Answered step by step

Verified Expert Solution

Question

1 Approved Answer

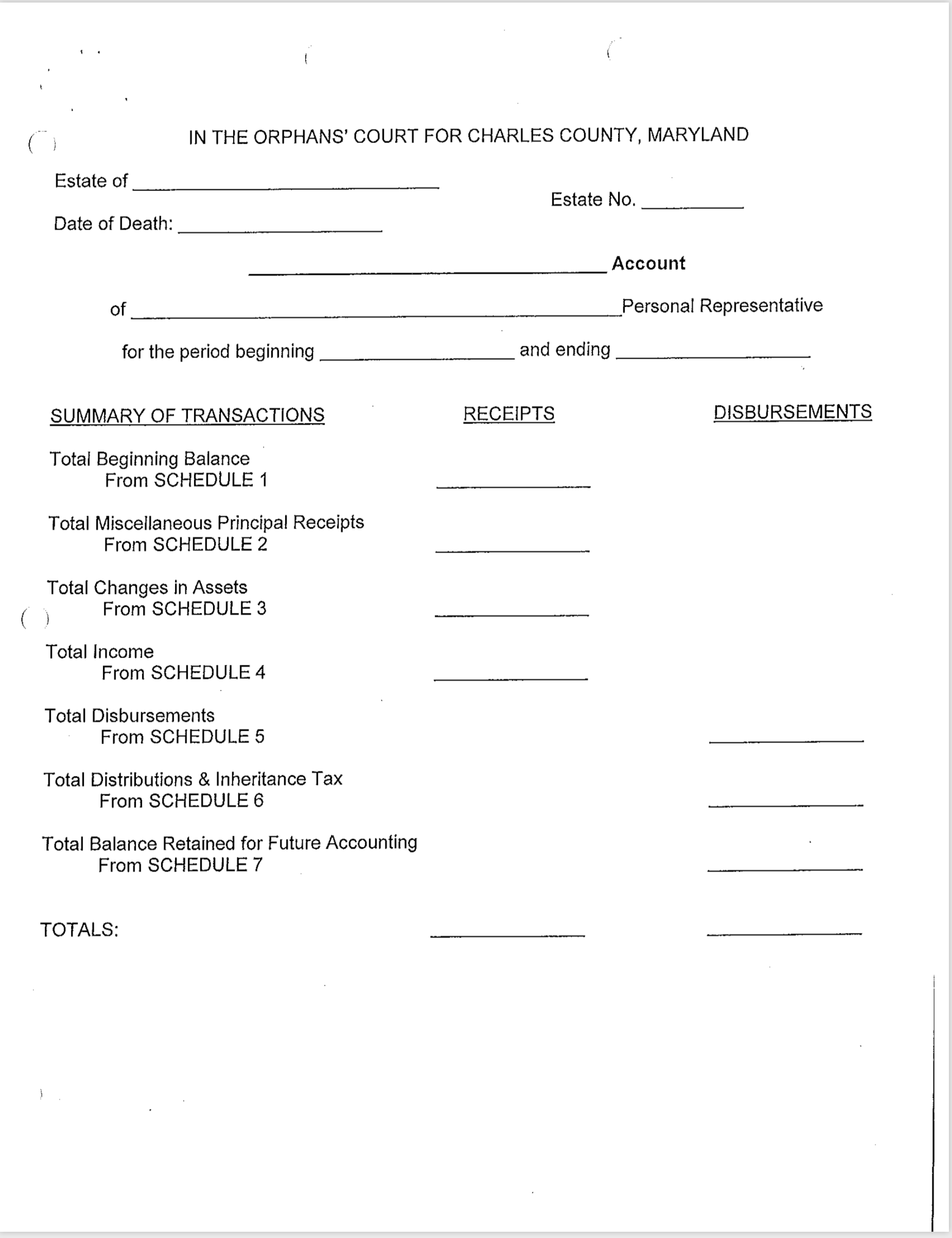

Dorothy M. Halls lived at 1500 Westinghouse Rd., Brandywine, MD. Brandywine is in Charles County, MD. She died on April 24, 2018. At the time

- Dorothy M. Halls lived at 1500 Westinghouse Rd., Brandywine, MD. Brandywine is in Charles County, MD.

- She died on April 24, 2018.

- At the time of her death, she was single and has one living child, Sidney Halls, and no grandchild(ren).

