Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dooley, Inc., has outstanding $50 million (par value) bonds that pay an annual coupon rate of interest of 8.5 percent. Par value of each bond

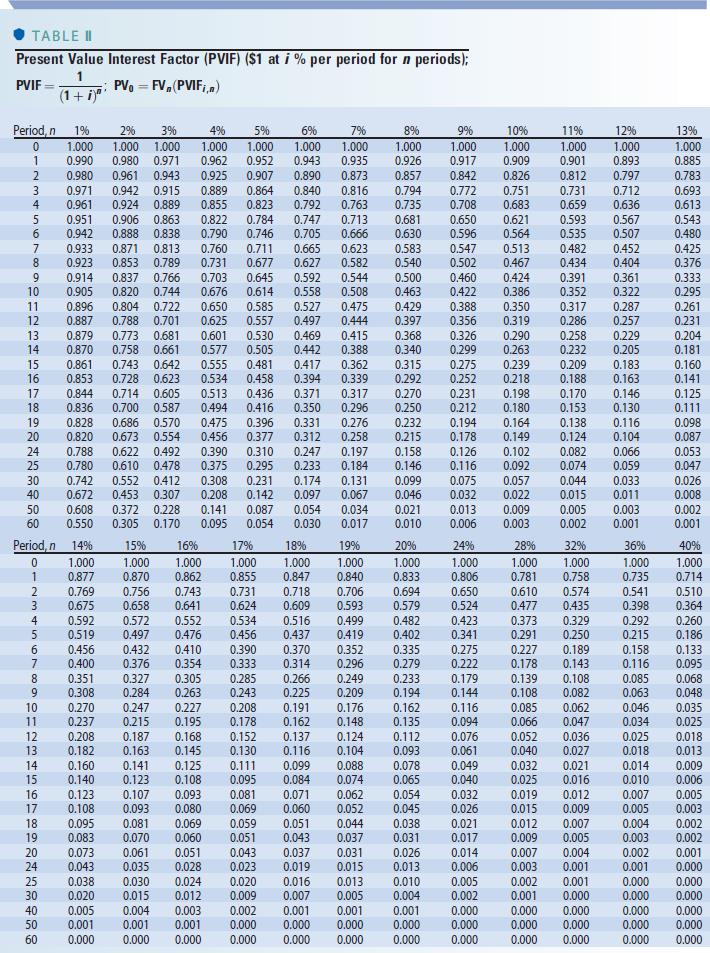

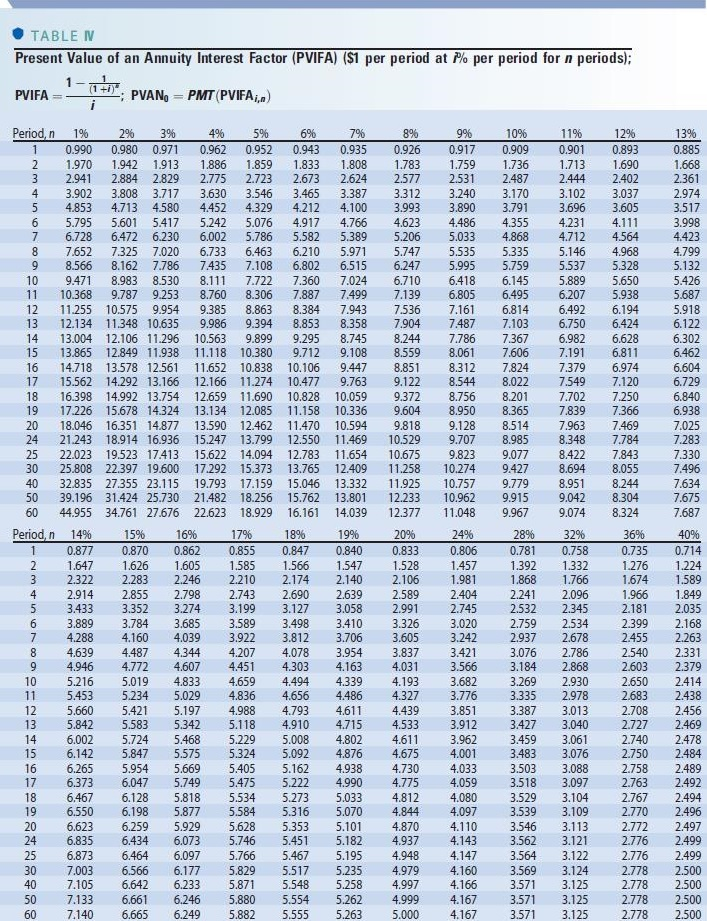

Dooley, Inc., has outstanding $50 million (par value) bonds that pay an annual coupon rate of interest of 8.5 percent. Par value of each bond is $1,000. The bonds are scheduled to mature in 17 years. Because of Dooleys increased risk, investors now require a 15 percent rate of return on bonds of similar quality with 17 years remaining until maturity. The bonds are callable at 112 percent of par at the end of 9 years. Use Table II and Table IV to answer the questions. Round your answers to the nearest dollar.

