Question

Donuts firm is considering a merger with Cookie Corp. Cookie has 3,000,000 shares outstanding and a target capital structure of 25% debt. Cookie's debt interest

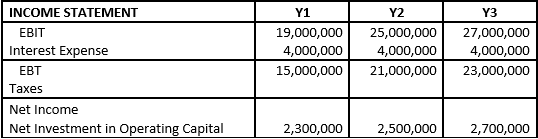

Donuts firm is considering a merger with Cookie Corp. Cookie has 3,000,000 shares outstanding and a target capital structure of 25% debt. Cookie's debt interest rate is 8% on $50M in debt. The risk-free interest rate is 0.55% and the market risk premium is 6%. Both firms are in the 25% tax bracket. Cookie's (levered) equity beta is 1.50. The current value of Cookie's stock is $50 per share. Donuts estimates synergies will produce the additional income given below. After year 3, the tax shields and free cash flows will grow by 3% and the combined firm will maintain the 25% debt ratio.

Use the WACC to get the horizon value (HV).

INCOME STATEMENT EBIT Interest Expense EBT Taxes Net Income Net Investment in Operating Capital Y1 19,000,000 4,000,000 15,000,000 Y2 25,000,000 4,000,000 21,000,000 Y3 27,000,000 4,000,000 23,000,000 2,300,000 2,500,000 2,700,000 INCOME STATEMENT EBIT Interest Expense EBT Taxes Net Income Net Investment in Operating Capital Y1 19,000,000 4,000,000 15,000,000 Y2 25,000,000 4,000,000 21,000,000 Y3 27,000,000 4,000,000 23,000,000 2,300,000 2,500,000 2,700,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started