Answered step by step

Verified Expert Solution

Question

1 Approved Answer

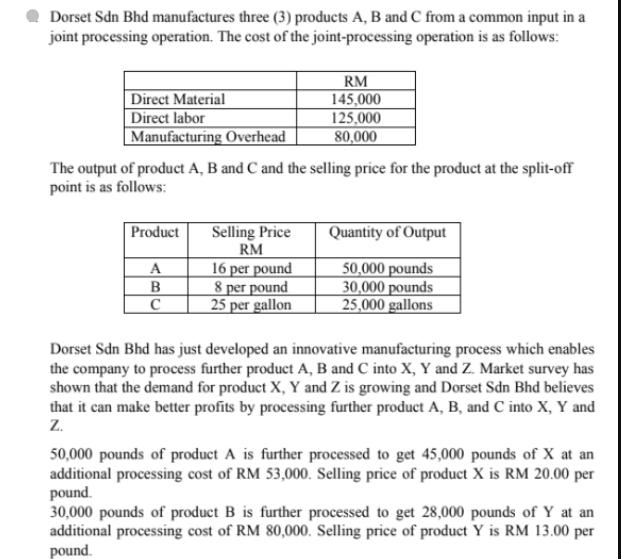

DorsetSdn Bhd manufactures three (3) products A, B and C from a common input in a joint processing operation. The cost of the joint-processing

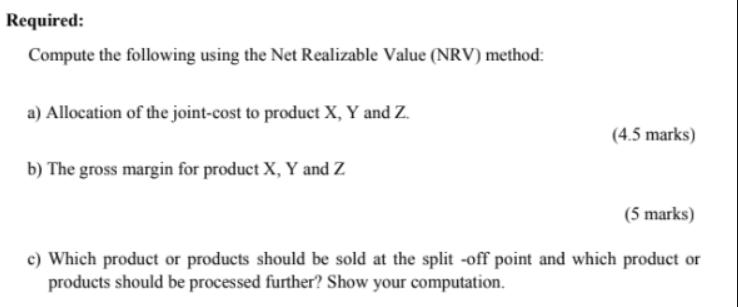

DorsetSdn Bhd manufactures three (3) products A, B and C from a common input in a joint processing operation. The cost of the joint-processing operation is as follows: Direct Material Direct labor Manufacturing Overhead The output of product A, B and C and the selling price for the product at the split-off point is as follows: Product A B C RM 145,000 125,000 80,000 Selling Price RM 16 per pound 8 per pound 25 per gallon Quantity of Output 50,000 pounds 30,000 pounds 25,000 gallons Dorset Sdn Bhd has just developed an innovative manufacturing process which enables the company to process further product A, B and C into X, Y and Z. Market survey has shown that the demand for product X, Y and Z is growing and Dorset Sdn Bhd believes that it can make better profits by processing further product A, B, and C into X, Y and Z. 50,000 pounds of product A is further processed to get 45,000 pounds of X at an additional processing cost of RM 53,000. Selling price of product X is RM 20.00 per pound. 30,000 pounds of product B is further processed to get 28,000 pounds of Y at an additional processing cost of RM 80,000. Selling price of product Y is RM 13.00 per pound. 25,000 gallons of product C is further processed to get 21,000 gallons of Z at an additional processing cost of RM 50,000. Selling price of product Z is RM 32.00 per gallon. Sales during October 2020 for product X is 44,000 pounds, product Y is 26,000 pounds and product Z is 20,000 gallons. (round up all decimal points to 3 decimal place). Required: Compute the following using the Net Realizable Value (NRV) method: a) Allocation of the joint-cost to product X, Y and Z. b) The gross margin for product X, Y and Z (4.5 marks) (5 marks) c) Which product or products should be sold at the split -off point and which product or products should be processed further? Show your computation.

Step by Step Solution

★★★★★

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a Allocation of Joint Cost to Product X Y and Z Total Joint Cost RM 145000 RM 125000 RM 80000 RM 350000 Allocating joint cost based on relative sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started