Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Don't worry about creating sheets and what not. If the calculations could be solved for both questions at the bottom that would be perfect. Thanks

Don't worry about creating sheets and what not. If the calculations could be solved for both questions at the bottom that would be perfect. Thanks

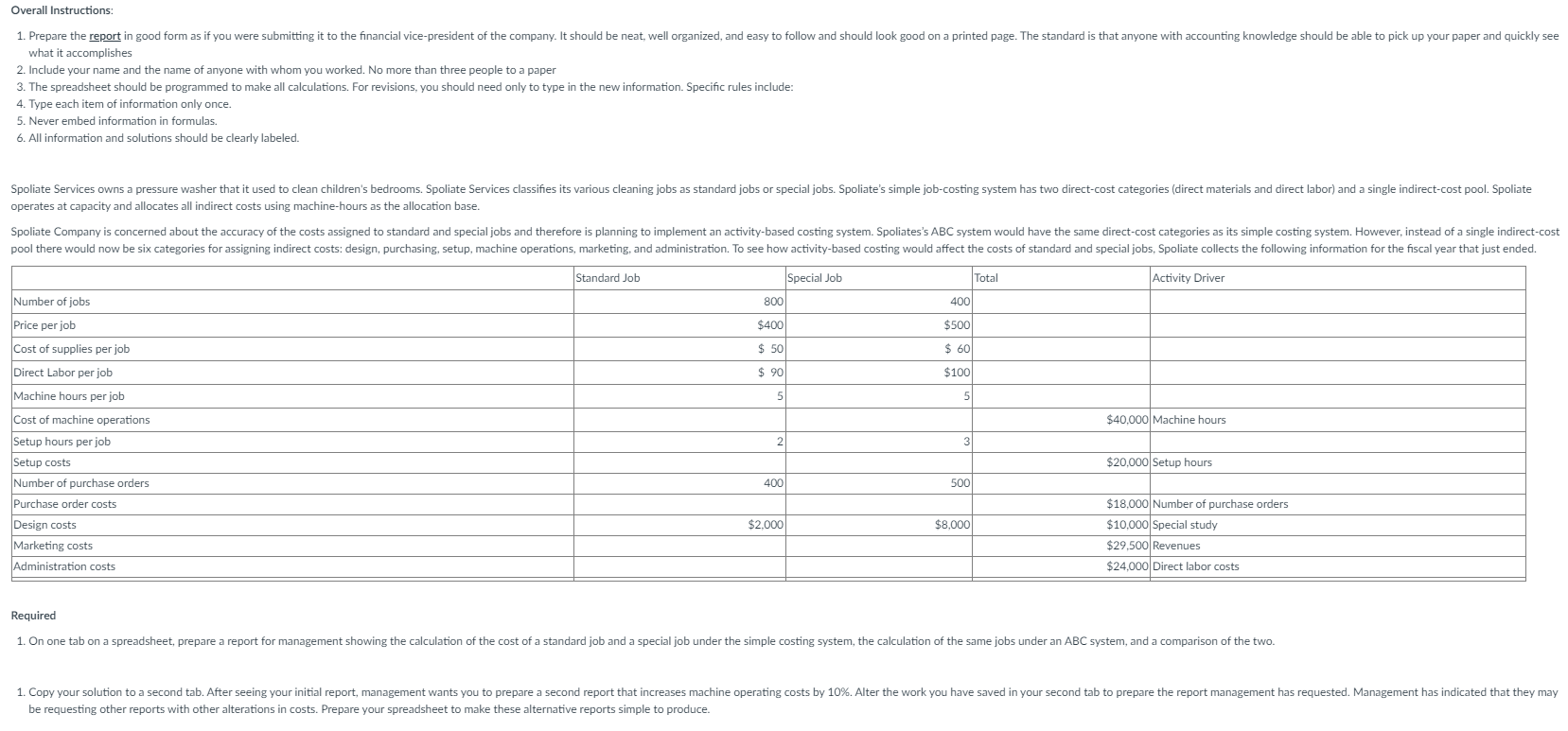

Overall Instructions: 1. Prepare the report in good form as if you were submitting it to the financial vice-president of the company. It should be neat, well organized, and easy to follow and should look good on a printed page. The standard is that anyone with accounting knowledge should be able to pick up your paper and quickly see what it accomplishes 2. Include your name and the name of anyone with whom you worked. No more than three people to a paper 3. The spreadsheet should be programmed to make all calculations. For revisions, you should need only to type in the new information. Specific rules include: 4. Type each item of information only once. . 5. Never embed information in formulas. 6. All information and solutions should be clearly labeled. Spoliate Services owns a pressure washer that it used to clean children's bedrooms. Spoliate Services classifies its various cleaning jobs as standard jobs or special jobs. Spoliate's simple job-costing system has two direct-cost categories (direct materials and direct labor) and a single indirect-cost pool. Spoliate operates at capacity and allocates all indirect costs using machine-hours as the allocation base. Spoliate Company is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Spoliates's ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, machine operations, marketing, and administration. To see how activity-based costing would affect the costs of standard and special jobs, Spoliate collects the following information for the fiscal year that just ended. Standard Job Special Job Total Activity Driver Number of jobs 800 400 Price per job $400 $500 Cost of supplies per job $ 50 $ 60 Direct Labor per job $ 90 $100 Machine hours per job 5 5 $40,000 Machine hours 2 3 $20,000 Setup hours 400 500 Cost of machine operations Setup hours per job Setup costs Number of purchase orders Purchase order costs Design costs Marketing costs Administration costs $2.000 $8,000 $18,000 Number of purchase orders $10,000 Special study $29,500 Revenues $24,000 Direct labor costs Required 1. On one tab on a spreadsheet, prepare a report for management showing the calculation of the cost of a standard job and a special job under the simple costing system, the calculation of the same jobs under an ABC system, and a comparison of the two. 1. Copy your solution to a second tab. After seeing your initial report, management wants you to prepare a second report that increases machine operating costs by 10%. Alter the work you have saved in your second tab to prepare the report management has requested. Management has indicated that they may be requesting other reports with other alterations in costs. Prepare your spreadsheet to make these alternative reports simple to produceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started