Answered step by step

Verified Expert Solution

Question

1 Approved Answer

dont use scholes model (HINT, THIS QUESTION IS NOT THAT DIFFICULT) Your firm has a market value balance sheet of Assets ($20)=Debt(14.3) + Equity ($5.7),

dont use scholes model

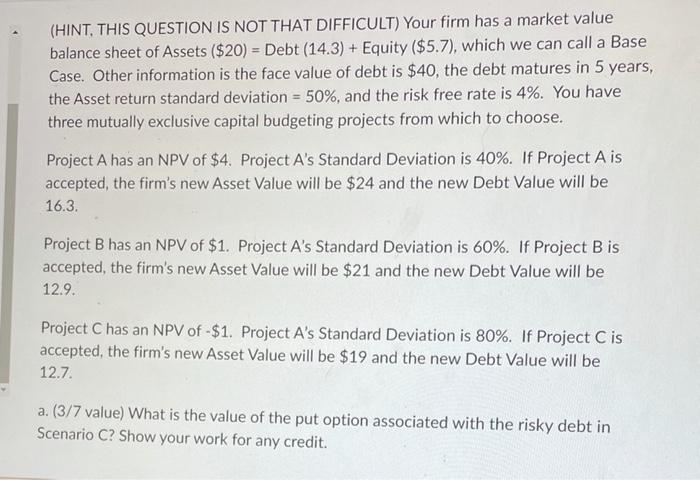

(HINT, THIS QUESTION IS NOT THAT DIFFICULT) Your firm has a market value balance sheet of Assets ($20)=Debt(14.3) + Equity ($5.7), which we can call a Base Case. Other information is the face value of debt is $40, the debt matures in 5 years, the Asset return standard deviation =50%, and the risk free rate is 4%. You have three mutually exclusive capital budgeting projects from which to choose. Project A has an NPV of \$4. Project A's Standard Deviation is 40%. If Project A is accepted, the firm's new Asset Value will be $24 and the new Debt Value will be 16.3. Project B has an NPV of \$1. Project A's Standard Deviation is 60%. If Project B is accepted, the firm's new Asset Value will be $21 and the new Debt Value will be 12.9. Project C has an NPV of $1. Project A's Standard Deviation is 80%. If Project C is accepted, the firm's new Asset Value will be $19 and the new Debt Value will be 12.7. a. (3/7 value) What is the value of the put option associated with the risky debt in Scenario C? Show your work for any credit. b. (4/7 value) Considering accepting mutually exclusive Projects A,B,C, or rejecting all three projects, what is the optimal strategy? Why? You must use numbers correctly in your explanation to get any credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started