Question

Dorechester Mini Case 1 Dorchester Ltd. is a British confectioner specializing in high-quality chocolates. Through its facilities in the United Kingdom, Dorchester manufactures candies that

Dorechester Mini Case 1

Dorchester Ltd. is a British confectioner specializing in high-quality chocolates. Through its facilities in the United Kingdom, Dorchester manufactures candies that it sells throughout Western Europe and the U.S.

With its current U.K.-based manufacturing facilities, Dorchester has been able to supply the U.S. market with 290,000 pounds (lbs) of candy per year. This limited supply has allowed its U.S. sales affiliate, located in Boston, to penetrate the U.S. market no farther West than St. Louis.

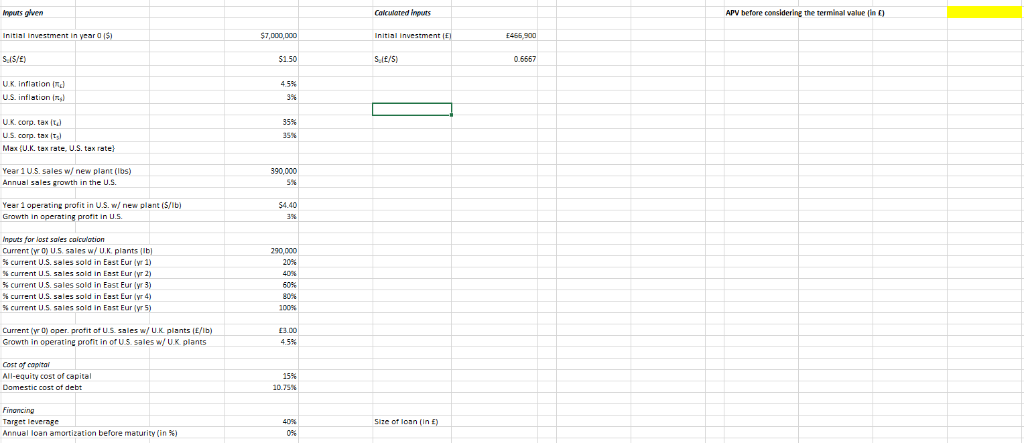

Dorchester believes that a new manufacturing facility located in the U.S., which would take one year to build and become operative, would allow it to supply the entire U.S. market. Dorchester estimates demand in the entire U.S. market the first year when the new facility would be operative (i.e., year 1) at 390,000 pounds, with subsequent growth at a 5% annual rate.

Having this new manufacturing facility would free up the amount currently shipped by Dorchester from the U.K. to the U.S. Dorchester believes that this idle capacity would only be a short-run problem. The firm believes the economic development taking place in Eastern Europe will allow it to sell there the full amount presently shipped to the U.S. from the U.K. within a period of five years (20% in year 1, 40% in year 2, , and 100% in year 5).

Dorchester presently (i.e., in year 0) generates an operating profit of 3.00 per pound on its U.S. exports from the U.K, which grows with U.K. inflation. Once the U.S. manufacturing facility is operating (i.e., in year 1), Dorchester expects that it will be able to initially price its product at $7.70 per pound, which would represent an operating profit of $4.40 per pound and is expected to keep track with the U.S. price level.

U.S. inflation is forecast at a rate of 3% for the next several years, while U.K. inflation is forecast at 4.5%. The current spot exchange rate is $1.50/. Dorchester uses PPP to forecast future exchange rates.

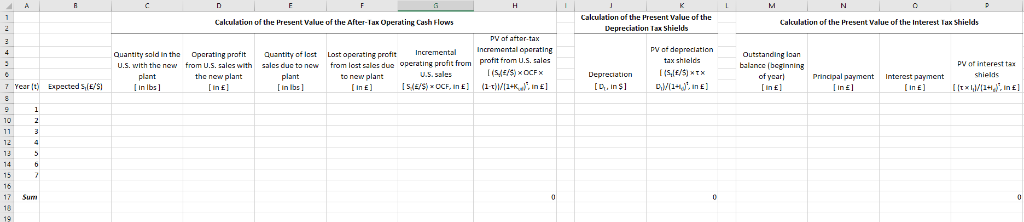

The new manufacturing facility is expected to cost $7,000,000. Dorchester plans to finance this amount by combining equity and debt, in line with its target leverage of 40%. Dorchester plans to raise the debt required to build the plant in the U.K., where it can issue a non-amortizing seven-year bond to borrow pounds sterling at 10.75% per annum. Dorchester estimates its domestic all-equity cost of capital to be 15%.

The corporate tax rates in the U.S. and the U.K. are both 35 percent. The U.S. Internal Revenue Service will allow Dorchester to depreciate the new facility over a seven-year period. After that time, the confectionery equipment, which accounts for the bulk of the investment, is expected to have substantial market value.

Answer the following questions using the information given above:

1. Should Dorchester build the new manufacturing plant in the U.S.? To answer the question, calculate how large the terminal value of the new manufacturing facility would need to be for the APV of the facility to be positive.

2. How does your answer to question 1 change if instead of raising the debt required to build the plant in the U.K., Dorchester borrows the same equivalent amount in dollars in the U.S. at a 9.5% annual interest rate, using again a non-amortizing seven-year bond?

3. Suppose now that the U.S. decreases the corporate income tax rate to 21%. How does your answer to question 1 change?

4. Suppose now that both the U.S. and the U.K. decrease the corporate income tax rate to 21%. How does your answer to question 1 change?

5. How would the answer to question 1 change if Dorchester were able to increase its sales in Eastern Europe faster than in the original forecast, selling there the full amount presently shipped to the U.S. from the U.K. within a period of three years (33.3% in year 1, 66.7% in year 2, and 100% in year 3)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started