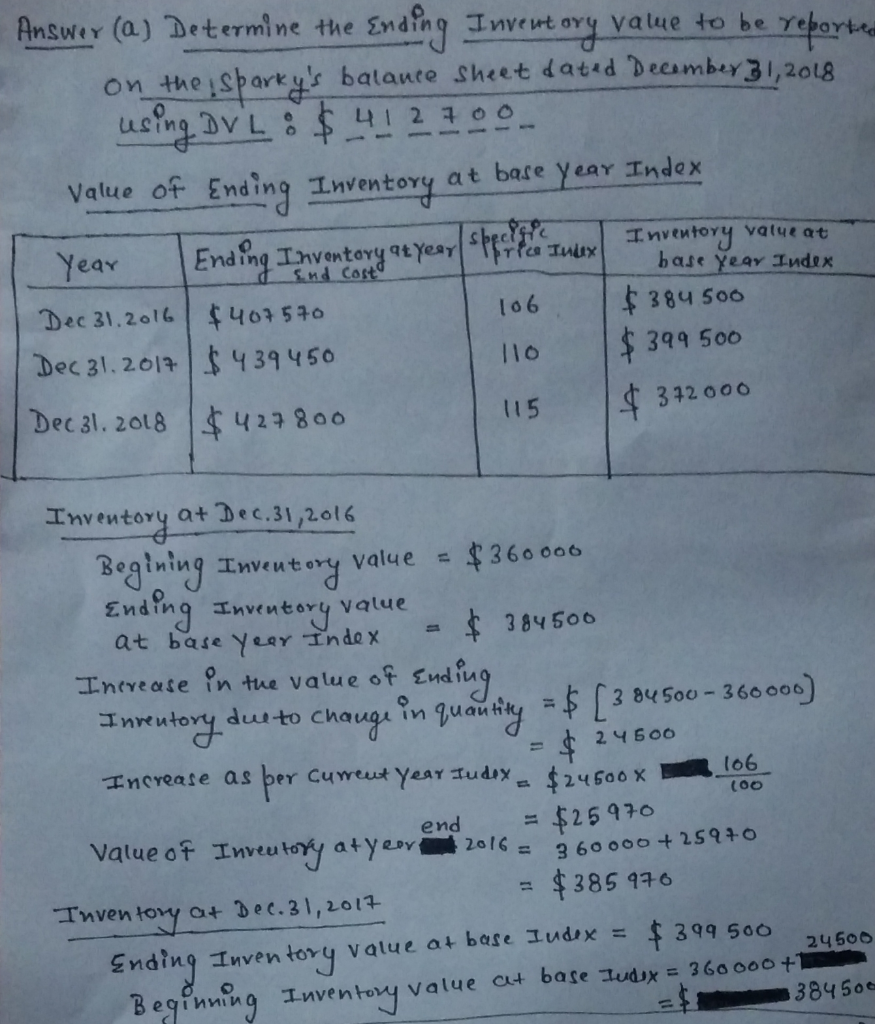

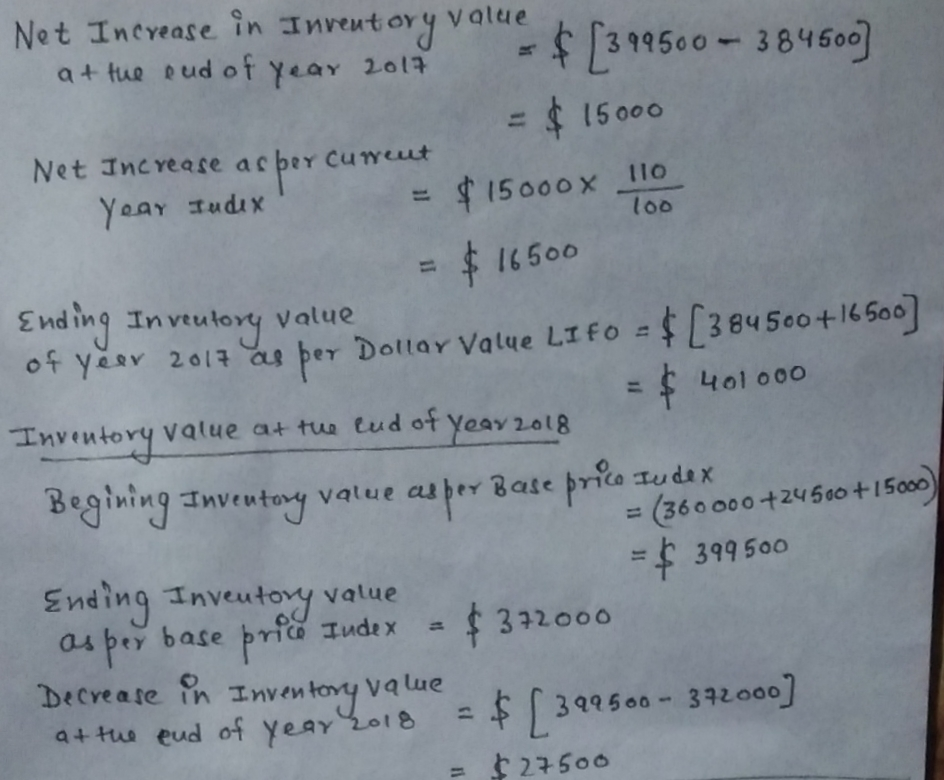

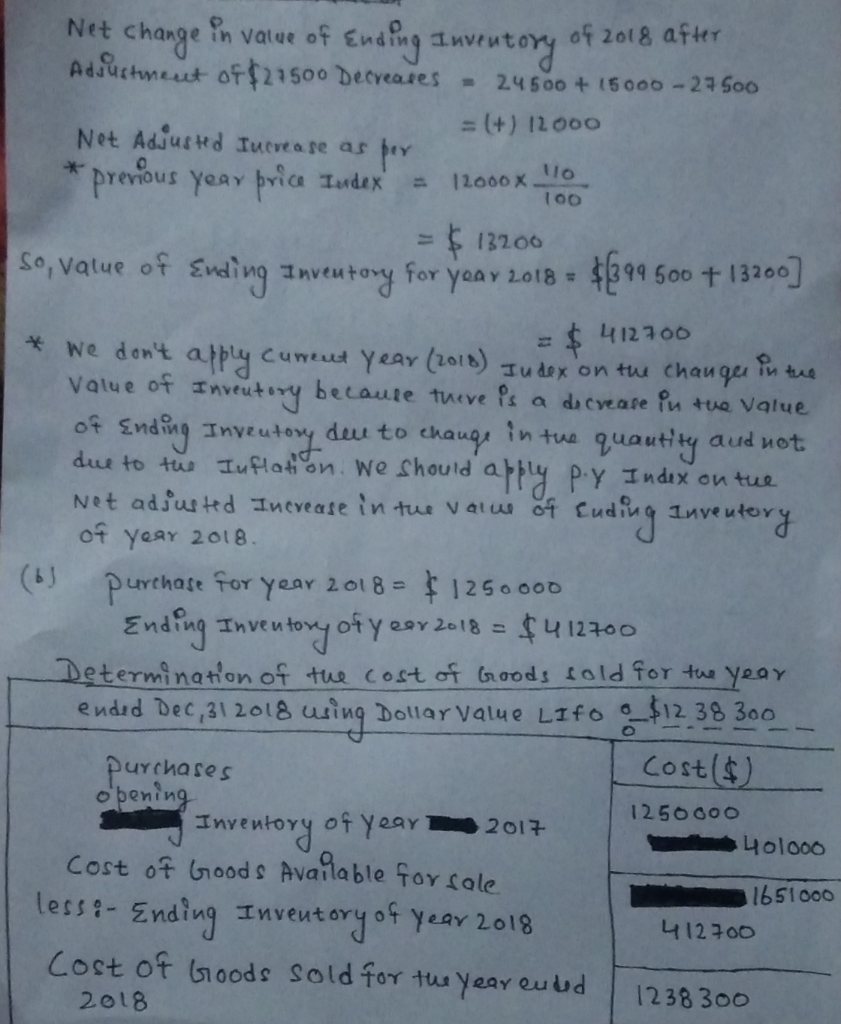

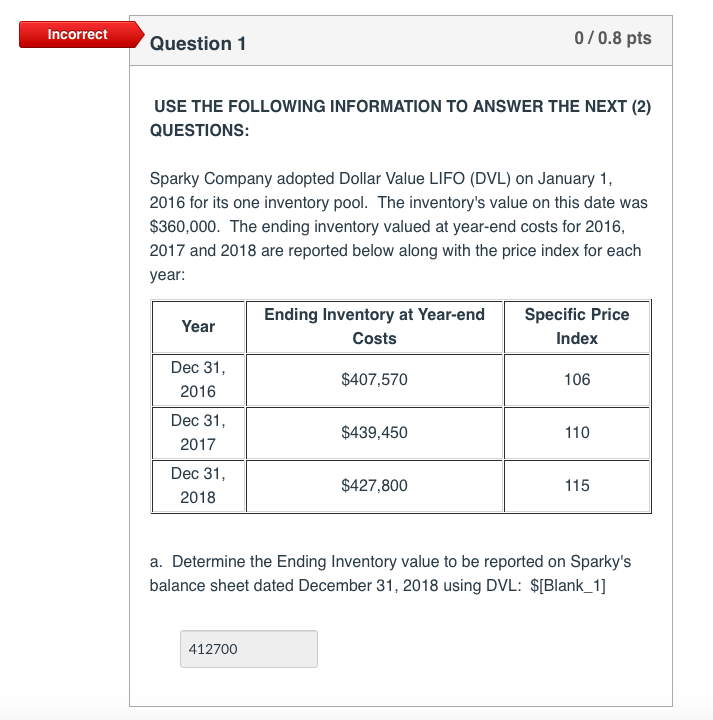

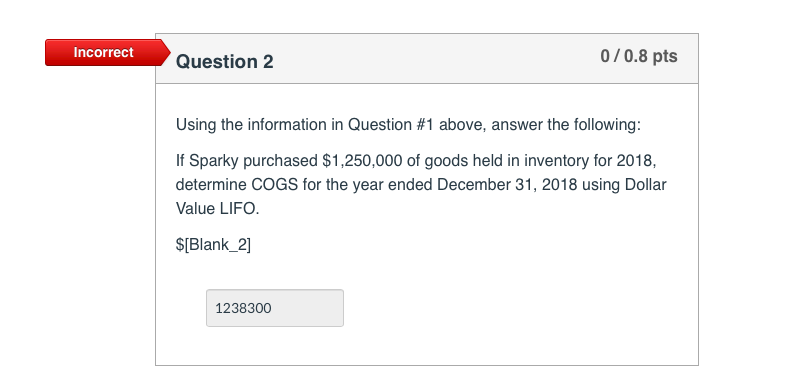

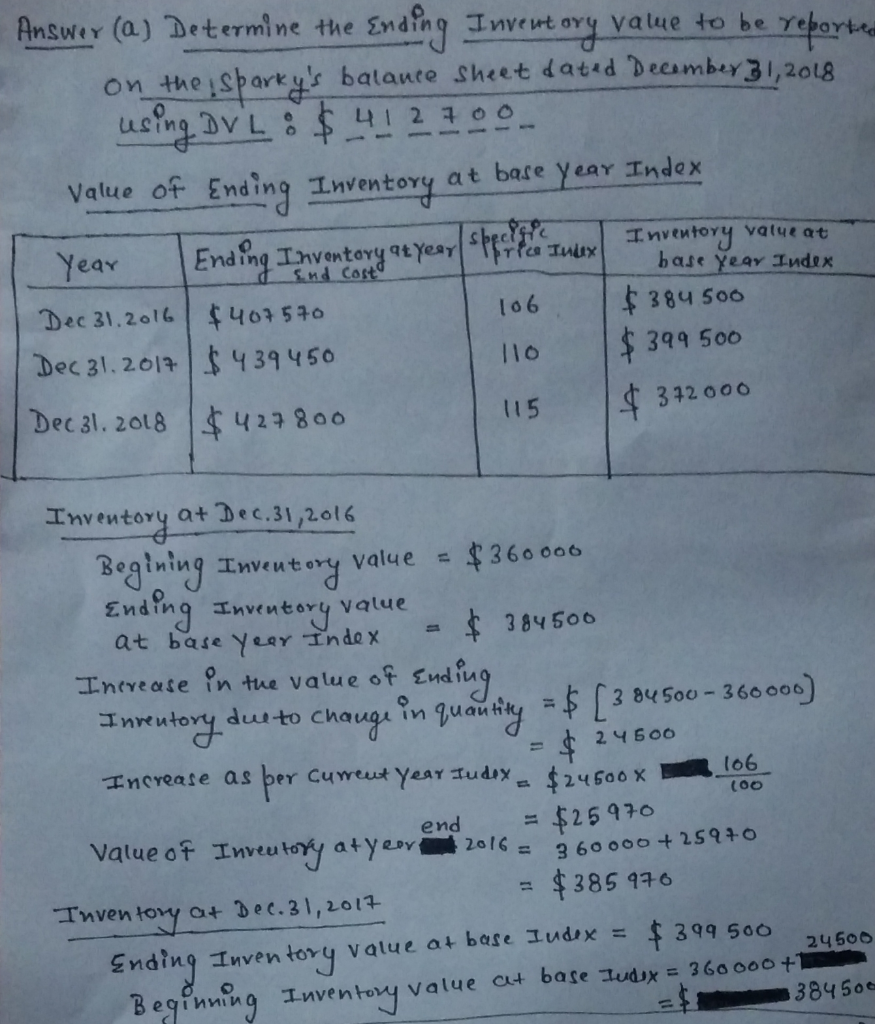

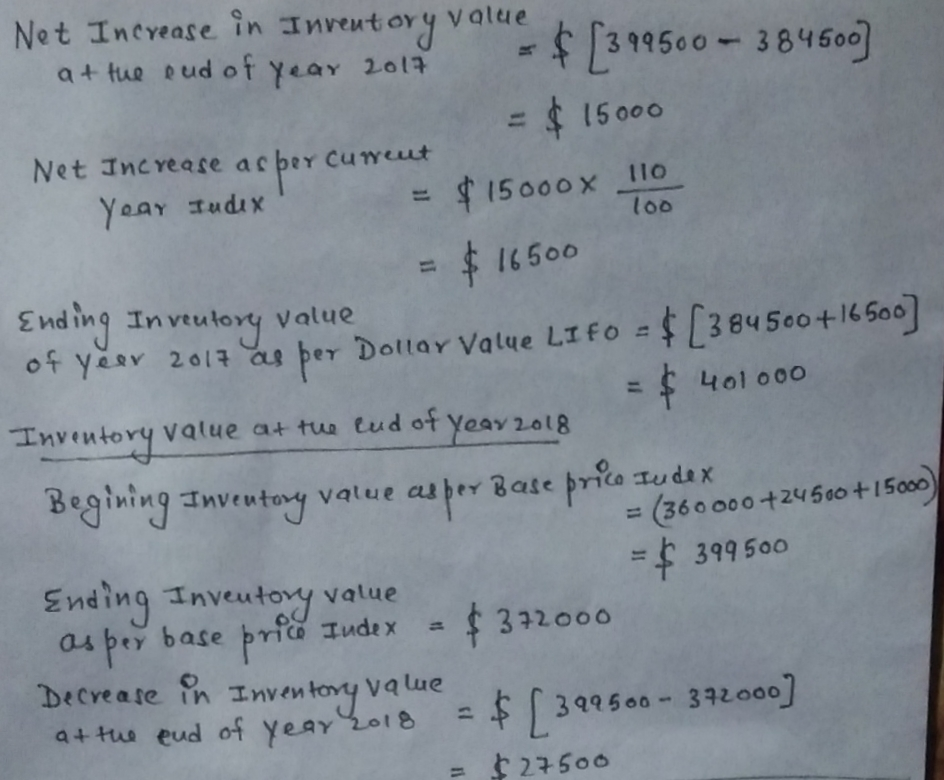

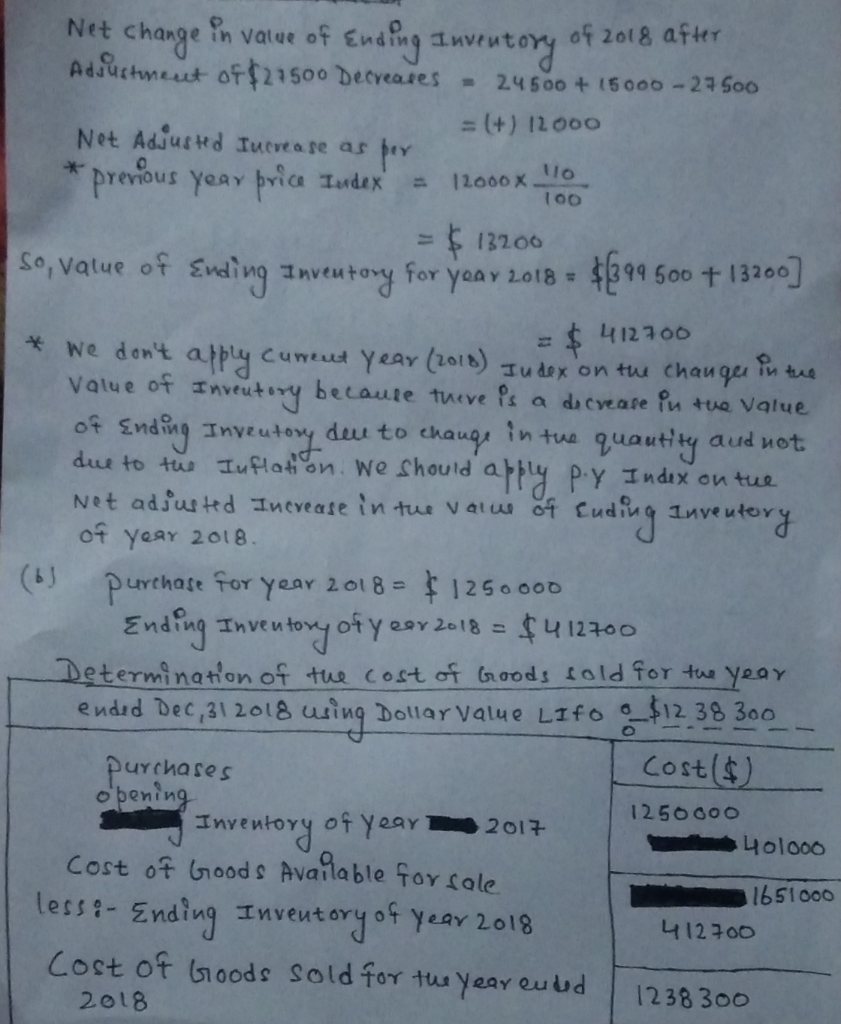

Incorrect 0/0.8 pts Question 1 USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (2) QUESTIONS: Sparky Company adopted Dollar Value LIFO (DVL) on January 1, 2016 for its one inventory pool. The inventory's value on this date was $360,000. The ending inventory valued at year-end costs for 2016, 2017 and 2018 are reported below