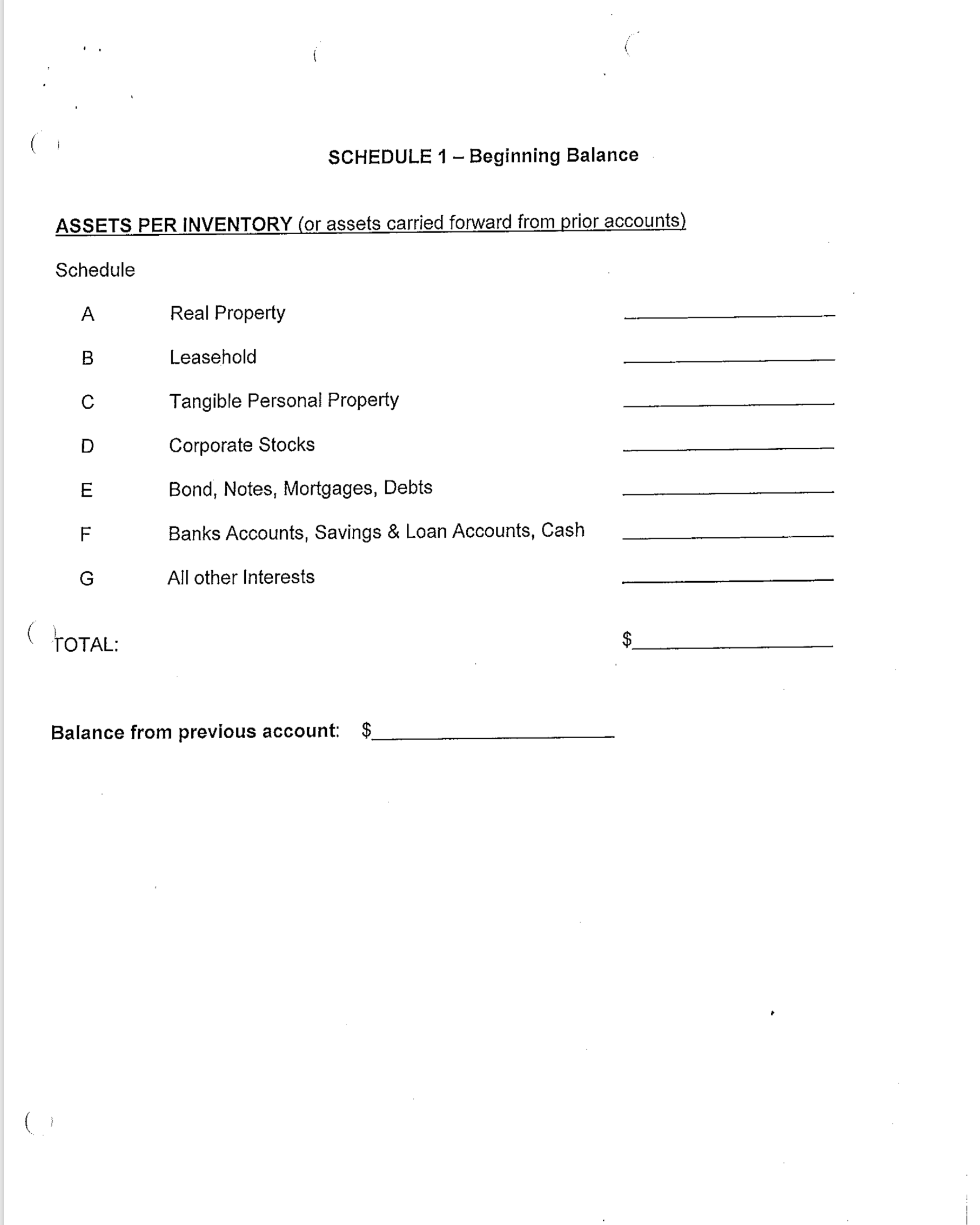

- Dorothy owned the house in which she resided on Westinghouse Rd. The house was titled solely in her name. The property was worth $188,180.00 at the time of her death. There was no mortgage or other lien on the property at the time of her death. Dorothy owned no other property, real or personal.

- Dorothy left an executed Will which was signed on July 1, 2008. This Will has been admitted into the probate court under her Estate case number (Estate No. 757-2018).

- In her Will, Dorothy left all her assets, real, personal and/or mixed, to Phyllis Harvey, a close friend, provided Ms. Harvey survives Dorothy by more than 30 days from the date of Dorothy's death. Phyllis has indeed survived Dorothy by more than 30 days.

- In her Will, Dorothy specifically disinherits her son, Sidney Halls, who resides at 75 Regency Way, Rockville, MD, from receiving any part of the estate assets.

- After Dorothy's death, the Will was in the law offices of Kerr & Kerr. Em Kerr prepared the Will in 2008 and kept the original Will in her office for safekeeping.

