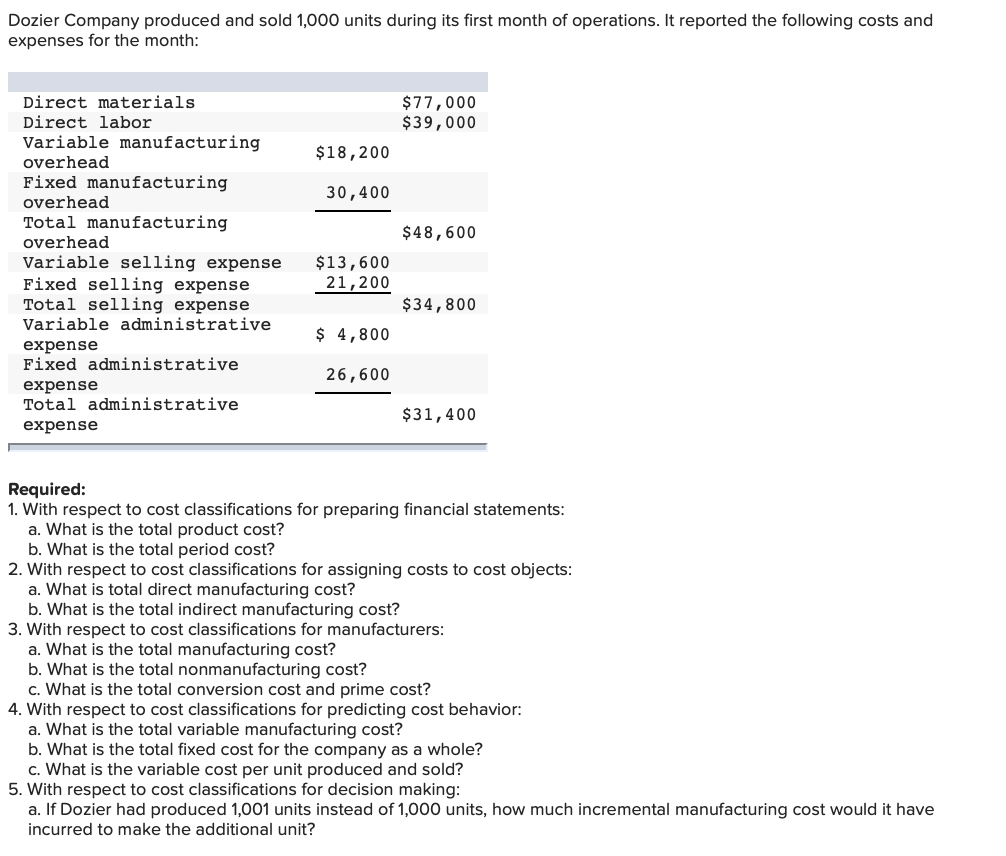

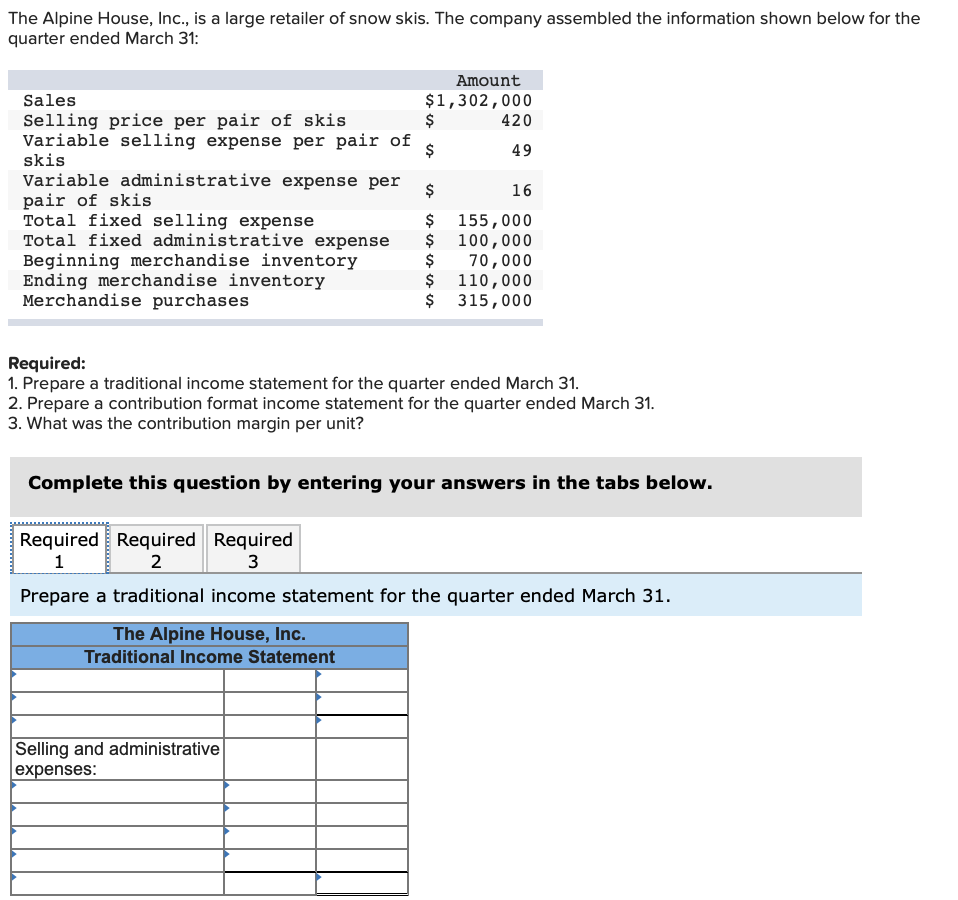

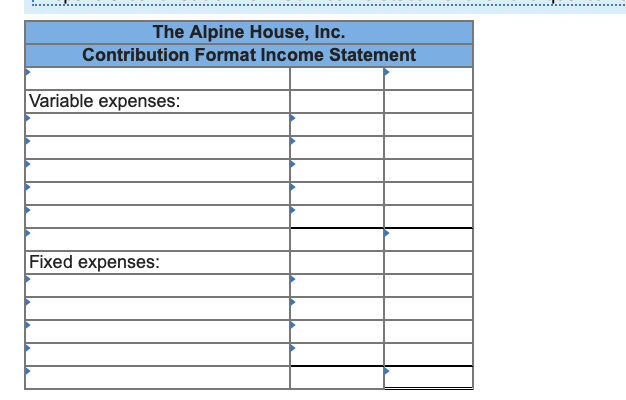

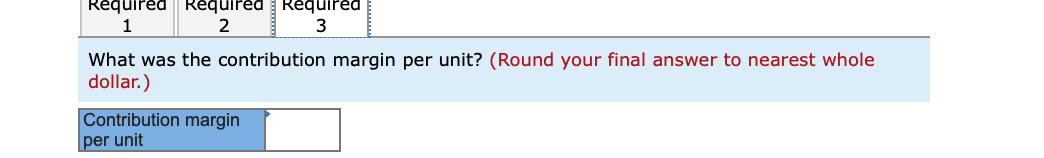

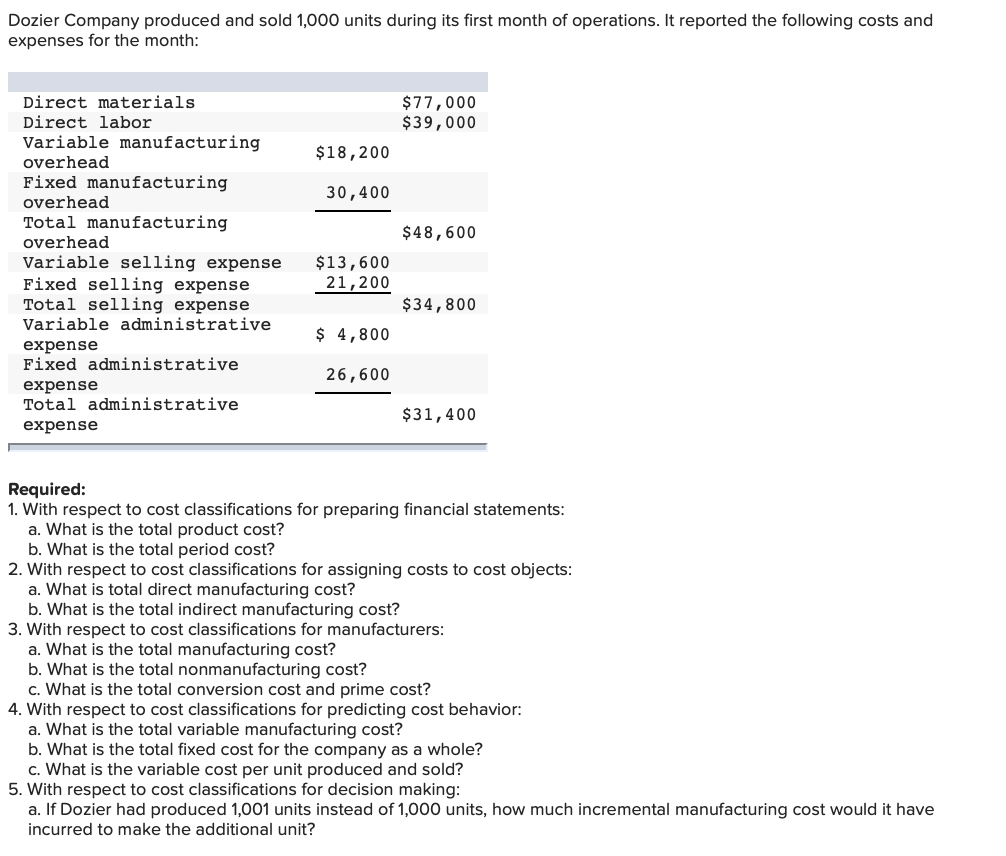

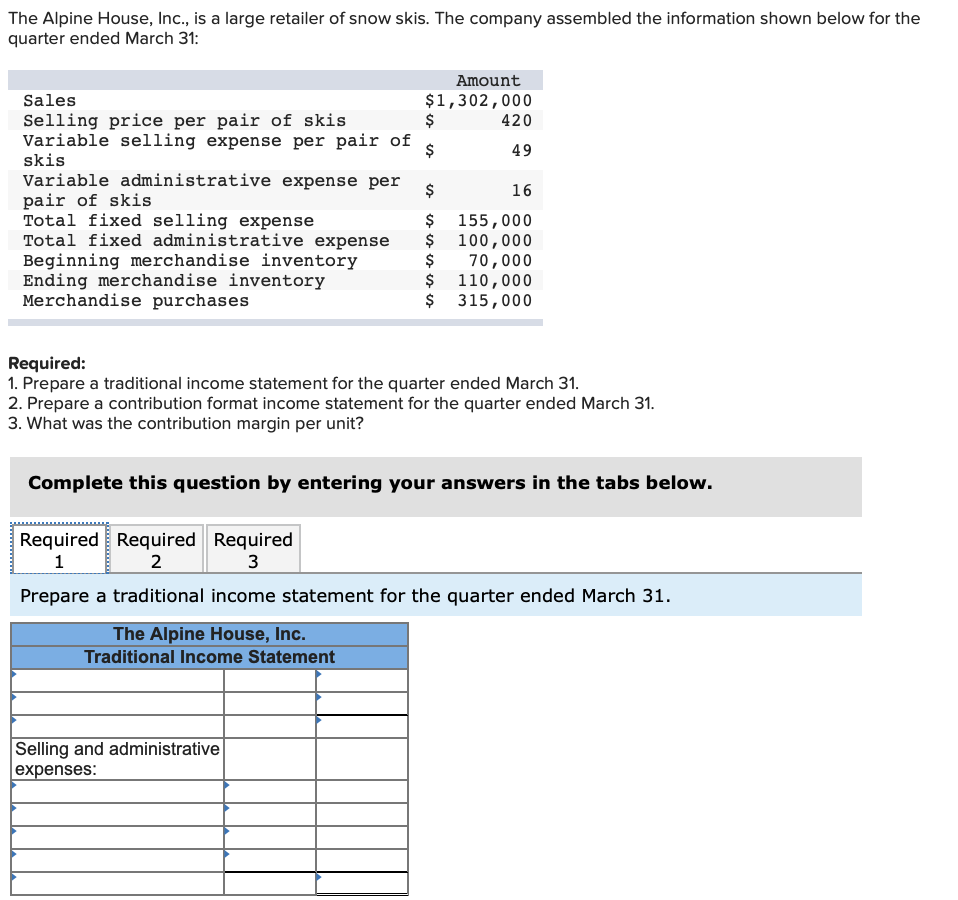

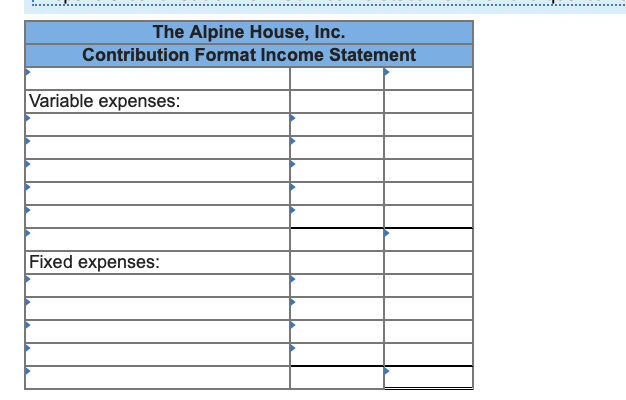

Dozier Company produced and sold 1,000 units during its first month of operations. It reported the following costs and expenses for the month: $77,000 $39,000 $18,200 30,400 $48,600 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing overhead Variable selling expense Fixed selling expense Total selling expense Variable