Answered step by step

Verified Expert Solution

Question

1 Approved Answer

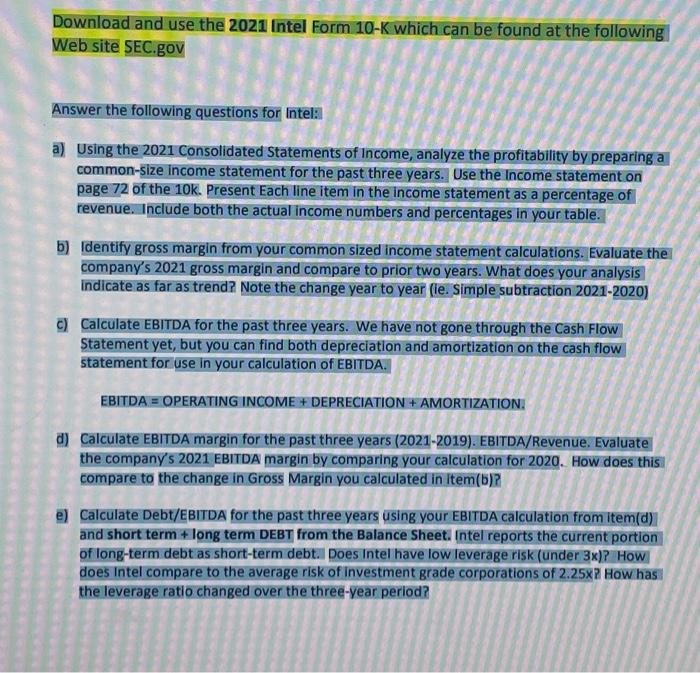

Download and use the 2021 Intel Form 10-K which can be found at the following Web site SEC.gov Answer the following questions for Intel: a)

Download and use the 2021 Intel Form 10-K which can be found at the following Web site SEC.gov Answer the following questions for Intel: a) Using the 2021 Consolidated Statements of Income, analyze the profitability by preparing a common-size income statement for the past three years. Use the Income statement on page 72 of the 10k. Present Each line item in the income statement as a percentage of revenue. Include both the actual income numbers and percentages in your table. 200 b) Identify gross margin from your common sized income statement calculations. Evaluate the company's 2021 gross margin and compare to prior two years. What does your analysis indicate as far as trend? Note the change year to year (ie. Simple subtraction 2021-2020) c) Calculate EBITDA for the past three years. We have not gone through the Cash Flow Statement yet, but you can find both depreciation and amortization on the cash flow statement for use in your calculation of EBITDA. EBITDA = OPERATING INCOME + DEPRECIATION + AMORTIZATION. d) Calculate EBITDA margin for the past three years (2021-2019). EBITDA/Revenue. Evaluate the company's 2021 EBITDA margin by comparing your calculation for 2020. How does this compare to the change in Gross Margin you calculated in item(b)? e) Calculate Debt/EBITDA for the past three years using your EBITDA calculation from item(d) and short term + long term DEBT from the Balance Sheet. Intel reports the current portion of long-term debt as short-term debt. Does Intel have low leverage risk (under 3x)? How does Intel compare to the average risk of investment grade corporations of 2.25x? How has the leverage ratio changed over the three-year period?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started