along with the price index for each year: Ending Inventory at Year-end Specific Price Year Costs Index Dec 31 $407,570 106 2016 Dec 31 $439,450 110 2017 Dec 31 $427,800 115 2018 Determine the Ending Inventory value to be reported on Sparky's balance sheet dated December 31, 2018 using DVL: $[Blank_1] a. 412700 Incorrect 0/0.8 pts Question 2 Using the information in Question #1 above, answer the following: If Sparky purchased $1,250,000 of goods held in inventory for 2018, determine COGS for the year ended December 31, 2018 using Dollar Value LIFO $IBlank_2] 1238300 Answer (a) Det ermine the yalue to be Sparky's balance Sheet datad Decambey 31,2o18 On the Value of Ending Inventory at base year Index Invewtoyy hase Year Index vatue at Ending Inventevy atyesy Year Pea Iuiex Dec 31,2o16 f403540 $384 500 l06 $439 450 399 500 Dec 31, 2017 332 o00 Dec 31, 2018 427800 15 hventory at Dec.31,2ol6 Begiaing Ewveutary In $360000 value value $384500 at base Y ear Index Incvease Yn the value of o- 360000) Ineutoy 3 84 500 chaugi in guanty durto 24600 Cuweut YeaY Hudix Insrease as $24500 x 25970 106 (00 end 2016= Value of Inveutoy atyarve 3 60000+t 25970 $385 976 wven towy Ending Inven tory Beginning nventory Dec.31,2017 399 500 Value at base Iudx = 24600 value a+ base Tudsx =3600oo +1 38450 Net Inevease in Inreut oy =$3 99500- 3 84 