Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Download the annual cash flow statement of a listed company from its corporate website. You are required to DESCRIBE the cash flow statement of the

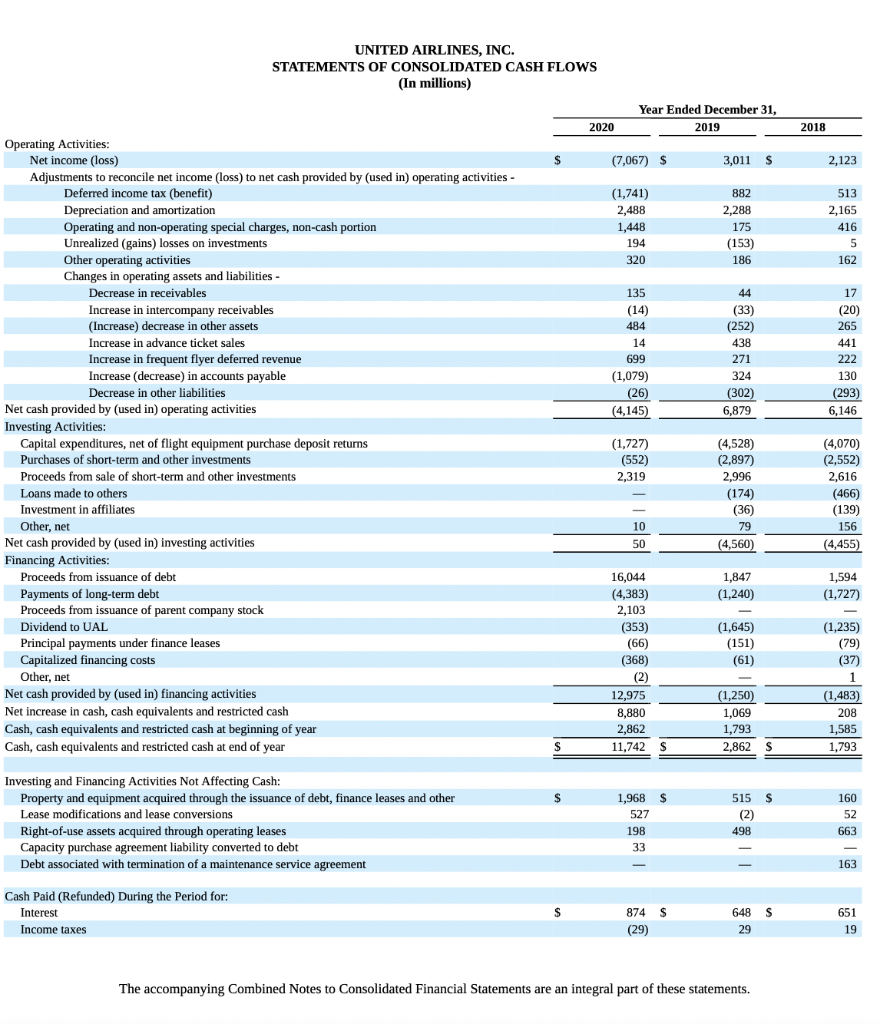

Download the annual cash flow statement of a listed company from its corporate website. You are required to DESCRIBE the cash flow statement of the company for two consecutive years. You are NOT required to evaluate the cash flows; ONLY: (a) to identify the MAIN cash flows per category of cash flows, and (b) to compare them with the previous year. The objective of this question is to familiarize students with real cash flow statements and their structure.

Cash flow statement:

1000-1500 words

UNITED AIRLINES, INC. STATEMENTS OF CONSOLIDATED CASH FLOWS (In millions) Year Ended December 31, 2020 2019 2018 $ (7,067) $ 3,011 $ 2,123 882 513 (1,741) 2,488 1,448 2,288 2,165 175 416 194 (153) 5 320 186 162 135 44 17 (20) (14) 484 (33) (252) 438 265 14 441 699 271 222 324 130 (1,079) (26) (4,145) (302) 6,879 (293) 6,146 Operating Activities: Net income (loss) Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities - Deferred income tax (benefit) Depreciation and amortization Operating and non-operating special charges, non-cash portion Unrealized (gains) losses on investments Other operating activities Changes in operating assets and liabilities - Decrease in receivables Increase in intercompany receivables (Increase) decrease in other assets Increase in advance ticket sales Increase in frequent flyer deferred revenue Increase (decrease) in accounts payable Decrease in other liabilities Net cash provided by (used in operating activities Investing Activities: Capital expenditures, net of flight equipment purchase deposit returns Purchases of short-term and other investments Proceeds from sale of short-term and other investments Loans made to others Investment in affiliates Other, net Net cash provided by (used in) investing activities Financing Activities: Proceeds from issuance of debt Payments of long-term debt Proceeds from issuance of parent company stock Dividend to UAL Principal payments under finance leases Capitalized financing costs Other, net Net cash provided by (used in) financing activities Net increase in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of year Cash, cash equivalents and restricted cash at end of year (1,727) (552) 2,319 (4,528) (2,897) 2,996 (174) (36) 79 (4,070) (2,552) 2,616 (466) (139) 156 10 50 (4,560) (4,455) 1,594 1,847 (1,240) (1,727) 16,044 (4,383) 2,103 (353) (66) (368) (2) (1,645) (151) (61) (1,235) (79) (37) ) (1,483) 12,975 8,880 2,862 208 (1,250) 1,069 1,793 2,862 $ 1,585 S 11,742 $ 1,793 S 160 1,968 $ 527 515 S (2) 52 Investing and Financing Activities Not Affecting Cash: Property and equipment acquired through the issuance of debt, finance leases and other Lease modifications and lease conversions Right-of-use assets acquired through operating leases Capacity purchase agreement liability converted to debt Debt associated with termination of a maintenance service agreement 198 498 663 33 163 Cash Paid (Refunded) During the Period for: Interest 874 $ 648 $ 651 Income taxes (29) 29 19 The accompanying Combined Notes to Consolidated Financial Statements are an integral part of these statements. UNITED AIRLINES, INC. STATEMENTS OF CONSOLIDATED CASH FLOWS (In millions) Year Ended December 31, 2020 2019 2018 $ (7,067) $ 3,011 $ 2,123 882 513 (1,741) 2,488 1,448 2,288 2,165 175 416 194 (153) 5 320 186 162 135 44 17 (20) (14) 484 (33) (252) 438 265 14 441 699 271 222 324 130 (1,079) (26) (4,145) (302) 6,879 (293) 6,146 Operating Activities: Net income (loss) Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities - Deferred income tax (benefit) Depreciation and amortization Operating and non-operating special charges, non-cash portion Unrealized (gains) losses on investments Other operating activities Changes in operating assets and liabilities - Decrease in receivables Increase in intercompany receivables (Increase) decrease in other assets Increase in advance ticket sales Increase in frequent flyer deferred revenue Increase (decrease) in accounts payable Decrease in other liabilities Net cash provided by (used in operating activities Investing Activities: Capital expenditures, net of flight equipment purchase deposit returns Purchases of short-term and other investments Proceeds from sale of short-term and other investments Loans made to others Investment in affiliates Other, net Net cash provided by (used in) investing activities Financing Activities: Proceeds from issuance of debt Payments of long-term debt Proceeds from issuance of parent company stock Dividend to UAL Principal payments under finance leases Capitalized financing costs Other, net Net cash provided by (used in) financing activities Net increase in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of year Cash, cash equivalents and restricted cash at end of year (1,727) (552) 2,319 (4,528) (2,897) 2,996 (174) (36) 79 (4,070) (2,552) 2,616 (466) (139) 156 10 50 (4,560) (4,455) 1,594 1,847 (1,240) (1,727) 16,044 (4,383) 2,103 (353) (66) (368) (2) (1,645) (151) (61) (1,235) (79) (37) ) (1,483) 12,975 8,880 2,862 208 (1,250) 1,069 1,793 2,862 $ 1,585 S 11,742 $ 1,793 S 160 1,968 $ 527 515 S (2) 52 Investing and Financing Activities Not Affecting Cash: Property and equipment acquired through the issuance of debt, finance leases and other Lease modifications and lease conversions Right-of-use assets acquired through operating leases Capacity purchase agreement liability converted to debt Debt associated with termination of a maintenance service agreement 198 498 663 33 163 Cash Paid (Refunded) During the Period for: Interest 874 $ 648 $ 651 Income taxes (29) 29 19 The accompanying Combined Notes to Consolidated Financial Statements are an integral part of these statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started