Download the financial ratios and analyze the profitability, liquidity, and solvency of the selected firm. Please write at least two paragraphs.

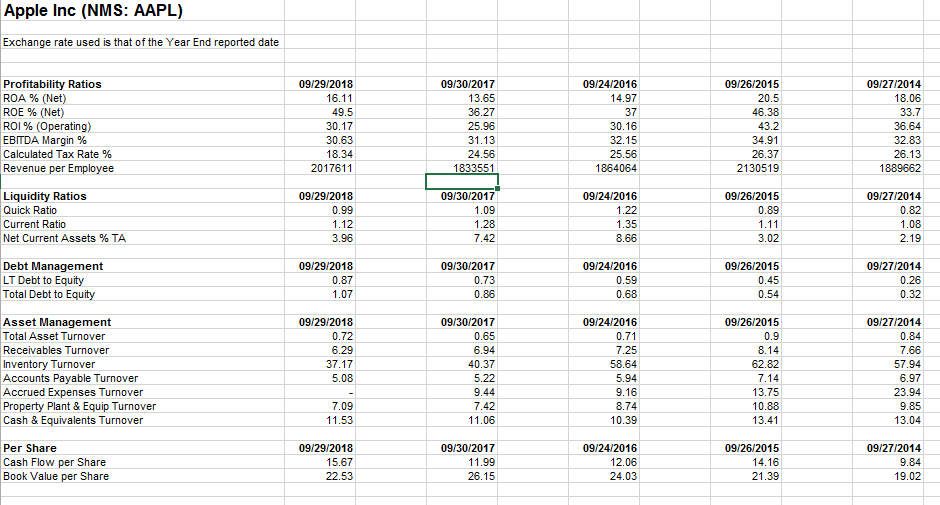

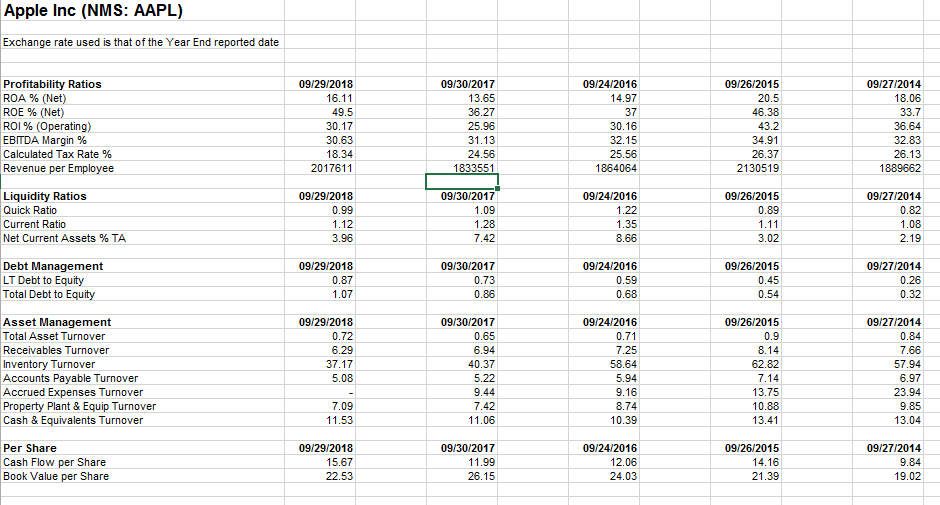

Apple Inc (NMS: AAPL) Exchange rate used is that of the Year End reported date 09/24/2016 14.97 [ Profitability Ratios ROA % (Net) ROE % (Net) ROI % (Operating) EBITDA Margin % Calculated Tax Rate % Revenue per Employee 09/29/2018 16.11 49.5 30.17 30.63 18.34 2017611 09/30/2017 13.65 36.27 25.96 31.13 24.56 1833551 30.16 32.15 25.56 1864064 09/26/2015 20.5 46.38 43.2 34.91 26.37 2130519 09/27/2014 18.06 33.7 36.64 32.83 26.13 1889662 Liquidity Ratios Quick Ratio Current Ratio Net Current Assets % TA 09/29/2018 0.99 1.12 3.96 09/30/2017 1.09 1.28 7.42 09/24/2016 1.22 1.35 8.66 09/26/2015 0.89 1.11 3.02 09/27/2014 0.82 1.08 2.19 Debt Management LT Debt to Equity Total Debt to Equity 09/29/2018 0.87 1.07 09/30/2017 0.73 0.86 09/24/2016 0.59 09/26/2015 0.45 0.54 09/27/2014 0.26 0.32 0.68 Asset Management Total Asset Turnover Receivables Turnover Inventory Turnover Accounts Payable Turnover Accrued Expenses Turnover Property Plant & Equip Turnover Cash & Equivalents Turnover 09/29/2018 0.72 6.29 37.17 5.08 09/30/2017 0.65 6.94 40.37 5.22 9.44 7.42 11.06 09/24/2016 0.71 7.25 58.64 5.94 9.16 8.74 10.39 09/26/2015 0.9 8.14 62.82 7.14 13.75 10.88 13.41 09/27/2014 0.84 7.66 57.94 6.97 23.94 9.85 13.04 7.09 11.53 Per Share Cash Flow per Share Book Value per Share 09/27/2014 09/29/2018 15.67 22.53 09/30/2017 11.99 26.15 09/24/2016 12.06 24.03 09/26/2015 14.16 9.84 21.39 19.02 Apple Inc (NMS: AAPL) Exchange rate used is that of the Year End reported date 09/24/2016 14.97 [ Profitability Ratios ROA % (Net) ROE % (Net) ROI % (Operating) EBITDA Margin % Calculated Tax Rate % Revenue per Employee 09/29/2018 16.11 49.5 30.17 30.63 18.34 2017611 09/30/2017 13.65 36.27 25.96 31.13 24.56 1833551 30.16 32.15 25.56 1864064 09/26/2015 20.5 46.38 43.2 34.91 26.37 2130519 09/27/2014 18.06 33.7 36.64 32.83 26.13 1889662 Liquidity Ratios Quick Ratio Current Ratio Net Current Assets % TA 09/29/2018 0.99 1.12 3.96 09/30/2017 1.09 1.28 7.42 09/24/2016 1.22 1.35 8.66 09/26/2015 0.89 1.11 3.02 09/27/2014 0.82 1.08 2.19 Debt Management LT Debt to Equity Total Debt to Equity 09/29/2018 0.87 1.07 09/30/2017 0.73 0.86 09/24/2016 0.59 09/26/2015 0.45 0.54 09/27/2014 0.26 0.32 0.68 Asset Management Total Asset Turnover Receivables Turnover Inventory Turnover Accounts Payable Turnover Accrued Expenses Turnover Property Plant & Equip Turnover Cash & Equivalents Turnover 09/29/2018 0.72 6.29 37.17 5.08 09/30/2017 0.65 6.94 40.37 5.22 9.44 7.42 11.06 09/24/2016 0.71 7.25 58.64 5.94 9.16 8.74 10.39 09/26/2015 0.9 8.14 62.82 7.14 13.75 10.88 13.41 09/27/2014 0.84 7.66 57.94 6.97 23.94 9.85 13.04 7.09 11.53 Per Share Cash Flow per Share Book Value per Share 09/27/2014 09/29/2018 15.67 22.53 09/30/2017 11.99 26.15 09/24/2016 12.06 24.03 09/26/2015 14.16 9.84 21.39 19.02