Question

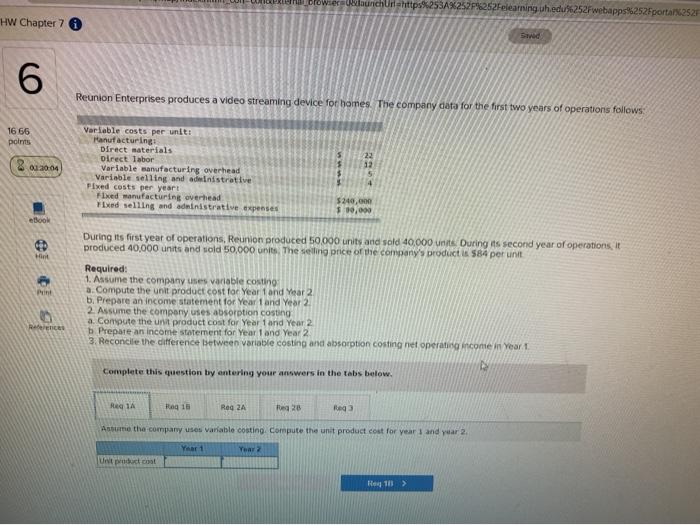

Dowiera launchurahttps%253 8262Felearning uhedu%252Fwebapps%252Fportal 252F HW Chapter 70 Sve 6 Reunion Enterprises produces a video streaming device for homes. The company data for the first

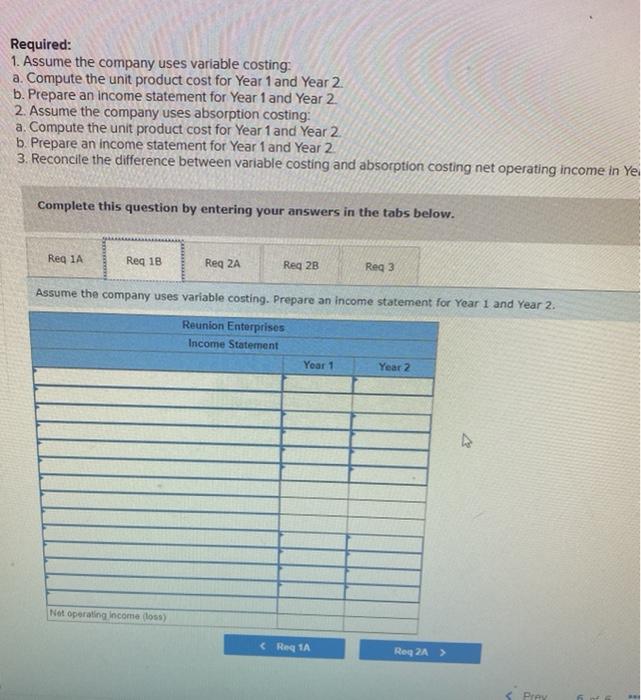

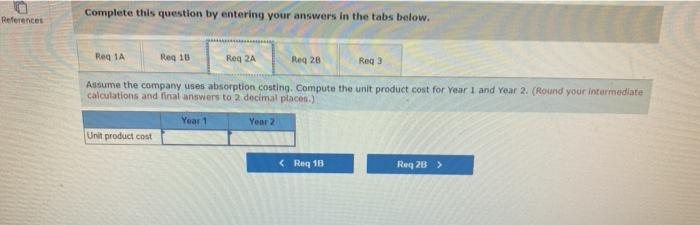

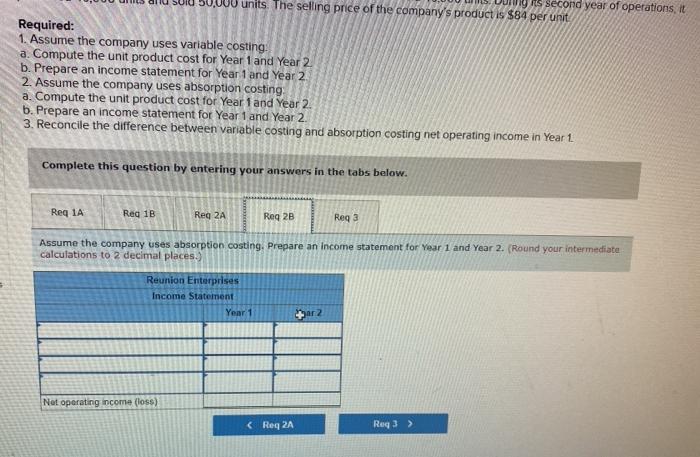

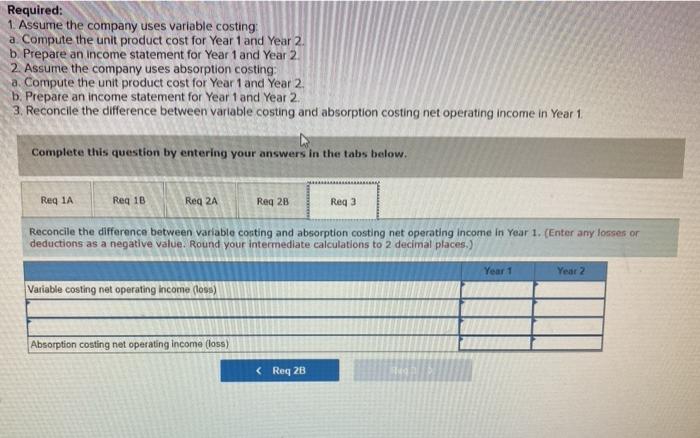

Required: 1. Assume the company uses variable costing a Compute the unit product cost for Year 1 and Year 2. b Prepare an income statement for Year 1 and Year 2 2. Assume the company uses absorption costing: a. Compute the unit product cost for Year 1 and Year 2 b. Prepare an income statement for Year 1 and Year 2. 3. Reconcile the difference between variable costing and absorption costing net operating income in Year 1 Complete this question by entering your answers in the tabs below. Req 1A Reg 16 Red 2A Reg 28 Req3 Reconcile the difference between variable conting and absorption costing net operating income in Year 1. (Enter any losses or deductions as a negative value. Round your intermediate calculations to 2 decimal places.) Year 1 Year 2 Variable costing net operating income (1985 Absorption costing net operating income (loss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started