administrative expense Fixed administrative expense Total administrative expense $13,600 21,200 $34,800 $ 4,800 26,600 $31,400 Required: 1. With respect to cost classifications for preparing financial statements: a. What is the total product cost? b. What is the total period cost? 2. With respect to cost classifications for assigning costs to cost objects: a. What is total direct manufacturing cost? b. What is the total indirect manufacturing cost? 3. With respect to cost classifications for manufacturers: a. What is the total manufacturing cost? b. What is the total nonmanufacturing cost? c. What is the total conversion cost and prime cost? 4. With respect to cost classifications for predicting cost behavior: a. What is the total variable manufacturing cost? b. What is the total fixed cost for the company as a whole? c. What is the variable cost per unit produced and sold? 5. With respect to cost classifications for decision making: a. If Dozier had produced 1,001 units instead of 1,000 units, how much incremental manufacturing cost would it have incurred to make the additional unit? The Alpine House, Inc., is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: Amount $1,302,000 $ 420 $ $ 49 Sales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases $ 16 $ 155,000 $ 100,000 $ 70,000 $ 110,000 $ 315,000 Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? Complete this question by entering your answers in the tabs below. Required Required Required 1 2 3 Prepare a traditional income statement for the quarter ended March 31. The Alpine House, Inc. Traditional Income Statement Selling and administrative expenses: The Alpine House, Inc. Contribution Format Income Statement Variable expenses: Fixed expenses: Required equired 1 2 3 What was the contribution margin per unit? (Round your final answer to nearest whole dollar.) Contribution margin per unit