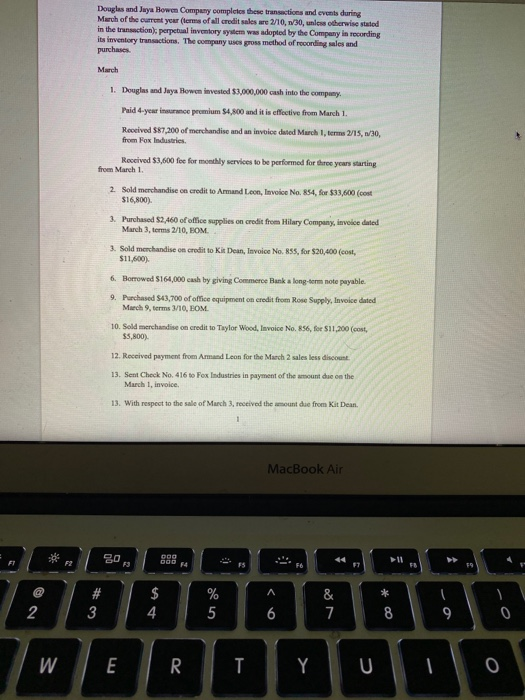

Douglas and Juya Bowen Company complete these transactions and events during March of the current your terms of all credit sales are 2/10, 1/30, unless otherwise stated in the transactions perpetual inventory system was adopted by the Company in recording its inventory transactions. The company was gross method of recording sales and purchases March 1. Douglas and Jaya Huwen invested $3,000,000 cash into the company. Paid 4-year ice premium 34,800 and it is effective from March 1 Received $87,200 of merchandise and an invloe dated March 1, terms 2/15, 1/30, from Fox Industries Received $3,600 fee for monthly services to be performed for three years starting from March 1. 2 Sold merchandise on credit to Amand Ln, Invoice No. 854, for $33,600 (cost $16,800). 3. Purchased $2,460 of office supplies on credit from Hilary Company, invoice dated March 3, terms 2/10, BOM 3. Sold merchandise on credit to Kit Dean, Invoice No. 855, for $20,400 (cost, $11,600) 6. Borrowed 5164,000 cash by giving Commerce Bank a long-term note payable. 9. Purchased $43,700 of office equipment on credit from Rose Supply, Invoice dated March terms 310, EOM. 10. Sold merchandise on credit to Taylor Wood, Invoice No. 856, for $11,200 (cost, $5,800) 12. Received payment from Armand Leon for the March 2 sales les discount. 13. Sent Check No. 416 to Fox Industries in payment of the amount due on the March 1, invoice 13. With respect to the sale of March 3, received the amount due from Kit Dean. MacBook Air 000 80 13 F2 COD F4 11 # * $ 4 % 5 & 7 2 6 8 9 W E R Y U 0 Douglas and Juya Bowen Company complete these transactions and events during March of the current your terms of all credit sales are 2/10, 1/30, unless otherwise stated in the transactions perpetual inventory system was adopted by the Company in recording its inventory transactions. The company was gross method of recording sales and purchases March 1. Douglas and Jaya Huwen invested $3,000,000 cash into the company. Paid 4-year ice premium 34,800 and it is effective from March 1 Received $87,200 of merchandise and an invloe dated March 1, terms 2/15, 1/30, from Fox Industries Received $3,600 fee for monthly services to be performed for three years starting from March 1. 2 Sold merchandise on credit to Amand Ln, Invoice No. 854, for $33,600 (cost $16,800). 3. Purchased $2,460 of office supplies on credit from Hilary Company, invoice dated March 3, terms 2/10, BOM 3. Sold merchandise on credit to Kit Dean, Invoice No. 855, for $20,400 (cost, $11,600) 6. Borrowed 5164,000 cash by giving Commerce Bank a long-term note payable. 9. Purchased $43,700 of office equipment on credit from Rose Supply, Invoice dated March terms 310, EOM. 10. Sold merchandise on credit to Taylor Wood, Invoice No. 856, for $11,200 (cost, $5,800) 12. Received payment from Armand Leon for the March 2 sales les discount. 13. Sent Check No. 416 to Fox Industries in payment of the amount due on the March 1, invoice 13. With respect to the sale of March 3, received the amount due from Kit Dean. MacBook Air 000 80 13 F2 COD F4 11 # * $ 4 % 5 & 7 2 6 8 9 W E R Y U 0