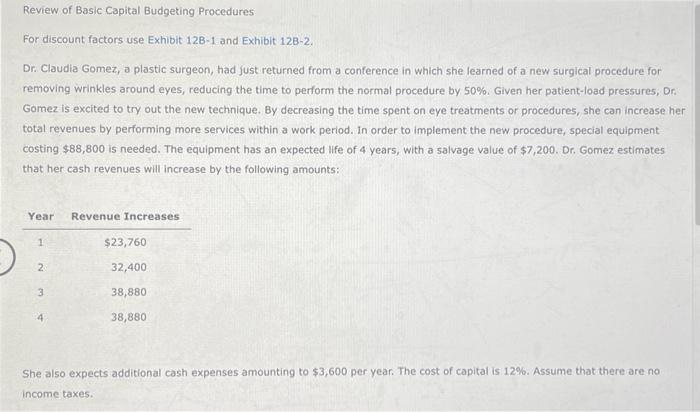

Dr. Claudia Gomez, a plastic surgeon, had just returned from a conference in which she learned of a new surgical procedure for

removing wrinkles around eyes, reducing the time to perform the normal procedure by 50%. Given her patient-load pressures, Dr.

Gomez is excited to try out the new technique. By decreasing the time spent on eye treatments or procedures, she can increase her

total revenues by performing more services within a work period. In order to implement the new procedure, special equipment

costing $88,800 is needed. The equipment has an expected life of 4 years, with a salvage value of $7,200. Dr. Gomez estimates

that her cash revenues will increase by the following amounts:

Pictures attached of the full problem/question

Will rate ASAP if correct

Thank you!

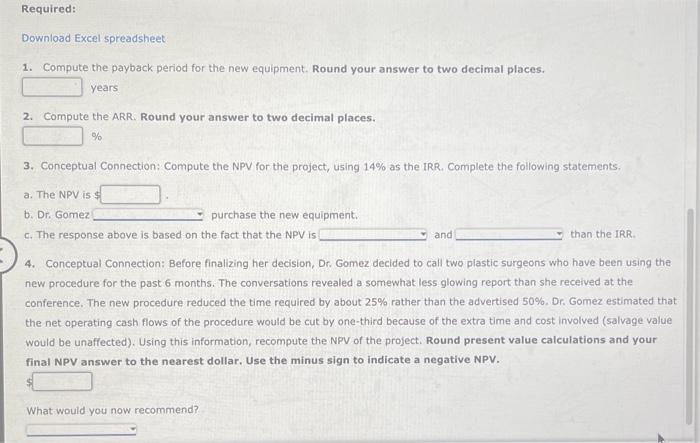

Review of Basic Capital Budgeting Procedures For discount factors use Exhibit 1281 and Exhibit 12B-2. Dr. Claudia Gomez, a plastic surgeon, had just returned from a conference in which she learned of a new surgical procedure for removing wrinkles around eyes, reducing the time to perform the normal procedure by 50%. Given her patient-1oad pressures, Dr. Gomez is excited to try out the new technique. By decreasing the time spent on eye treatments or procedures, she can increase her total revenues by performing more services within a work period. In order to implement the new procedure, special equipment costing $88,800 is needed. The equipment has an expected llfe of 4 years, with a salvage value of $7,200. Dr. Gomez estimates that her cash revenues will increase by the following amounts: She also expects additional cash expenses amounting to $3,600 per year. The cost of capital is 12%. Assume that there are no income taxes. 1. Compute the payback period for the new equipment. Round your answer to two decimal places. years 2. Compute the ARR. Round your answer to two decimal places. % 3. Conceptual Connection: Compute the NPV for the project, using 14% as the IRR. Complete the following statements. a. The NPV is 4 b. Dr. Gomez purchase the new equipment. c. The response above is based on the fact that the NPV is and than the IRR. 4. Conceptual Connection: Before finalizing her decision, Dr. Gomez decided to call two plastic surgeons who have been using the new procedure for the past 6 months. The conversations revealed a somewhat less glowing report than she recelved at the conference. The new procedure reduced the time required by about 25% rather than the advertised 50%. Dr. Gomez estimated that the net operating cash flows of the procedure would be cut by one-third because of the extra time and cost involved (salvage value would be unaffected). Using this information, recompute the NPV of the project. Round present value calculations and your final NPV answer to the nearest dollar. Use the minus sign to indicate a negative NPV. Review of Basic Capital Budgeting Procedures For discount factors use Exhibit 1281 and Exhibit 12B-2. Dr. Claudia Gomez, a plastic surgeon, had just returned from a conference in which she learned of a new surgical procedure for removing wrinkles around eyes, reducing the time to perform the normal procedure by 50%. Given her patient-1oad pressures, Dr. Gomez is excited to try out the new technique. By decreasing the time spent on eye treatments or procedures, she can increase her total revenues by performing more services within a work period. In order to implement the new procedure, special equipment costing $88,800 is needed. The equipment has an expected llfe of 4 years, with a salvage value of $7,200. Dr. Gomez estimates that her cash revenues will increase by the following amounts: She also expects additional cash expenses amounting to $3,600 per year. The cost of capital is 12%. Assume that there are no income taxes. 1. Compute the payback period for the new equipment. Round your answer to two decimal places. years 2. Compute the ARR. Round your answer to two decimal places. % 3. Conceptual Connection: Compute the NPV for the project, using 14% as the IRR. Complete the following statements. a. The NPV is 4 b. Dr. Gomez purchase the new equipment. c. The response above is based on the fact that the NPV is and than the IRR. 4. Conceptual Connection: Before finalizing her decision, Dr. Gomez decided to call two plastic surgeons who have been using the new procedure for the past 6 months. The conversations revealed a somewhat less glowing report than she recelved at the conference. The new procedure reduced the time required by about 25% rather than the advertised 50%. Dr. Gomez estimated that the net operating cash flows of the procedure would be cut by one-third because of the extra time and cost involved (salvage value would be unaffected). Using this information, recompute the NPV of the project. Round present value calculations and your final NPV answer to the nearest dollar. Use the minus sign to indicate a negative NPV