Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) DP Architects International, a firm that specializes in artistic architecture on large infrastructures is evaluating the feasibility of a project that will entail

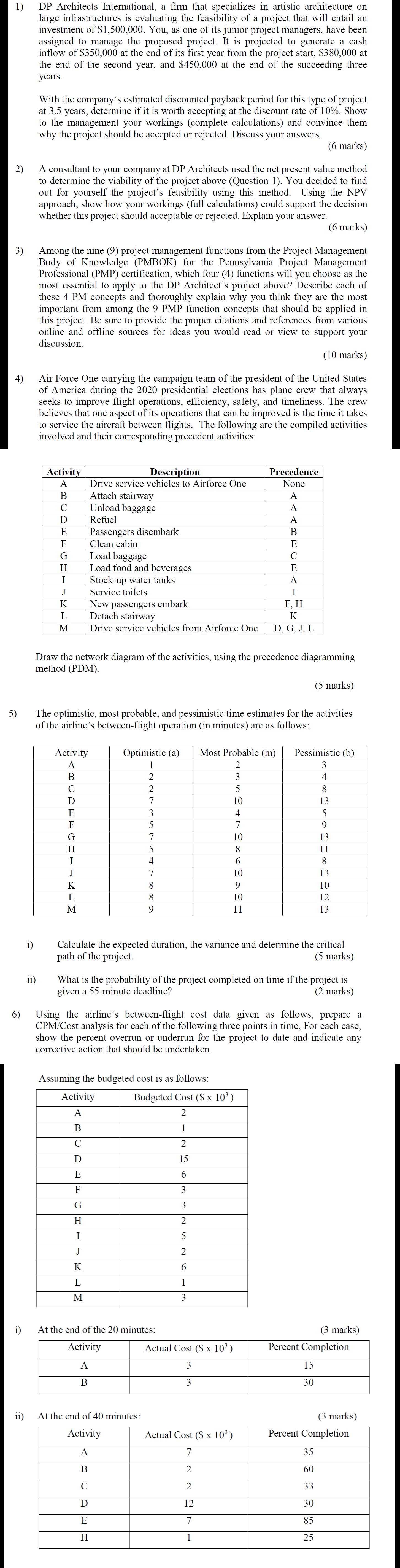

1) DP Architects International, a firm that specializes in artistic architecture on large infrastructures is evaluating the feasibility of a project that will entail an investment of $1,500,000. You, as one of its junior project managers, have been assigned to manage the proposed project. It is projected to generate a cash inflow of $350,000 at the end of its first year from the project start, $380,000 at the end of the second year, and $450,000 at the end of the succeeding three years. With the company's estimated discounted payback period for this type of project at 3.5 years, determine if it is worth accepting at the discount rate of 10%. Show to the management your workings (complete calculations) and convince them why the project should be accepted or rejected. Discuss your answers. (6 marks) 2) A consultant to your company at DP Architects used the net present value method to determine the viability of the project above (Question 1). You decided to find out for yourself the project's feasibility using this method. Using the NPV approach, show how your workings (full calculations) could support the decision whether this project should acceptable or rejected. Explain your answer. (6 marks) 3) 4) 5) 6) i) ii) i) Among the nine (9) project management functions from the Project Management Body of Knowledge (PMBOK) for the Pennsylvania Project Management. Professional (PMP) certification, which four (4) functions will you choose as the most essential to apply to the DP Architect's project above? Describe each of these 4 PM concepts and thoroughly explain why you think they are the most important from among the 9 PMP function concepts that should be applied in this project. Be sure to provide the proper citations and references from various online and offline sources for ideas you would read or view to support your discussion. (10 marks) Air Force One carrying the campaign team of the president of the United States of America during the 2020 presidential elections has plane crew that always seeks to improve flight operations, efficiency, safety, and timeliness. The crew believes that one aspect of its operations that can be improved is the time it takes to service the aircraft between flights. The following are the compiled activities involved and their corresponding precedent activities: Activity A B C D ii) E F G H I J K L M Description Drive service vehicles to Airforce One Attach stairway Unload baggage Refuel Passengers disembark Clean cabin Load baggage Load food and beverages Stock-up water tanks Service toilets Draw the network diagram of the activities, using the precedence diagramming method (PDM). Activity A B C D E F G H I J K L M New passengers embark Detach stairway Drive service vehicles from Airforce One D, G, J, L The optimistic, most probable, and pessimistic time estimates for the activities of the airline's between-flight operation (in minutes) are as follows: Optimistic (a) Most Probable (m) 1 2 2 3 2 5 7 10 3 4 5 7 S478 5 4 8 9 At the end of 40 minutes: Activity A B C D E H Precedence None A A A B E C E A I F, H K Assuming the budgeted cost is as follows: Activity A B C D E F G H I J K L M Budgeted Cost ($ x 10) 2 1 2 15 6 3 3 2 5 2 6 1 3 Calculate the expected duration, the variance and determine the critical path of the project. (5 marks) At the end of the 20 minutes: Activity A B 7 10 8 6 10 9 10 11 What is the probability of the project completed on time if the project is given a 55-minute deadline? (2 marks) Using the airline's between-flight cost data given as follows, prepare a CPM/Cost analysis for each of the following three points in time, For each case, show the percent overrun or underrun for the project to date and indicate any corrective action that should be undertaken. Actual Cost ($ x 10) 3 3 Actual Cost ($ x 10) 7 2 2 12 7 1 (5 marks) Pessimistic (b) 3 4 8 13 5 9 13 11 8 13 10 12 13 15 30 (3 marks) Percent Completion 35 60 33 30 85 25 (3 marks) Percent Completion

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 Given Initial Investment 1500000 Cash Inflows 350000 Year 1 380000 Year 2 450000 Years 35 Discount Rate 10 Estimated Discounted Payback Period 35 years Calculate the discounted cash flows for each y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started