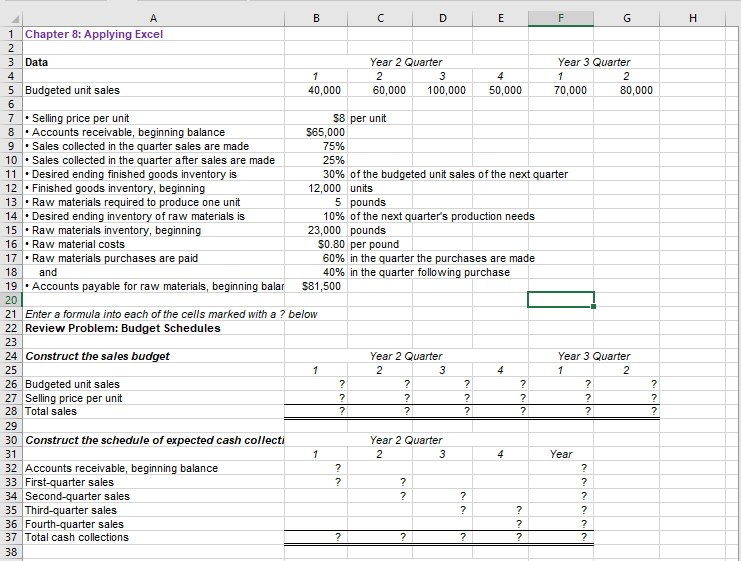

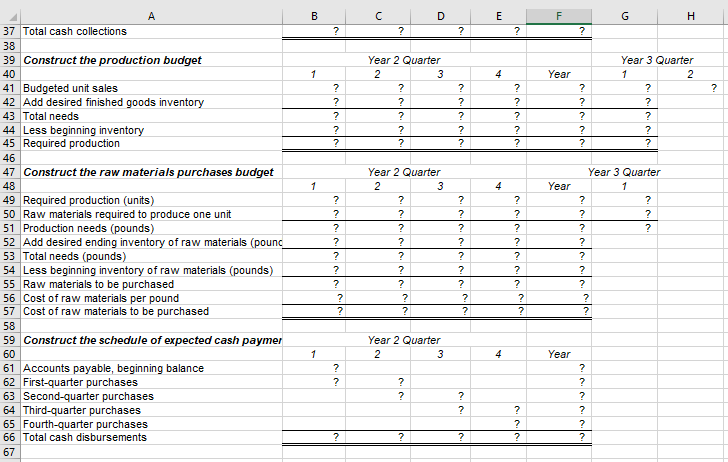

Download the Applying Excel form and enter formulas in all cells that contain question marks.

For example, in cell B26 enter the formula "= B5".

Check your worksheet by changing the budgeted unit sales in Quarter 2 of Year 2 in cell C5 to 75,000 units. The required production for the year should be 274,000 units. The cost of raw materials to be purchased for the year should be $1,106,800, whereas the total cash disbursements for the year should be $1,095,980. If you do not get this answer, find the errors in your worksheet and correct them.

Save your completed Applying Excel form to your computer and then upload it here by clicking Browse. Next, click Save. You will use this worksheet to answer the questions in Part 2.

B D E H A F 1 Chapter 8: Applying Excel 2 3 Data Year 2 Quarter Year 3 Quarter 4 1 2 3 4 2 5 Budgeted unit sales 40,000 60,000 100,000 50,000 70,000 80,000 6 7 Selling price per unit $8 per unit 8 Accounts receivable, beginning balance $65,000 9 Sales collected in the quarter sales are made 75% 10 Sales collected in the quarter after sales are made 25% 11 Desired ending finished goods inventory is 30% of the budgeted unit sales of the next quarter 12 . Finished goods inventory, beginning 12,000 units 13. Raw materials required to produce one unit 5 pounds 14 Desired ending inventory of raw materials is 10% of the next quarter's production needs 15. Raw materials inventory, beginning 23,000 pounds 16 . Raw material costs $0.80 per pound 17 Raw materials purchases are paid 60% in the quarter the purchases are made 18 and 40% in the quarter following purchase 19 Accounts payable for raw materials, beginning balar $81,500 20 21 Enter a formula into each of the cells marked with a ? below 22 Review Problem: Budget Schedules 23 24 Construct the sales budget Year 2 Quarter Year 3 Quarter 25 1 3 4 2 26 Budgeted unit sales ? ? ? 27 Selling price per unit ? 28 Total sales ? ? 29 30 Construct the schedule of expected cash collecti Year 2 Quarter 2 Year 32 Accounts receivable, beginning balance ? ? 33 First-quarter sales ? ? 34 Second-quarter sales ? ? ? 35 Third-quarter sales ? 36 Fourth-quarter sales ? 37 Total cash collections ? ? 38 2 ? ? ? ? ? ? ? ? ? ? ? 31 1 3 ? ? ? ? ? ? ? B C D E F G H ? ? ? ? ? 1 4 Year ? ? ? ? ? ? Year 2 Quarter 2 3 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Year 3 Quarter 2 ? ? ? ? ? Year 3 Quarter 1 4 Year 1 ? ? ? ? ? A 37 Total cash collections 38 39 Construct the production budget 40 41 Budgeted unit sales 42 Add desired finished goods inventory 43 Total needs 44 Less beginning inventory 45 Required production 46 47 Construct the raw materials purchases budget 48 49 Required production (units) 50 Raw materials required to produce one unit 51 Production needs (pounds) 52 Add desired ending inventory of raw materials (pound 53 Total needs (pounds) 54 Less beginning inventory of raw materials (pounds) 55 Raw materials to be purchased 56 Cost of raw materials per pound 57 Cost of raw materials to be purchased 58 59 Construct the schedule of expected cash paymer 60 61 Accounts payable, beginning balance 62 First-quarter purchases 63 Second-quarter purchases 64 Third-quarter purchases 65 Fourth-quarter purchases 66 Total cash disbursements 67 ? ? ? ? ? ? ? ? ? Year 2 Quarter 2 3 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Year 2 Quarter 2 3 1 4 Year