Answered step by step

Verified Expert Solution

Question

1 Approved Answer

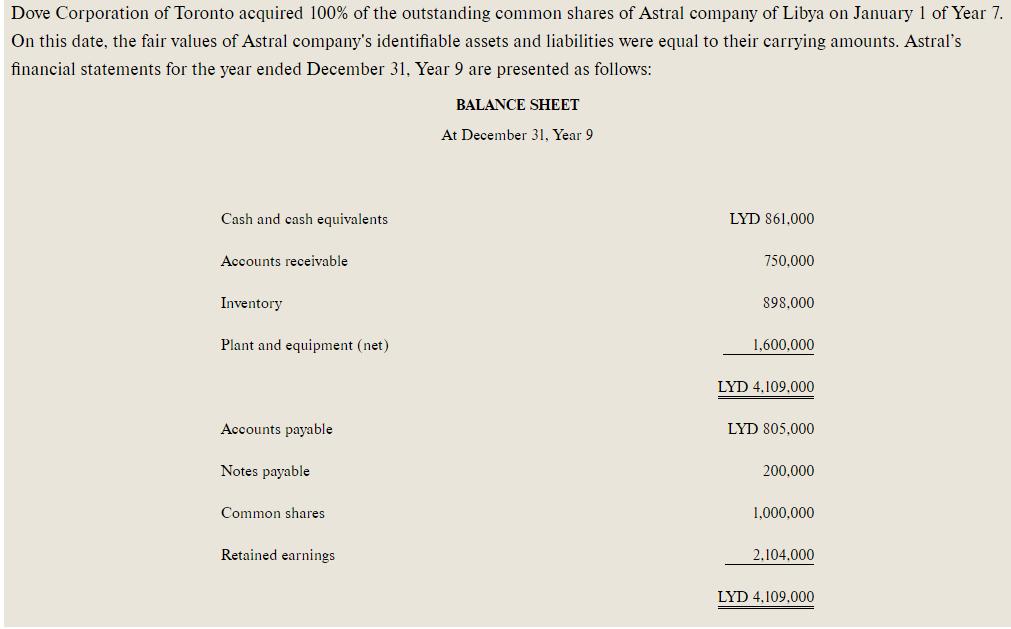

Dove Corporation of Toronto acquired 100% of the outstanding common shares of Astral company of Libya on January 1 of Year 7. On this

