Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Hull Division manufactures a number of variants of its main chemical industrial Product. The division decided long term ago to work under a

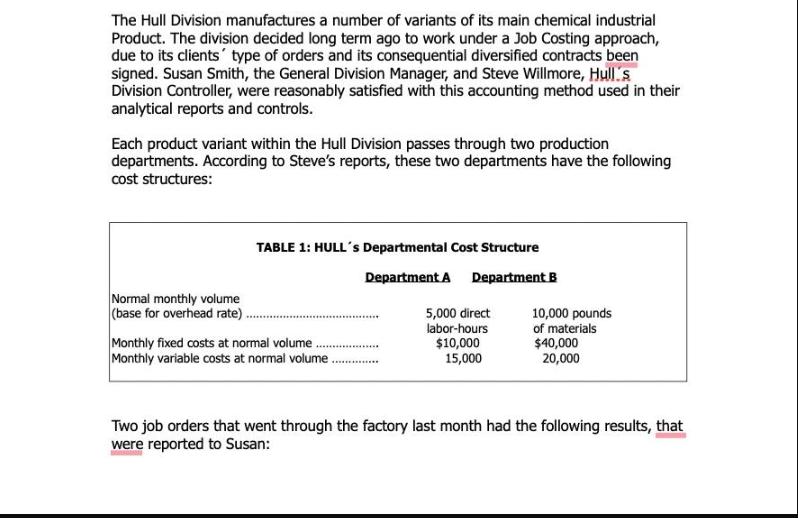

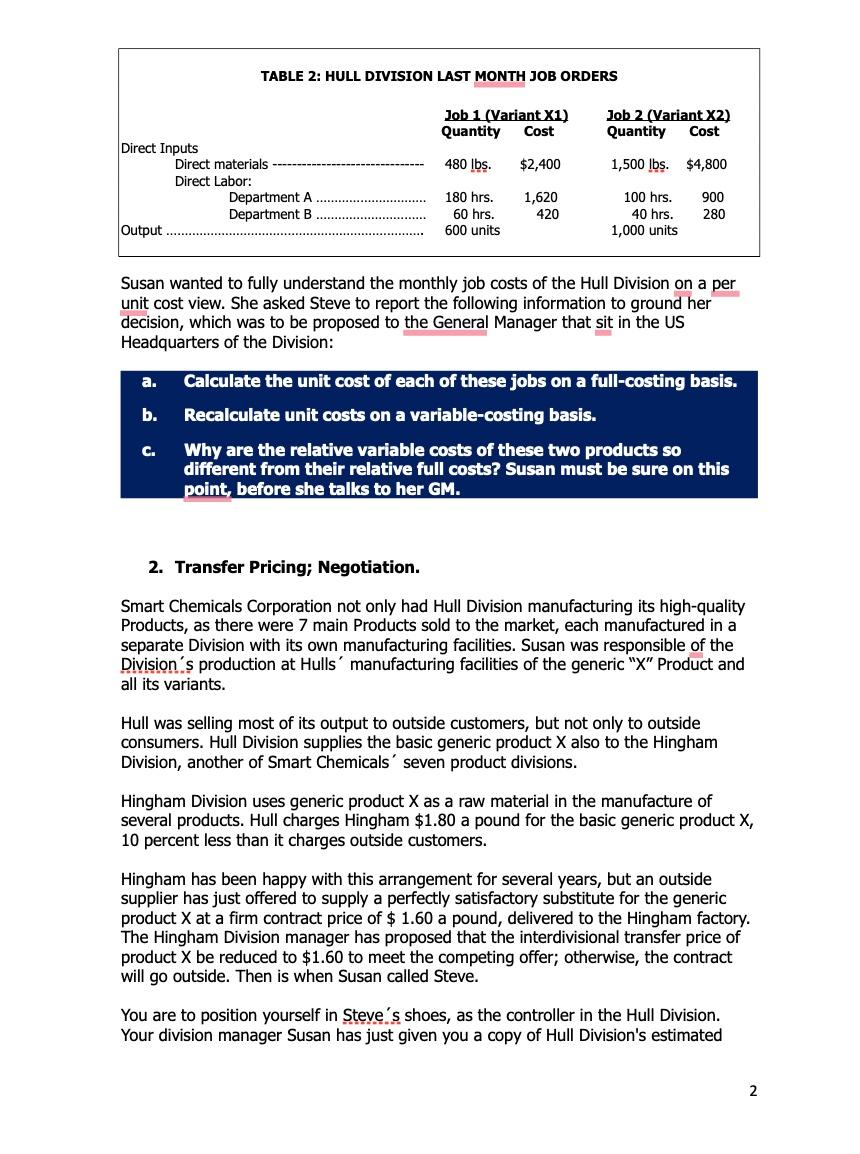

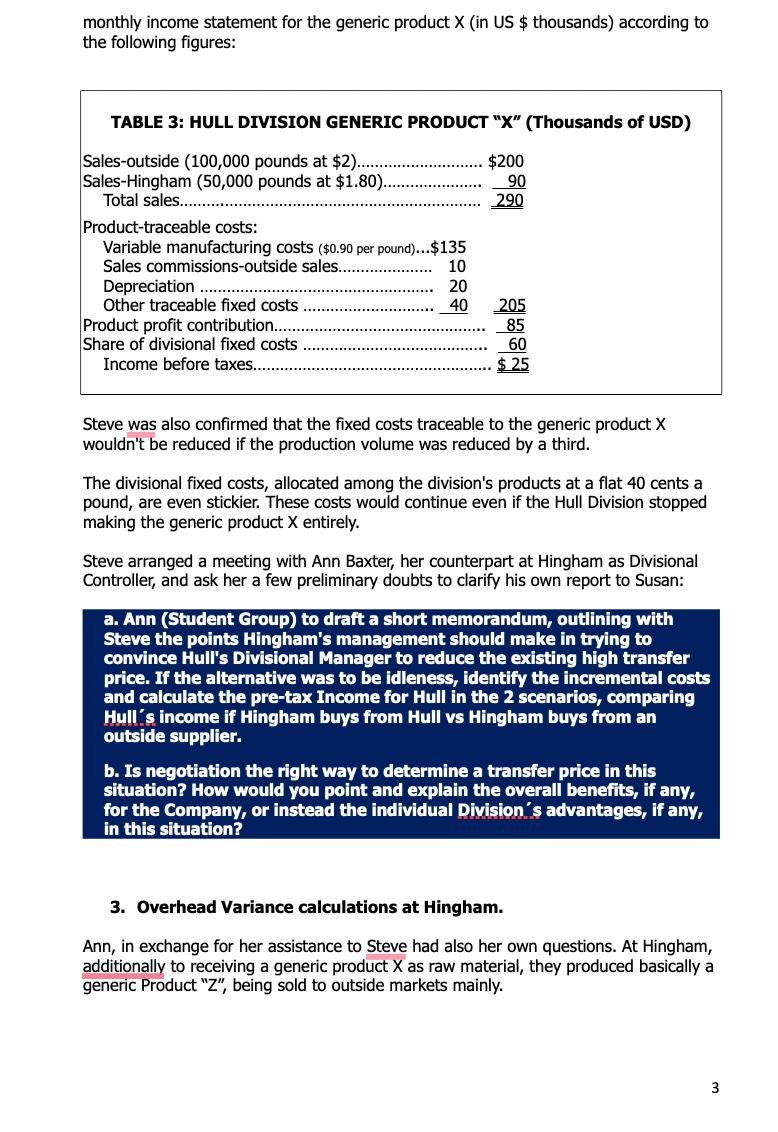

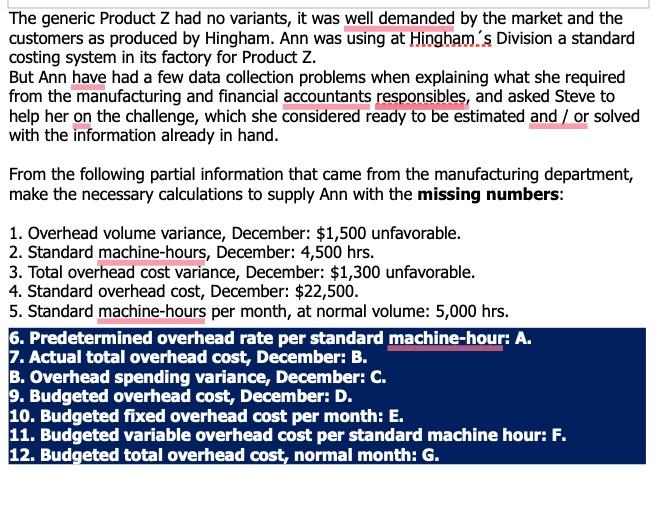

The Hull Division manufactures a number of variants of its main chemical industrial Product. The division decided long term ago to work under a Job Costing approach, due to its clients' type of orders and its consequential diversified contracts been signed. Susan Smith, the General Division Manager, and Steve Willmore, Hull's Division Controller, were reasonably satisfied with this accounting method used in their analytical reports and controls. Each product variant within the Hull Division passes through two production departments. According to Steve's reports, these two departments have the following cost structures: Normal monthly volume (base for overhead rate) TABLE 1: HULL's Departmental Cost Structure Department A Department B Monthly fixed costs at normal volume Monthly variable costs at normal volume. 5,000 direct labor-hours $10,000 15,000 10,000 pounds of materials $40,000 20,000 Two job orders that went through the factory last month had the following results, that were reported to Susan: Direct Inputs Output a. b. TABLE 2: HULL DIVISION LAST MONTH JOB ORDERS C. Direct materials Direct Labor: Department A Department B Job 1 (Variant X1) Quantity Cost $2,400 1,620 420 480 lbs. 180 hrs. 60 hrs. 600 units Job 2 (Variant X2) Quantity Cost 1,500 lbs. $4,800 Susan wanted to fully understand the monthly job costs of the Hull Division on a per unit cost view. She asked Steve to report the following information to ground her decision, which was to be proposed to the General Manager that sit in the US Headquarters of the Division: 100 hrs. 40 hrs. 1,000 units 900 280 Calculate the unit cost of each of these jobs on a full-costing basis. Recalculate unit costs on a variable-costing basis. Why are the relative variable costs of these two products so different from their relative full costs? Susan must be sure on this point, before she talks to her GM. 2. Transfer Pricing; Negotiation. Smart Chemicals Corporation not only had Hull Division manufacturing its high-quality Products, as there were 7 main Products sold to the market, each manufactured