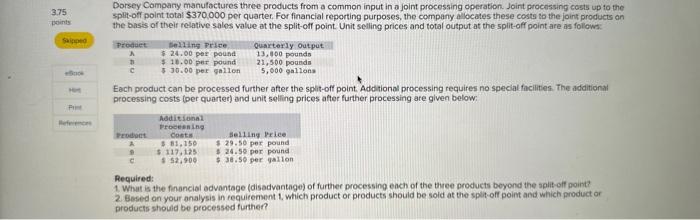

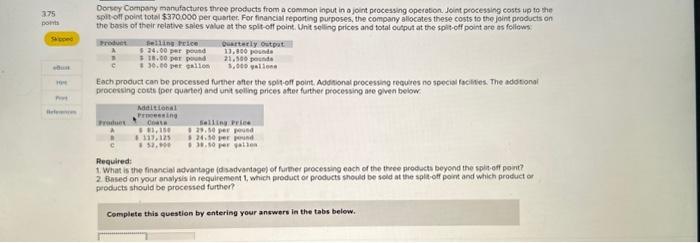

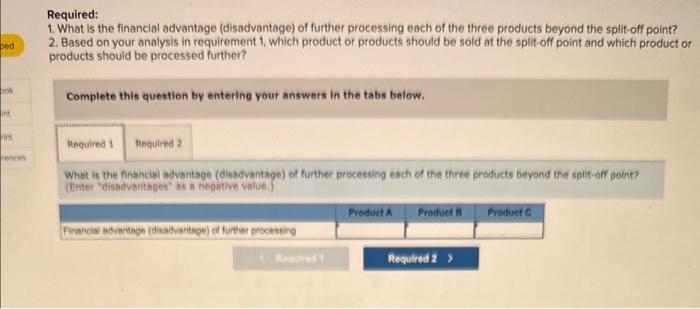

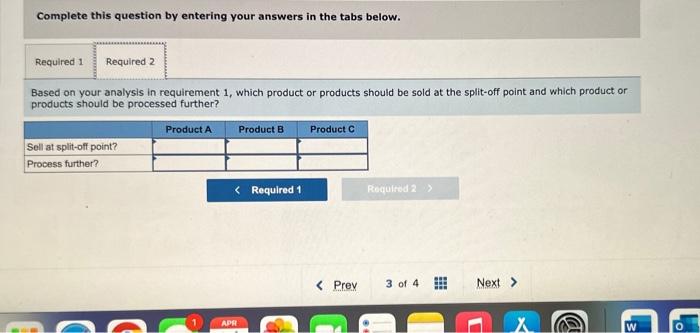

Dorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-of point totai $370,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products on the basts of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as folows Each product can be processed further after the split-off point Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products boyond the spiit-off point? 2. Bosed on your analysis in requirement 1 . which product or products should be soid at the split-off poimt and which product or products shouid be processed further? Dorsey Compsny manufactutes three products from a comment input in o joint processing operetion, Joint processing coses up to she spit oll point totil $370000 per quartec. For financial reporting purposes, the company allocates these costs to the joint products on the bosis of their relatwe sales value at the spit-off point. Unit selling prices and total output at the split-off point are as folicws Each proouct can be processed further after the solt-off point. Addinonal procesing reoures no soeciai facimes. The adotional processing cots (por quated) and unt selling prices atter further processing ate given below: Required: 2. Bused on your anslysis in requirensent 1, which product or products showld be seld at the spltooft point and which product or products should be procesied further? Complete this question by entering your answers in the tabs below. Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? 2. Based on your analysis in requirement 1, which product or products should be sold at the split-off point and which product or products should be processed further? Complete this question by entering your answers in the tabs below. What is the financisl advantage (dlesdventage) of further procesting esch of the three products beyond the split-off goint? (Enter "disbdvbntagen" os o negotlve vblue.) Complete this question by entering your answers in the tabs below. Based on your analysis in requirement 1 , which product or products should be sold at the split-off point and which product or products should be processed further? Dorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-of point totai $370,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products on the basts of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as folows Each product can be processed further after the split-off point Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products boyond the spiit-off point? 2. Bosed on your analysis in requirement 1 . which product or products should be soid at the split-off poimt and which product or products shouid be processed further? Dorsey Compsny manufactutes three products from a comment input in o joint processing operetion, Joint processing coses up to she spit oll point totil $370000 per quartec. For financial reporting purposes, the company allocates these costs to the joint products on the bosis of their relatwe sales value at the spit-off point. Unit selling prices and total output at the split-off point are as folicws Each proouct can be processed further after the solt-off point. Addinonal procesing reoures no soeciai facimes. The adotional processing cots (por quated) and unt selling prices atter further processing ate given below: Required: 2. Bused on your anslysis in requirensent 1, which product or products showld be seld at the spltooft point and which product or products should be procesied further? Complete this question by entering your answers in the tabs below. Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? 2. Based on your analysis in requirement 1, which product or products should be sold at the split-off point and which product or products should be processed further? Complete this question by entering your answers in the tabs below. What is the financisl advantage (dlesdventage) of further procesting esch of the three products beyond the split-off goint? (Enter "disbdvbntagen" os o negotlve vblue.) Complete this question by entering your answers in the tabs below. Based on your analysis in requirement 1 , which product or products should be sold at the split-off point and which product or products should be processed further