Answered step by step

Verified Expert Solution

Question

1 Approved Answer

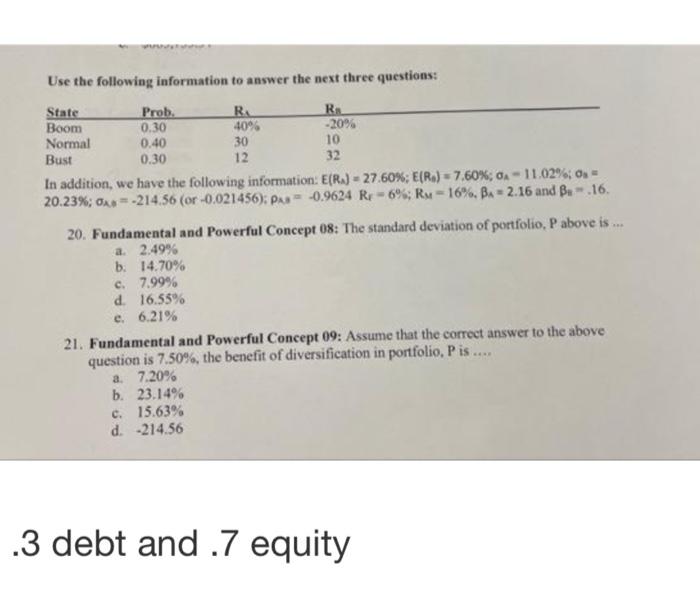

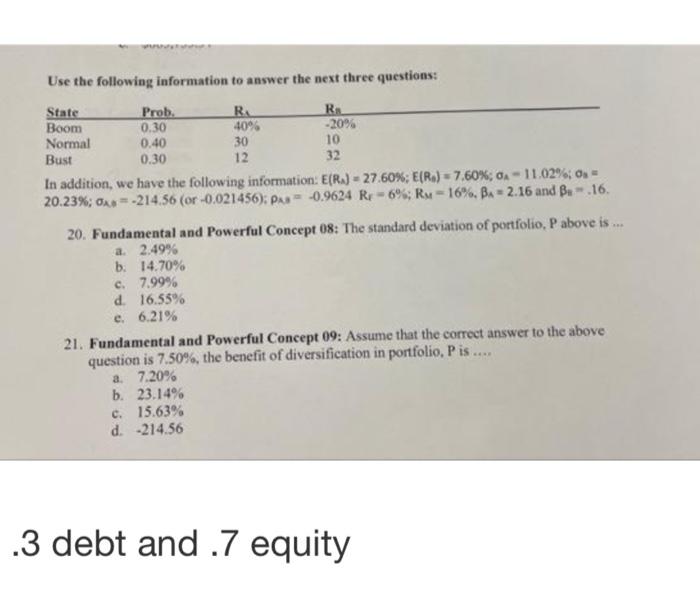

DONT USE EXCEL I NEED TO SEE HOW A PORTFOLIO IS MUTIPLED WITH THE STANDARD DEVIATIONS. www.s Use the following information to answer the next

DONT USE EXCEL I NEED TO SEE HOW A PORTFOLIO IS MUTIPLED WITH THE STANDARD DEVIATIONS.

www.s Use the following information to answer the next three questions: State Prob. R R 0.30 40% -20% Boom Normal 0.40 30 10 Bust 0.30 12 32 In addition, we have the following information: E(R.) = 27.60 % ; E ( R ) = 7.60%; 0A- 11.02 %; os = 20.23%; 0 -214.56 (or -0.021456); Pas -0.9624 R-6%; RM-16%, BA= 2.16 and B.16. 20. Fundamental and Powerful Concept 08: The standard deviation of portfolio, P above is... a. 2.49 % b. 14.70% c. 7.99% d. 16.55% e. 6.21% 21. Fundamental and Powerful Concept 09: Assume that the correct answer to the above question is 7.50%, the benefit of diversification in portfolio, P is. MAND a. 7.20% b. 23.14% c. 15.63% d. -214.56 .3 debt and .7 equity www.s Use the following information to answer the next three questions: State Prob. R R 0.30 40% -20% Boom Normal 0.40 30 10 Bust 0.30 12 32 In addition, we have the following information: E(R.) = 27.60 % ; E ( R ) = 7.60%; 0A- 11.02 %; os = 20.23%; 0 -214.56 (or -0.021456); Pas -0.9624 R-6%; RM-16%, BA= 2.16 and B.16. 20. Fundamental and Powerful Concept 08: The standard deviation of portfolio, P above is... a. 2.49 % b. 14.70% c. 7.99% d. 16.55% e. 6.21% 21. Fundamental and Powerful Concept 09: Assume that the correct answer to the above question is 7.50%, the benefit of diversification in portfolio, P is. MAND a. 7.20% b. 23.14% c. 15.63% d. -214.56 .3 debt and .7 equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started