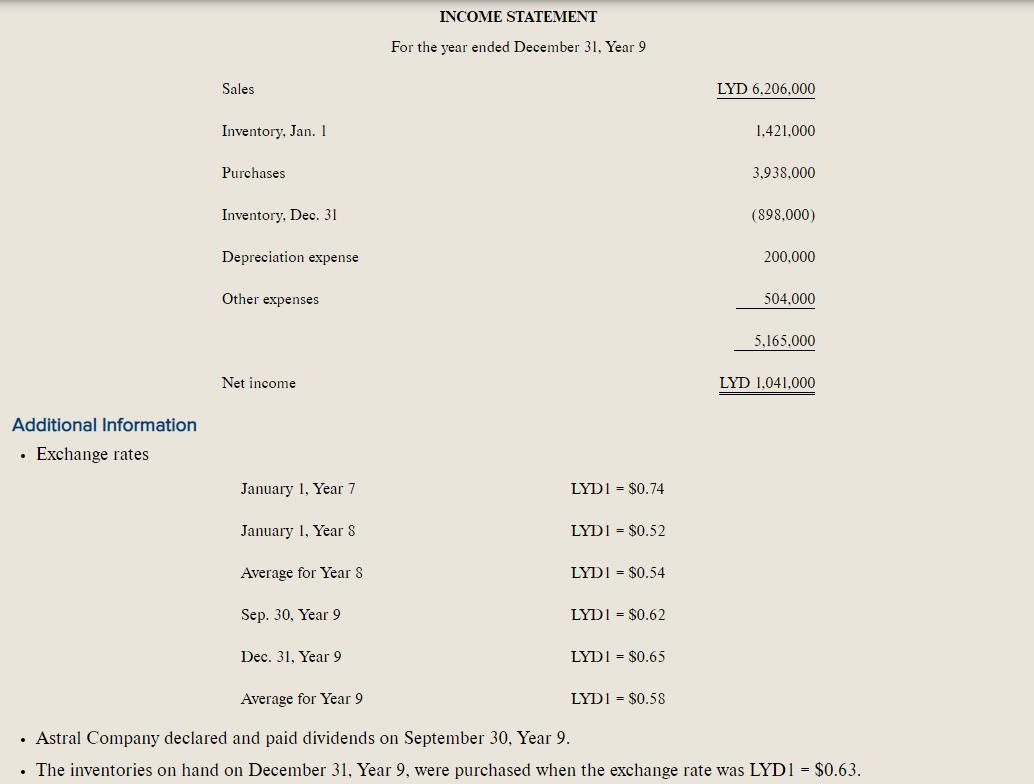

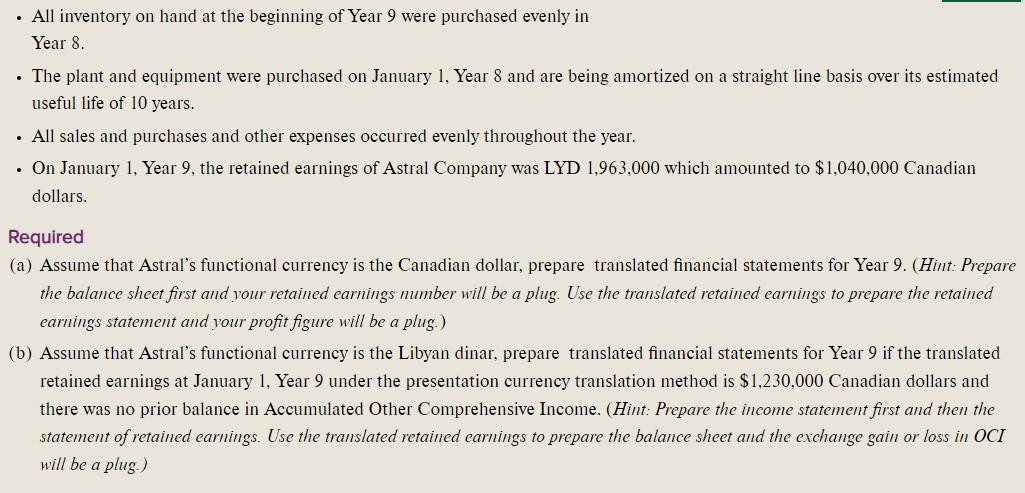

Dove Corporation of Toronto acquired 100% of the outstanding common shares of Astral company of Libya on January 1 of Year 7. On this date, the fair values of Astral company's identifiable assets and liabilities were equal to their carrying amounts. Astral's financial statements for the year ended December 31, Year 9 are presented as follows: Cash and cash equivalents Accounts receivable Inventory Plant and equipment (net) Accounts payable Notes payable Common shares Retained earnings BALANCE SHEET At December 31, Year 9 LYD 861,000 750,000 898.000 1,600,000 LYD 4.109,000 LYD 805,000 200,000 1,000,000 2.104.000 LYD 4,109,000 Additional Information Exchange rates Sales Inventory, Jan. 1 Purchases Inventory, Dec. 31 Depreciation expense Other expenses Net income January 1, Year 7 January 1, Year S Average for Year 8 Sep. 30, Year 9 Dec. 31, Year 9 INCOME STATEMENT For the year ended December 31, Year 9 LYD1 = $0.74 LYD1 = $0.52 LYDI = $0.54 LYDI = $0.62 LYDI = $0.65 LYDI = $0.58 LYD 6,206,000 1.421,000 3,938,000 (898,000) 200,000 504.000 5,165,000 LYD 1.041.000 Average for Year 9 Astral Company declared and paid dividends on September 30, Year 9. The inventories on hand on December 31, Year 9, were purchased when the exchange rate was LYD1 = $0.63. All inventory on hand at the beginning of Year 9 were purchased evenly in Year 8. . The plant and equipment were purchased on January 1, Year 8 and are being amortized on a straight line basis over its estimated useful life of 10 years. All sales and purchases and other expenses occurred evenly throughout the year. . On January 1, Year 9, the retained earnings of Astral Company was LYD 1,963,000 which amounted to $1,040,000 Canadian dollars. Required (a) Assume that Astral's functional currency is the Canadian dollar, prepare translated financial statements for Year 9. (Hint: Prepare the balance sheet first and your retained earnings number will be a plug. Use the translated retained earnings to prepare the retained earnings statement and your profit figure will be a plug.) (b) Assume that Astral's functional currency is the Libyan dinar, prepare translated financial statements for Year 9 if the translated retained earnings at January 1, Year 9 under the presentation currency translation method is $1,230,000 Canadian dollars and there was no prior balance in Accumulated Other Comprehensive Income. (Hint: Prepare the income statement first and then the statement of retained earnings. Use the translated retained earnings to prepare the balance sheet and the exchange gain or loss in OCI will be a plug.)

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Translated Financial Statements for Year 9 Assuming Canadian Dollar CAD as Functional Currency Bal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started