Question

Dover Corporation(DOV (NYSE)sing the financial statements. Answer the following questions, 1) Is your company able to meet its obligations for the next 12 months? 2)

Dover Corporation(DOV (NYSE)sing the financial statements. Answer the following questions, 1) Is your company able to meet its obligations for the next 12 months? 2) Who is financing more the assets, external investors or banks, shareholders or suppliers? 3) If you were a Banker are you willing to lend to your company? Use the format below to support your answers. Question # / Answer Calculation or Ratio Used Reason or Logic used You must visit the SEC10K of your firm and read the sections, financial statements and management discussions. Dover current ratio for the three months ending June 30, 2020 was 1.32. dover quick ration;2020-06-30 current asset inventoiry-$1.91B Current liabilities $2.11B quick ratio-0.91 Current and historical debt to equity ratio values for Dover (DOV) over the last 10 years. The debt/equity ratio can be defined as a measure of a company's financial leverage calculated by dividing its long-term debt by stockholders' equity. Dover debt/equity for the three months ending June 30, 2020 was 0.97.

Dover Corporation(DOV (NYSE)sing the financial statements. Answer the following questions, 1) Is your company able to meet its obligations for the next 12 months? 2) Who is financing more the assets, external investors or banks, shareholders or suppliers? 3) If you were a Banker are you willing to lend to your company? Use the format below to support your answers. Question # / Answer Calculation or Ratio Used Reason or Logic used You must visit the SEC10K of your firm and read the sections, financial statements and management discussions. Dover current ratio for the three months ending June 30, 2020 was 1.32. dover quick ration;2020-06-30 current asset inventoiry-$1.91B Current liabilities $2.11B quick ratio-0.91 Current and historical debt to equity ratio values for Dover (DOV) over the last 10 years. The debt/equity ratio can be defined as a measure of a company's financial leverage calculated by dividing its long-term debt by stockholders' equity. Dover debt/equity for the three months ending June 30, 2020 was 0.97.

please refer SEC information for Dover corporation 2020

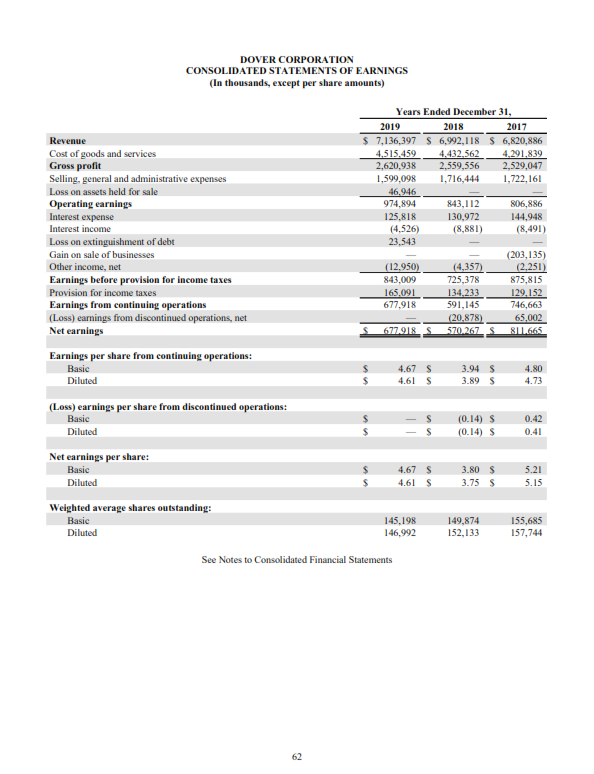

DOVER CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (In thousands, except per share amounts) Revenue Cost of goods and services Gross profit Selling, general and administrative expenses Loss on assets held for sale Operating earnings Interest expense Interest income Loss on extinguishment of debt Gain on sale of businesses Other income, net Earnings before provision for income taxes Provision for income taxes Earnings from continuing operations (Loss) earnings from discontinued operations, net Net earnings Earnings per share from continuing operations: Basic Diluted Years Ended December 31, 2019 2018 2017 $ 7,136,397 $ 6,992,118 $ 6,820,886 4.515.459 4.432.562 4.291.839 2,620,938 2.559,556 2,529,047 1,599,098 1,716,444 1,722,161 46,946 974,894 843,112 806,886 125,818 130,972 144,948 (4,526) (8,881) (8,491) 23,543 (203,135) (12.950) (4,357) (2.251) 843,009 725,378 875,815 165,091 134.233 129,152 677,918 591,145 746,663 (20.878) 65,002 677018S 570.267 S 811.665 s $ 4.67 S 4.61 s 3.94 $ 3.89 $ 4.80 4.73 (Loss) earnings per share from discontinued operations: Basic Diluted s $ (0.14) $ (0.14) $ 0.42 0.41 S Net earnings per share: Basic Diluted 4.67 S 4.61 S 3.80 S 3.75 5.21 5.15 s Weighted average shares outstanding: Basic Diluted 145,198 146,992 149,874 152,133 155,685 157,744 See Notes to Consolidated Financial Statements 62 DOVER CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (In thousands, except per share amounts) Revenue Cost of goods and services Gross profit Selling, general and administrative expenses Loss on assets held for sale Operating earnings Interest expense Interest income Loss on extinguishment of debt Gain on sale of businesses Other income, net Earnings before provision for income taxes Provision for income taxes Earnings from continuing operations (Loss) earnings from discontinued operations, net Net earnings Earnings per share from continuing operations: Basic Diluted Years Ended December 31, 2019 2018 2017 $ 7,136,397 $ 6,992,118 $ 6,820,886 4.515.459 4.432.562 4.291.839 2,620,938 2.559,556 2,529,047 1,599,098 1,716,444 1,722,161 46,946 974,894 843,112 806,886 125,818 130,972 144,948 (4,526) (8,881) (8,491) 23,543 (203,135) (12.950) (4,357) (2.251) 843,009 725,378 875,815 165,091 134.233 129,152 677,918 591,145 746,663 (20.878) 65,002 677018S 570.267 S 811.665 s $ 4.67 S 4.61 s 3.94 $ 3.89 $ 4.80 4.73 (Loss) earnings per share from discontinued operations: Basic Diluted s $ (0.14) $ (0.14) $ 0.42 0.41 S Net earnings per share: Basic Diluted 4.67 S 4.61 S 3.80 S 3.75 5.21 5.15 s Weighted average shares outstanding: Basic Diluted 145,198 146,992 149,874 152,133 155,685 157,744 See Notes to Consolidated Financial Statements 62Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started