Answered step by step

Verified Expert Solution

Question

1 Approved Answer

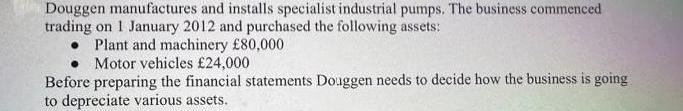

Douggen manufactures and installs specialist industrial pumps. The business commenced trading on 1 January 2012 and purchased the following assets: Plant and machinery 80,000

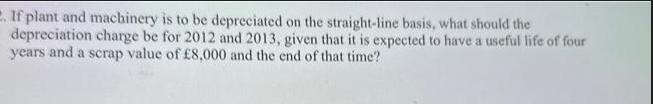

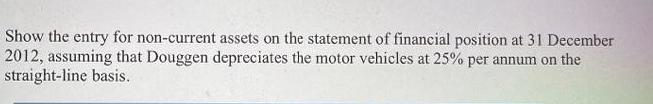

Douggen manufactures and installs specialist industrial pumps. The business commenced trading on 1 January 2012 and purchased the following assets: Plant and machinery 80,000 Motor vehicles 24,000 Before preparing the financial statements Douggen needs to decide how the business is going to depreciate various assets. 2. If plant and machinery is to be depreciated on the straight-line basis, what should the depreciation charge be for 2012 and 2013, given that it is expected to have a useful life of four years and a scrap value of 8,000 and the end of that time? Show the entry for non-current assets on the statement of financial position at 31 December 2012, assuming that Douggen depreciates the motor vehicles at 25% per annum on the straight-line basis.

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation of Plant and Machinery The straightline depreciation formula is Depreciation Expense In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started