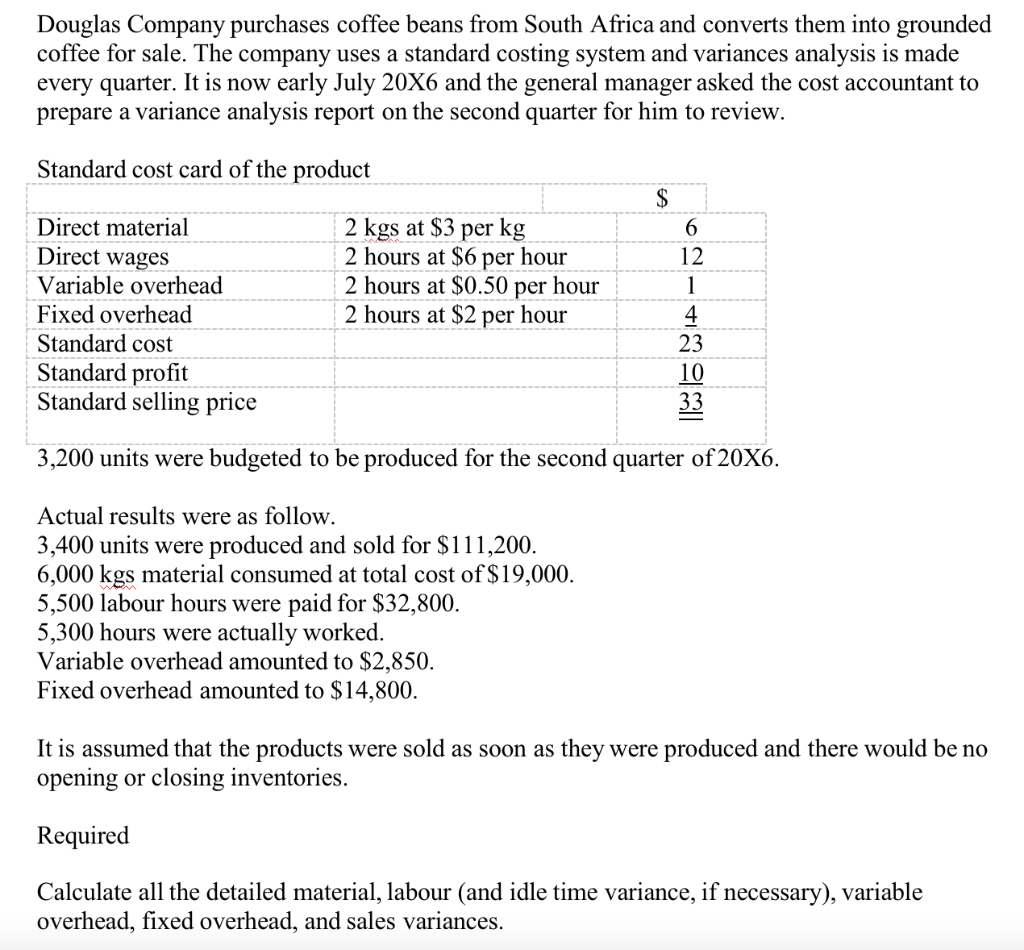

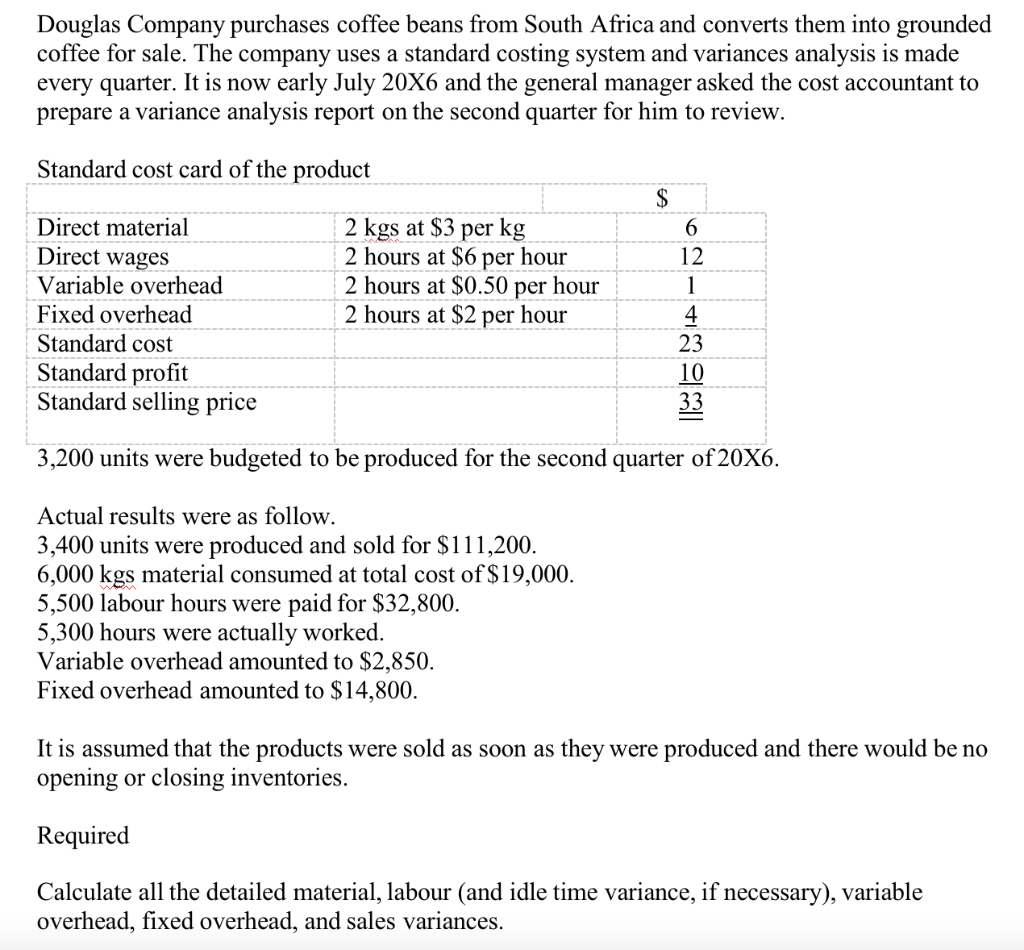

Douglas Company purchases coffee beans from South Africa and converts them into grounded coffee for sale. The company uses a standard costing system and variances analysis is made every quarter. It is now early July 20X6 and the general manager asked the cost accountant to prepare a variance analysis report on the second quarter for him to review. Standard cost card of the product 2 kgs at $3 per kg 2 hours at $6 per hour 2 hours at $0.50 per hour 2 hours at $2 per hour $ Direct material Direct wages Variable overhead Fixed overhead Standard cost Standard profit 10 Standard selling price 33 3,200 units were budgeted to be produced for the second quarter of 20X6. Actual results were as follow. 3,400 units were produced and sold for $111,200. 6,000 kgs material consumed at total cost of $19,000. 5,500 labour hours were paid for $32,800. 5,300 hours were actually worked. Variable overhead amounted to $2,850. Fixed overhead amounted to $14,800. 6 12 1 4 23 It is assumed that the products were sold as soon as they were produced and there would be no opening or closing inventories. Required Calculate all the detailed material, labour (and idle time variance, if necessary), variable overhead, fixed overhead, and sales variances. Douglas Company purchases coffee beans from South Africa and converts them into grounded coffee for sale. The company uses a standard costing system and variances analysis is made every quarter. It is now early July 20X6 and the general manager asked the cost accountant to prepare a variance analysis report on the second quarter for him to review. Standard cost card of the product 2 kgs at $3 per kg 2 hours at $6 per hour 2 hours at $0.50 per hour 2 hours at $2 per hour $ Direct material Direct wages Variable overhead Fixed overhead Standard cost Standard profit 10 Standard selling price 33 3,200 units were budgeted to be produced for the second quarter of 20X6. Actual results were as follow. 3,400 units were produced and sold for $111,200. 6,000 kgs material consumed at total cost of $19,000. 5,500 labour hours were paid for $32,800. 5,300 hours were actually worked. Variable overhead amounted to $2,850. Fixed overhead amounted to $14,800. 6 12 1 4 23 It is assumed that the products were sold as soon as they were produced and there would be no opening or closing inventories. Required Calculate all the detailed material, labour (and idle time variance, if necessary), variable overhead, fixed overhead, and sales variances