in a separate Division with its own manufacturing facilities. Susan was responsible of the Division's production at Hulls manufacturing facilities of the generic "X" Product and all its variants. Hull was selling most of its output to outside customers, but not only to outside consumers. Hull Division supplies the basic generic product X also to the Hingham Division, another of Smart Chemicals' seven product divisions. Hingham Division uses generic product X as a raw material in the manufacture of several products. Hull charges Hingham $1.80 a pound for the basic generic product X, 10 percent less than it charges outside customers. Hingham has been happy with this arrangement for several years, but an outside supplier has just offered to supply a perfectly satisfactory substitute for the generic product X at a firm contract price of $ 1.60 a pound, delivered to the Hingham factory. The Hingham Division manager has proposed that the interdivisional transfer price of product X be reduced to $1.60 to meet the competing offer; otherwise, the contract will go outside. Then is when Susan called Steve. You are to position yourself in Steve's shoes, as the controller in the Hull Division. Your division manager Susan has just given you a copy of Hull Division's estimated 2 monthly income statement for the generic product X (in US $ thousands) according to the following figures: TABLE 3: HULL DIVISION GENERIC PRODUCT "X" (Thousands of USD) Sales-outside (100,000 pounds at $2)... $200 Sales-Hingham (50,000 pounds at $1.80).. 90 Total sales. 290 Product-traceable costs: Variable manufacturing costs ($0.90 per pound)... $135 Sales commissions-outside sales. 10 Depreciation Other traceable fixed costs Product profit contribution.. Share of divisional fixed costs Income before taxes... 20 40 205 85 60 $25 Steve was also confirmed that the fixed costs traceable to the generic product X wouldn't be reduced if the production volume was reduced by a third. The divisional fixed costs, allocated among the division's products at a flat 40 cents a pound, are even stickier. These costs would continue even if the Hull Division stopped making the generic product X entirely. Steve arranged a meeting with Ann Baxter, her counterpart at Hingham as Divisional Controller, and ask her a few preliminary doubts to clarify his own report to Susan: a. Ann (Student Group) to draft a short memorandum, outlining with Steve the points Hingham's