Answered step by step

Verified Expert Solution

Question

1 Approved Answer

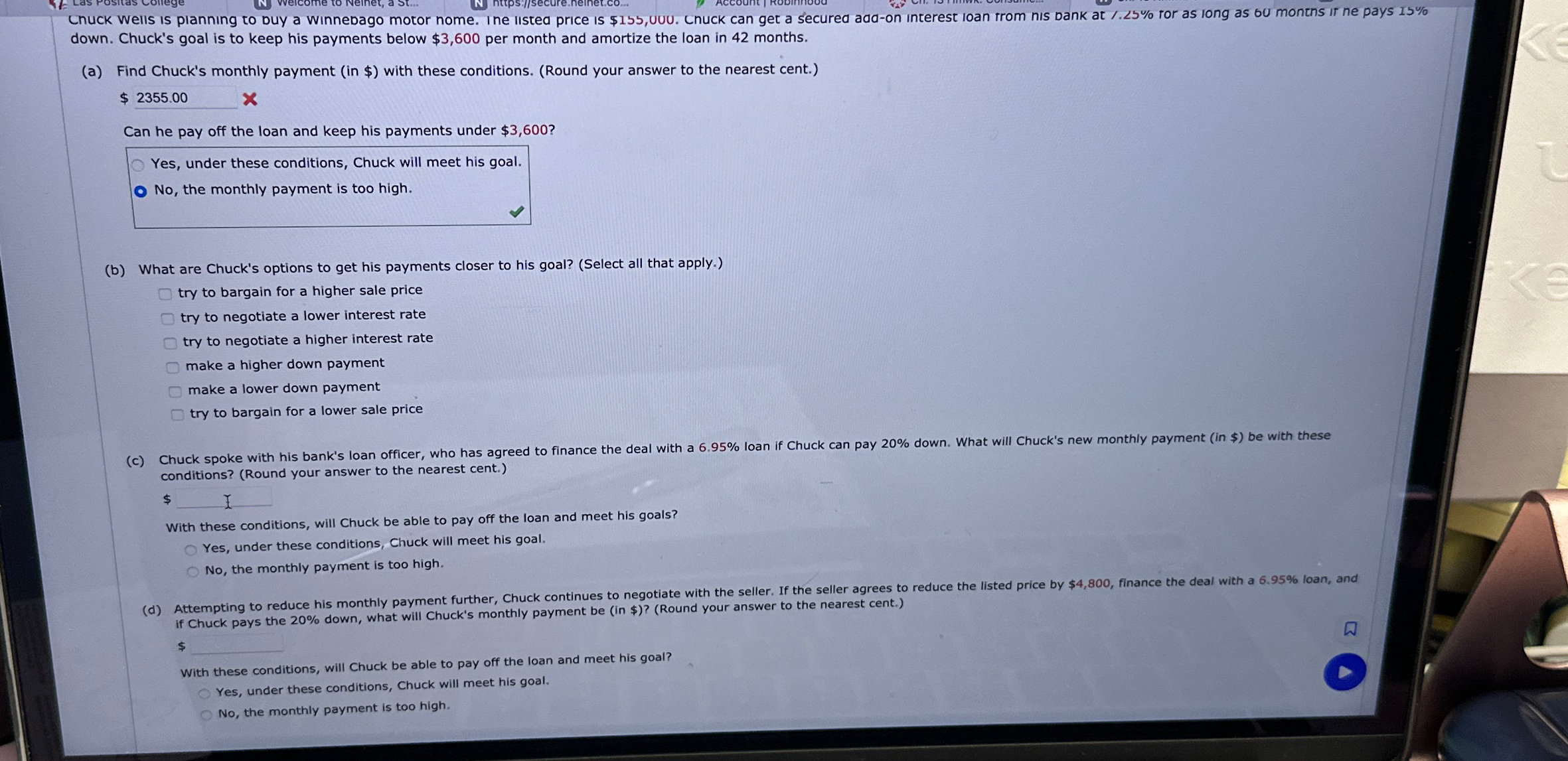

down. Chuck's goal is to keep his payments below $ 3 , 6 0 0 per month and amortize the loan in 4 2 months.

down. Chuck's goal is to keep his payments below $ per month and amortize the loan in months.

a Find Chuck's monthly payment in $ with these conditions. Round your answer to the nearest cent.

Can he pay off the loan and keep his payments under $

Yes, under these conditions, Chuck will meet his goal.

No the monthly payment is too high.

b What are Chuck's options to get his payments closer to his goal? Select all that apply.

try to bargain for a higher sale price

try to negotiate a lower interest rate

try to negotiate a higher interest rate

make a higher down payment

make a lower down payment

try to bargain for a lower sale price conditions? Round your answer to the nearest cent.

With these conditions, will Chuck be able to pay off the loan and meet his goals?

Yes, under these conditions, Chuck will meet his goal.

No the monthly payment is too high. if Chuck pays the down, what will Chuck's monthly payment be in $ Round your answer to the nearest cent.

$

With these conditions, will Chuck be able to pay off the loan and meet his goal?

Yes, under these conditions, Chuck will meet his goal.

No the monthly payment is too high.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started