Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Downward-sloping. QUESTION 3 Assume a 20-year coupon-bearing bond with a 10% coupon rate and a face value of 100. Note that the coupon payments are

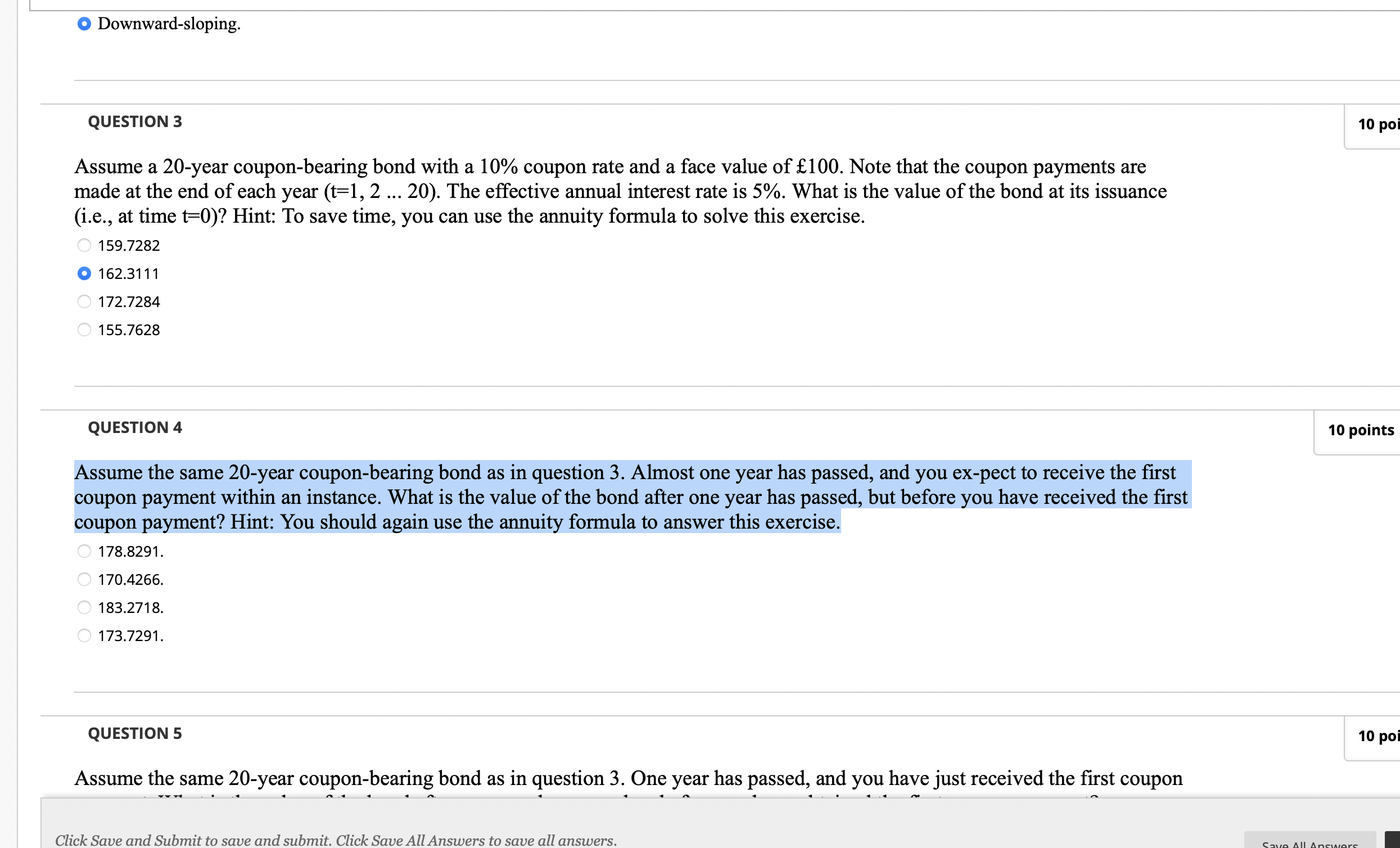

Downward-sloping. QUESTION 3 Assume a 20-year coupon-bearing bond with a 10% coupon rate and a face value of 100. Note that the coupon payments are made at the end of each year (t=1,220). The effective annual interest rate is 5%. What is the value of the bond at its issuance (i.e., at time t=0 )? Hint: To save time, you can use the annuity formula to solve this exercise. 159.7282162.3111172.7284155.7628 QUESTION 4 Assume the same 20-year coupon-bearing bond as in question 3. Almost one year has passed, and you ex-pect to receive the first coupon payment within an instance. What is the value of the bond after one year has passed, but before you have received the first coupon payment? Hint: You should again use the annuity formula to answer this exercise. 178.8291.170.4266.183.2718.173.7291. QUESTION 5 Assume the same 20-year coupon-bearing bond as in question 3. One year has passed, and you have just received the first coupon Click Save and Submit to save and submit. Click Save All Answers to save all answers

Downward-sloping. QUESTION 3 Assume a 20-year coupon-bearing bond with a 10% coupon rate and a face value of 100. Note that the coupon payments are made at the end of each year (t=1,220). The effective annual interest rate is 5%. What is the value of the bond at its issuance (i.e., at time t=0 )? Hint: To save time, you can use the annuity formula to solve this exercise. 159.7282162.3111172.7284155.7628 QUESTION 4 Assume the same 20-year coupon-bearing bond as in question 3. Almost one year has passed, and you ex-pect to receive the first coupon payment within an instance. What is the value of the bond after one year has passed, but before you have received the first coupon payment? Hint: You should again use the annuity formula to answer this exercise. 178.8291.170.4266.183.2718.173.7291. QUESTION 5 Assume the same 20-year coupon-bearing bond as in question 3. One year has passed, and you have just received the first coupon Click Save and Submit to save and submit. Click Save All Answers to save all answers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started