Question

Doug Judy is preparing to launch a new business(based on the advice of his lawyer, he has decided to organize his business as a Limited

Doug Judy is preparing to launch a new business(based on the advice of his lawyer, he has decided to organize his business as a Limited Liability Company (LLC)). However, he wants to determine how his business should be classified (i.e.,taxed) for federal tax purposes.

Facts -The company will manufacture and sell tracksuits (i.e., leisure-type wear). Doug has been designing and making track suits for himself for the last three years. -The company will be 100% owned by Doug. -The company will be funded by Doug contributing $1,000,000 in cash and a machine (personal-use property). The machine has a fair market value of $16,000, a cost basis of $14,000. The placed in-service date will be 1/15/24 and the recovery period will be 5 years. -In the company's initial year of operations, Doug plans to take distributions from the company equal to 15% of taxable income.

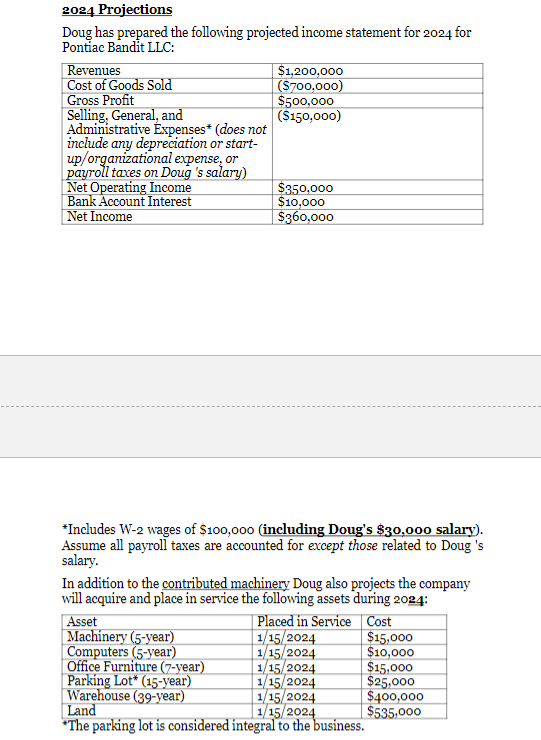

-The company will begin business on January 15, 2024. By the start of business, the company will have incurred organizational costs of $5,000 and start-up costs of $54,000. These costs are not included in the income statement provided below.

-Doug will face the maximum marginal tax rate of 37% on any income taxed at the individual level. Doug has no other sources of wage or self-employment income (i.e., he currently has no earnings that count towards the Social Security wage base). -Doug will be actively engaged in the management of the company as its President and CEO. For his work, Doug plans to draw a reasonable salary of $30,000 from the company. To ensure comparability between entities, you should reduce Doug 's distribution from the C Corporations by the amount of reasonable salary -Doug wants to maximize the company's depreciation deductions

-Assume any distribution from a C Corporation will be treated as a qualified dividend by Doug.

-Doug and the company will operate on a calendar-year basis. -Doug is unmarried (single) and aged 42. Objective: A Choice of Entity Recommendation Using the information provided by Doug, estimate the total tax burden that the business entity and Doug will face in tax year 2024 if the business were to operate for federal tax purposes as a C-Corporation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started