Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Down options from the top to the bottom: 1). Less / More 2). Less / More 3). Lower / Higher 4). Difference / Sum 5).

Down options from the top to the bottom:

1). Less / More

2). Less / More

3). Lower / Higher

4). Difference / Sum

5). Take Home / Gross

6). Five months / A year

7). Civil Service Programs / Your state workers compensation insurance

8). Short term / Long term

9). Are / are not

10). Are / are not

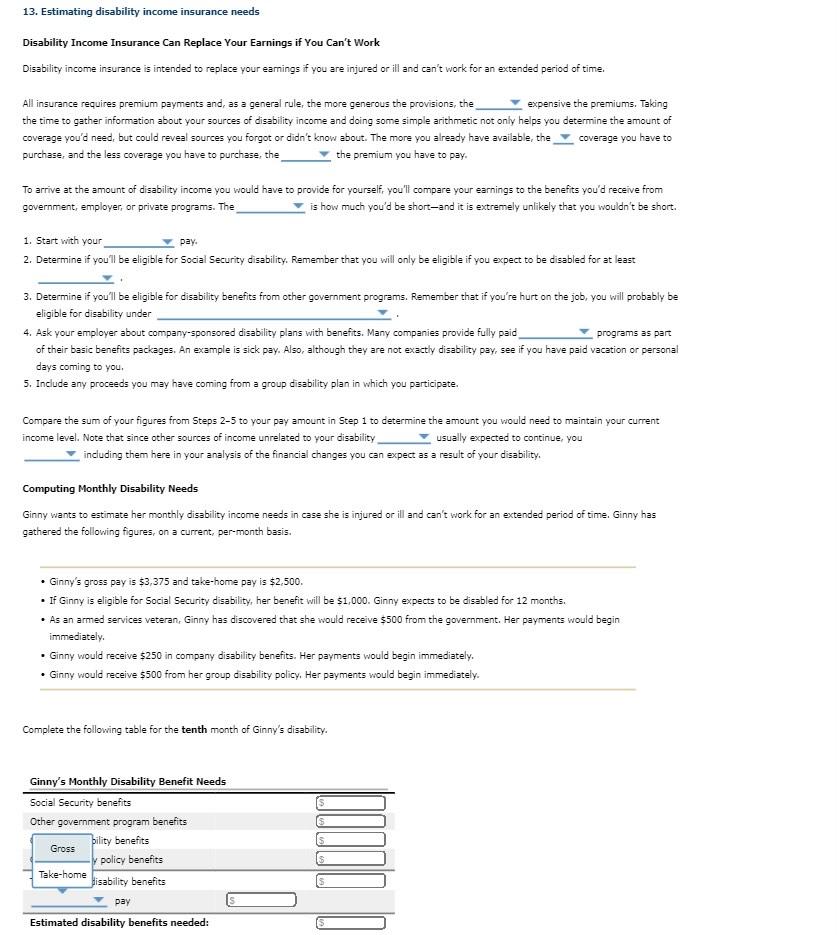

13. Estimating disability income insurance needs Disability Income Insurance Can Replace Your Earnings if You Can't Work Disability income insurance is intended to replace your eamings if you are injured or ill and can't work for an extended period of time, All insurance requires premium payments and, as a general rule, the more generous the provisions, the the time to gather information about your sources of disability income and doing some simple arithmetic not only helps you determine the amount of coverage you'd need, but could reveal sources you forgot or didn't know about. The more you already have available, the coverage you have to purchase, and the less coverage you have to purchase, the the premium you have to pay. To arrive at the amount of disability income you would have to provide for yourself, you'll compare your earnings to the benefits you'd receive from government, employer, or private programs. The is how much you'd be short-and it is extremely unlikely that you wouldn't be short. 1. Start with your pay. 2. Determine if you'll be eligible for Social Security disability. Remember that you will only be eligible if you expect to be disabled for at least 3. Determine if you'll be eligible for disability benefits from other qovernment proarams. Remember that if you're hurt on the job, you will probably be eligible for disability under. 4. Ask your employer about company-sponsored disability plans with benefits. Many companies provide fully paid programs as part of their basic benefits packages. An example is sick pay. Also, although they are not exactly disability pay, see if you have paid vacation or personal days coming to you, 5. Include any proceeds you may have coming from a group disability plan in which you participate. Compare the sum of your figures from Steps 2-5 to your pay amount in Step 1 to determine the amount you would need to maintain your current income level, Note that since other sources of income unrelated to your disability usually expected to continue, you including them here in your analysis of the financial changes you can expect as a result of your disability. Computing Monthly Disability Needs Ginny wants to estimate her monthly disability income needs in case she is injured or ill and can't work for an extended period of time, Ginny has gathered the following figures, on a current, per-month basis. - Ginny's gross pay is $3,375 and take-home pay is $2,500. - If Ginny is eligible for Social Security disability, her benefit will be $1,000. Ginny expects to be disabled for 12 months. - As an armed services veteran, Ginny has discovered that she would receive $500 from the government. Her payments would begin immediately. - Ginny would receive $250 in company disability benefits. Her payments would begin immediately. - Ginny would receive $500 from her group disability policy, Her payments would begin immediately. Complete the following table for the tenth month of Ginny's disability. 13. Estimating disability income insurance needs Disability Income Insurance Can Replace Your Earnings if You Can't Work Disability income insurance is intended to replace your eamings if you are injured or ill and can't work for an extended period of time, All insurance requires premium payments and, as a general rule, the more generous the provisions, the the time to gather information about your sources of disability income and doing some simple arithmetic not only helps you determine the amount of coverage you'd need, but could reveal sources you forgot or didn't know about. The more you already have available, the coverage you have to purchase, and the less coverage you have to purchase, the the premium you have to pay. To arrive at the amount of disability income you would have to provide for yourself, you'll compare your earnings to the benefits you'd receive from government, employer, or private programs. The is how much you'd be short-and it is extremely unlikely that you wouldn't be short. 1. Start with your pay. 2. Determine if you'll be eligible for Social Security disability. Remember that you will only be eligible if you expect to be disabled for at least 3. Determine if you'll be eligible for disability benefits from other qovernment proarams. Remember that if you're hurt on the job, you will probably be eligible for disability under. 4. Ask your employer about company-sponsored disability plans with benefits. Many companies provide fully paid programs as part of their basic benefits packages. An example is sick pay. Also, although they are not exactly disability pay, see if you have paid vacation or personal days coming to you, 5. Include any proceeds you may have coming from a group disability plan in which you participate. Compare the sum of your figures from Steps 2-5 to your pay amount in Step 1 to determine the amount you would need to maintain your current income level, Note that since other sources of income unrelated to your disability usually expected to continue, you including them here in your analysis of the financial changes you can expect as a result of your disability. Computing Monthly Disability Needs Ginny wants to estimate her monthly disability income needs in case she is injured or ill and can't work for an extended period of time, Ginny has gathered the following figures, on a current, per-month basis. - Ginny's gross pay is $3,375 and take-home pay is $2,500. - If Ginny is eligible for Social Security disability, her benefit will be $1,000. Ginny expects to be disabled for 12 months. - As an armed services veteran, Ginny has discovered that she would receive $500 from the government. Her payments would begin immediately. - Ginny would receive $250 in company disability benefits. Her payments would begin immediately. - Ginny would receive $500 from her group disability policy, Her payments would begin immediately. Complete the following table for the tenth month of Ginny's disabilityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started