- The Will named Phyllis as the estate Personal Representative (PR). Her address is 75 Congress St., Clarksburg, MD. The witnesses to the Will's execution were Robert Jones, 13 Oven St., Landover, MD and Sallie Thomson, 45 Quaker Lane, Brandywine, MD.

- Sallie has retained Kerr & Kerr to represent her in the handling of matters pertaining to this estate, including the preparation of all probate forms. The law firm's address is 77 S. Washington St., Suite 307, Rockville, MD.

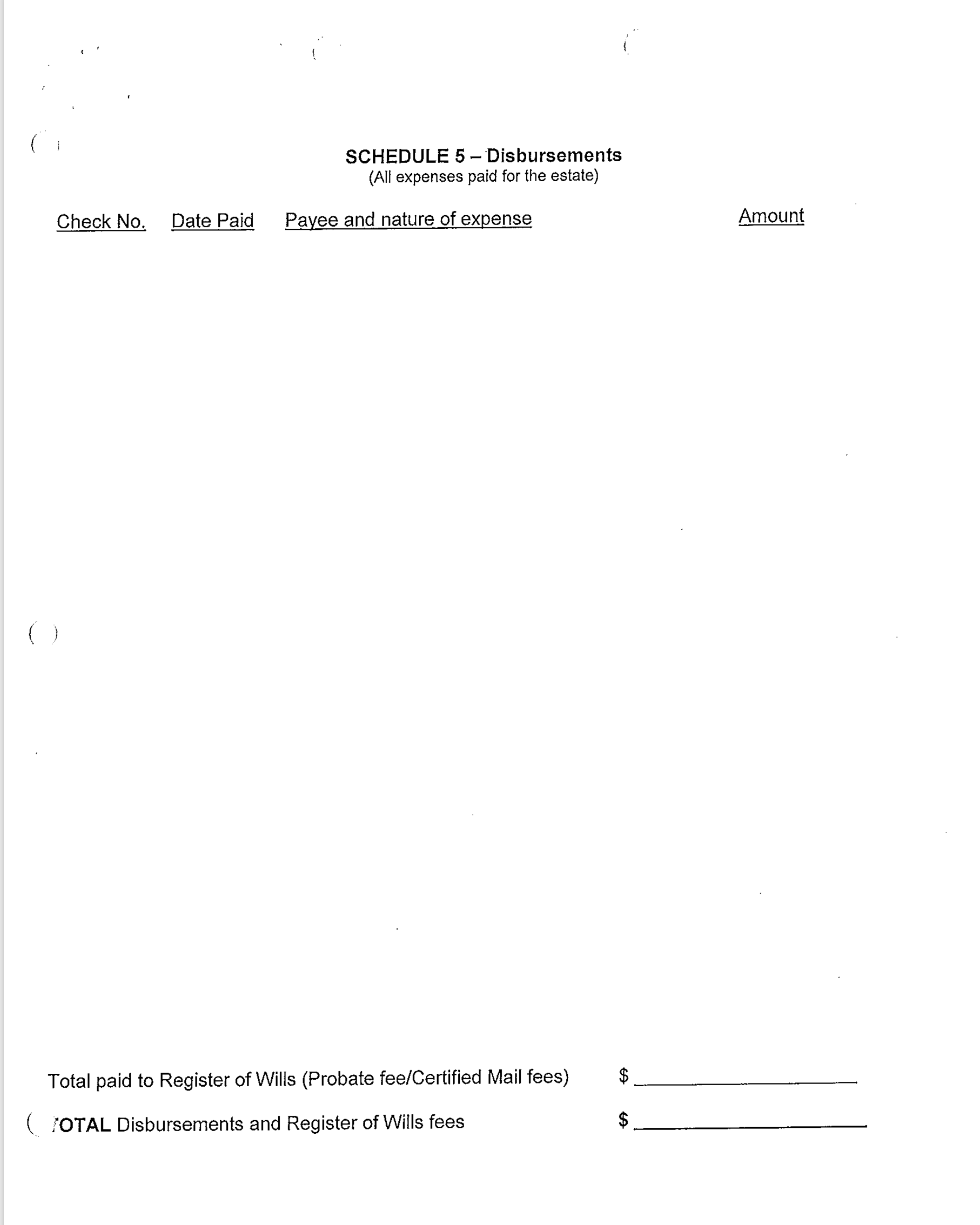

- Assume the following are the sole expenditures made by Phyllis on behalf of the estate: (a) newspaper publication costs of $99.00; (b) insurance/surety bond for the personal representative of $100.00; (c) probate fees and various certified mail costs of $405.59; (d) attorney's fees to Em Kerr and her law firm of $2,115.00; and (e)deed recording fees of $80.00.

- There are no inheritance taxes to be paid on behalf of the estate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started