- What price would the bonds sell for assuming investors do not expect them to be called? $

- What price would the bonds sell for assuming investors expect them to be called at the end of 9 years? $

TABLE II Present Value Interest Factor (PVIF) ($1 at i % per period for n periods); PVIF PV = FV, (PVIF,.) (1 + i)" Period n 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 24 25 30 40 50 60 1% 1.000 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 0.788 0.780 0.742 0.672 0.608 0.550 7% 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.276 0.258 0.197 0.184 0.131 0.067 0.034 0.017 9% 1.000 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.126 0.116 0.075 0.032 0.013 0.006 13% 1.000 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.053 0.047 0.026 0.008 0.002 0.001 2% 3% 4% 5% 6% 1.000 1.000 1.000 1.000 1.000 0.980 0.971 0.962 0.952 0.943 0.961 0.943 0.925 0.907 0.890 0.942 0.915 0.889 0.864 0.840 0.924 0.889 0.855 0.823 0.792 0.906 0.863 0.822 0.784 0.747 0.888 0.838 0.790 0.746 0.705 0.871 0.813 0.760 0.711 0.665 0.853 0.789 0.731 0.677 0.627 0.837 0.766 0.703 0.645 0.592 0.820 0.744 0.676 0.614 0.558 0.804 0.722 0.650 0.585 0.527 0.788 0.701 0.625 0.557 0.497 0.773 0.681 0.601 0.530 0.469 0.758 0.661 0.577 0.505 0.442 0.743 0.642 0.555 0.481 0.417 0.728 0.623 0.534 0.458 0.394 0.714 0.605 0.513 0.436 0.371 0.700 0.587 0.494 0.416 0.350 0.686 0.570 0.475 0.396 0.331 0.673 0.554 0.456 0.377 0.312 0.622 0.492 0.390 0.310 0.247 0.610 0.478 0.375 0.295 0.233 0.552 0.412 0.308 0.231 0.174 0.453 0.307 0.208 0.142 0.097 0.372 0.228 0.141 0.087 0.054 0.305 0.170 0.095 0.054 0.030 15% 16% 17% 18% 1.000 1.000 1.000 1.000 0.870 0.862 0.855 0.847 0.756 0.743 0.731 0.718 0.658 0.641 0.624 0.609 0.572 0.552 0.534 0.516 0.497 0.476 0.456 0.437 0.432 0.410 0.390 0.370 0.376 0.354 0.333 0.314 0.327 0.305 0.285 0.266 0.284 0.263 0.243 0.225 0.247 0.227 0.208 0.191 0.215 0.195 0.178 0.162 0.187 0.168 0.152 0.137 0.163 0.145 0.130 0.116 0.141 0.125 0.111 0.099 0.123 0.108 0.095 0.084 0.107 0.093 0.081 0.071 0.093 0.080 0.069 0.060 0.081 0.069 0.059 0.051 0.070 0.060 0.051 0.043 0.061 0.051 0.043 0.037 0.035 0.028 0.023 0.019 0.030 0.024 0.020 0.016 0.015 0.012 0.009 0.007 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.000 8% 1.000 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.158 0.146 0.099 0.046 0.021 0.010 20% 1.000 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.013 0.010 0.004 0.001 0.000 0.000 10% 1.000 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.102 0.092 0.057 0.022 0.009 0.003 28% 1.000 0.781 0.610 0.477 0.373 0.291 0.227 0.178 0.139 0.108 0.085 0.066 0.052 0.040 0.032 0.025 0.019 0.015 0.012 0.009 0.007 0.003 0.002 0.001 0.000 0.000 0.000 11% 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.082 0.074 0.044 0.015 0.005 0.002 32% 1.000 0.758 0.574 0.435 0.329 0.250 0.189 0.143 0.108 0.082 0.062 0.047 0.036 0.027 0.021 0.016 0.012 0.009 0.007 0.005 0.004 0.001 0.001 0.000 0.000 0.000 0.000 12% 1.000 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.066 0.059 0.033 0.011 0.003 0.001 36% 1.000 0.735 0.541 0.398 0.292 0.215 0.158 0.116 0.085 0.063 0.046 0.034 0.025 0.018 0.014 0.010 0.007 0.005 0.004 0.003 0.002 0.001 0.000 0.000 0.000 0.000 0.000 Period, 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 24 25 30 40 50 60 14% 1.000 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.073 0.043 0.038 0.020 0.005 0.001 0.000 19% 1.000 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0.052 0.044 0.037 0.031 0.015 0.013 0.005 0.001 0.000 0.000 24% 1.000 0.806 0.650 0.524 0.423 0.341 0.275 0.222 0.179 0.144 0.116 0.094 0.076 0.061 0.049 0.040 0.032 0.026 0.021 0.017 0.014 0.006 0.005 0.002 0.000 0.000 0.000 40% 1.000 0.714 0.510 0.364 0.260 0.186 0.133 0.095 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000 