management should make in trying to convince Hull's Divisional Manager to reduce the existing high transfer price. If the alternative was to be idleness, identify the incremental costs and calculate the pre-tax Income for Hull in the 2 scenarios, comparing Hull's income if Hingham buys from Hull vs Hingham buys from an outside supplier. b. Is negotiation the right way to determine a transfer price in this situation? How would you point and explain the overall benefits, if any, for the Company, or instead the individual Division's advantages, if any, in this situation? 3. Overhead Variance calculations at Hingham. Ann, in exchange for her assistance to Steve had also her own questions. At Hingham, additionally to receiving a generic product X as raw material, they produced basically a generic Product "Z", being sold to outside markets mainly. 3 The generic Product Z had no variants, it was well demanded by the market and the customers as produced by Hingham. Ann was using at Hingham's Division a standard costing system in its factory for Product Z. But Ann have had a few data collection problems when explaining what she required from the manufacturing and financial accountants responsibles, and asked Steve to help her on the challenge, which she considered ready to be estimated and / or solved with the information already in hand. From the following partial information that came from the manufacturing department, make the necessary calculations to supply Ann with the missing numbers: 1. Overhead volume variance, December: $1,500 unfavorable. 2. Standard machine-hours, December: 4,500 hrs. 3. Total overhead cost variance, December: $1,300 unfavorable. 4. Standard overhead cost, December: $22,500. 5. Standard machine-hours per month, at normal volume: 5,000 hrs. 6. Predetermined overhead rate per standard machine-hour: A. 7. Actual total overhead cost, December: B. B. Overhead spending variance, December: C. 9. Budgeted overhead cost, December: D. 10. Budgeted fixed overhead cost per month: E. 11. Budgeted variable overhead cost per standard machine hour: F. 12. Budgeted total overhead cost, normal month: G.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 1 c Explanation for the Difference in Relative Variable Costs The relative variable costs of the two products are different from their relative full costs due to the allocation of fixe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started