600 a+ tue oud of Year 2013 Value =15000 Net Increase a acber cuweut = $ 15000x 110 lo0 Year Tudix Ending Inveutory Value of yeer 2013as per Dollar Value LI fo =384 Seo + 16 Sa0] = 401 000 Inventory value at tua tud ot Yeay 2o18 Begining anveutony value asber Base P (360 000+24500 +15000 Iu dex =399 500 Ending Inveutony as per base prica Iudex 332 000 Decreate in Inven tony Va $ [ 399500-39200o] value Value a+ tus eud of yearot8 27500 in vatue of Ending Net change of 2018 after Reoanenn = (+) 12000 AdSuctmet off21500 Decveares 24500 + 15 000-23 Soo Net Adjustd Iuerea se as prevous yaay bria Iudex 1 2000x. 13200 = Sovalue of Ending Inveutony for yoav 2o18 = $99 500 t 13200 Y $ Cumeut Year (201b) 412700 * Ne dont Iu dex on tu Value of nveutery becaute tueve Ps a dicyeare tue Value Endiny nveutony of deau to Gyn nt afty Py Indix on tue chaugs in tue aud not due to tus Iuflat on. We Should Not adjus ttd Incvease in tue vat ot Cudfieg anveutery of yaar 201 8. ( Purchase for year 2018= Endfing anvutony of y s Determination of tue cost of noods told for tu yeay endid Dec,31 2018 wing 1250000 $412700 eaY 2018 $12 38 300 Dollar Value LIfo Cost($) Purchases 1250000 Invewtory of year Cost of brood Available for Sale 2017 401000 161000 lesss- Ending Inveut ory of year 2018 412700 Cost ot noods Sold for tus year eu ud 1238 300 2018