TABLE IN Present Value of an Annuity Interest Factor (PVIFA) ($1 per period at 1% per period for n periods); PVIFA PVAN, = PMT (PVIFA in) 1 un 6 Period, n 1% 2% 3% 0.990 0.980 0.971 2 1.970 1.942 1.913 3 2.941 2.884 2.829 4 3.902 3.808 3.717 4.853 4.713 4.580 5.795 5.601 5.417 7 6.728 6.472 6.230 8 7.652 7.325 7.020 9 8.566 8.162 7.786 10 9.471 8.983 8.530 11 10.368 9.787 9.253 12 11.255 10.575 9.954 13 12.134 11.348 10.635 14 13.004 12.106 11.296 15 13.865 12.849 11.938 16 14.718 13.578 12.561 17 15.562 14.292 13.166 18 16.398 14.992 13.754 19 17.226 15.678 14.324 20 18.046 16.351 14.877 24 21.243 18.914 16.936 25 22.023 19.523 17.413 30 25.808 22.397 19.600 40 32.835 27.355 23.115 50 39.196 31.424 25.730 60 44.955 34.761 27.676 4% 5% 0.962 0.952 1.886 1.859 2.775 2.723 3.630 3.546 4.452 4.329 5.242 5.076 6.002 5.786 6.733 6.463 7.435 7.108 8.111 7.722 8.760 8.306 9.385 8.863 9.986 9.394 10.563 9.899 11.118 10.380 11.652 10.838 12.166 11.274 12.659 11.690 13.134 12.085 13.590 12.462 15.247 13.799 15.622 14.094 17.292 15.373 19.793 17.159 21.482 18.256 22.623 18.929 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 12.550 12.783 13.765 15.046 15.762 16.161 7% 0.935 1.808 2.624 3.387 4.100 4.766 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 10.059 10.336 10.594 11.469 11.654 12.409 13.332 13.801 14.039 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 10.529 10.675 11.258 11.925 12.233 12.377 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.312 8.544 8.756 8.950 9.128 9.707 9.823 10.274 10.757 10.962 11.048 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7824 8.022 8.201 8.365 8.514 8.985 9.077 9.427 9.779 9.915 9.967 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 8.348 8.422 8.694 8.951 9.042 9.074 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.784 7.843 8.055 8.244 8.304 8.324 13% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 7.283 7.330 7.496 7.634 7.675 7.687 Period, 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 24 25 30 40 50 60 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 6.835 6.873 7.003 7.105 7.133 7.140 15% 0.870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 6.198 6.259 6.434 6.464 6.566 6.642 6.661 6.665 16% 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.669 5.749 5.818 5.877 5.929 6.073 6.097 6.177 6.233 6.246 6.249 17% 0.855 1.585 2.210 2.743 3.199 3.589 3.922 4.207 4.451 4.659 4.836 4.988 5.118 5.229 5.324 5.405 5.475 5.534 5.584 5.628 5.746 5.766 5.829 5.871 5.880 5.882 18% 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5.008 5.092 5.162 5.222 5.273 5.316 5.353 5.451 5.467 5.517 5.548 5.554 5.555 19% 0.840 1.547 2.140 2.639 3.058 3.410 3.706 3.954 4.163 4.339 4.486 4.611 4.715 4.802 4.876 4.938 4.990 5.033 5.070 5.101 5.182 5.195 5.235 5.258 5.262 5.263 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.193 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.844 4.870 4.937 4.948 4.979 4.997 4.999 5.000 24% 0.806 1.457 1.981 2.404 2.745 3.020 3.242 3.421 3.566 3.682 3.776 3.851 3.912 3.962 4.001 4.033 4.059 4.080 4.097 4.110 4.143 4.147 4.160 4.166 4.167 4.167 28% 0.781 1.392 1.868 2.241 2.532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.503 3.518 3.529 3.539 3.546 3.562 3.564 3.569 3.571 3.571 3.571 32% 0.758 1.332 1.766 2.096 2.345 2.534 2.678 2.786 2.868 2.930 2.978 3.013 3.040 3.061 3.076 3.088 3.097 3.104 3.109 3.113 3.121 3.122 3.124 3.125 3.125 3.125 36% 0.735 1.276 1.674 1.966 2.181 2.399 2.455 2.540 2.603 2.650 2.683 2.708 2.727 2.740 2.750 2.758 2.763 2.767 2.770 2.772 2.776 2.776 2.778 2.778 2.778 2.778 40% 0.714 1.224 1.589 1.849 2.035 2.168 2.263 2.331 2.379 2.414 2.438 2.456 2.469 2.478 2.484 2.489 2.492 2.494 2.496 2.497 2.499 2.499 2.500 2.500 2.500 2.500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started