Question

Dr Cr 10% preference share capital 20000 Ordinary share capital 70000 10% debentures (repayable 2014) 30000 Goodwill at cost 15500 Buildings at cost 95000 Equipment

| Dr | Cr | |

| 10% preference share capital | 20000 | |

| Ordinary share capital | 70000 | |

| 10% debentures (repayable 2014) | 30000 | |

| Goodwill at cost | 15500 | |

| Buildings at cost | 95000 | |

| Equipment at cost | 8000 | |

| Motor vehicles at cost | 17200 | |

| Provision for depreciation: equipment 1.1.2009 | 2400 | |

| Provision for depreciation: motors 1.1.2009 | 5160 | |

| Stock 1.1.2009 | 22690 | |

| Sales | 98200 | |

| Purchases | 53910 | |

| Carriage inwards | 1620 | |

| Salaries and wages | 9240 | |

| Directors remuneration | 6300 | |

| Motor expenses | 8120 | |

| Rates and insurances | 2930 | |

| General expenses | 560 | |

| Debenture interest | 1500 | |

| Debtors | 18610 | |

| Creditors | 11370 | |

| Bank | 8390 | |

| General reserve | 5000 | |

| Share premium account | 14000 | |

| Interim ordinary dividend paid | 3500 | |

| Profit and loss account 31.12.2008 | 16940 | |

| 23,070 | 273,070 | |

The following trial balance is extracted from the books of FW Ltd as on December 31, 2009

The following adjustments are needed:

- Stock at 31.12.2009 $27,220

- depreciation motors $3000, equipment $1200

- FW Ltd has a wear and tear policy of buildings 2.5%, Motor vehicles 12.5% and Equipment 10%. The equipment was purchased 1.1. 2009 while Motor vehicle was purchased and brought into the business 1.6.2009

- Accrue debenture interest 1.500

- Provide for preference dividend 2,000 and final ordinary dividend of 10%

- transfer 2,000 to general reserve

- Write off goodwill 3,000

- Authorized share capital is 20,000 in preference shares and 100,000 in ordinary shares

- Provide for corporation tax at 25%

- Bad debt expenses represent 15% of debtors

- Creditors comprises (Trade creditors 9730; other creditors 2000)

- Rates and insurances included donations of 1050 o cultural activities, 500 t national sports, and 12.5% of the balance to a political party

- Wages of 3500 was paid to Mr. Fs ex wife for child support

- motor expenses include 5% for repairs done to Mr. W private motor vehicle

- Directors remuneration has 300 pad to the companys lawyer for legal action brought against Mr. F for abusing a former employee

- Mr. F and Mr. W are directors of the unrelated company ABC Co. Ltd and receive the following benefits:

A. Directors fee of $5000 and $6000 respectively

B. Motor vehicles costing 250,000 and 400,000 respectively. The benefit to each director is 2.5% of the cost of the vehicles

C. Mr. W was provided with a cellular phone valuing 2,000; ABC also pays all business and private calls made by Mr. W. The last phone bill came to 3,500 of which 60% was for private calls

REQUIRED:

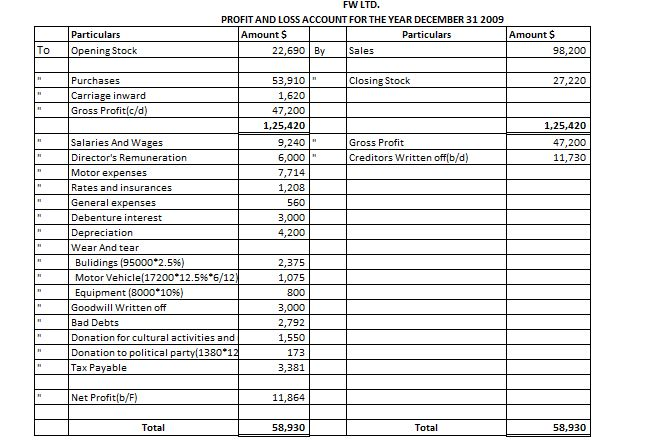

1. Prepare the profit and loss account and corporate tax computation for the year ended December 31, 2009

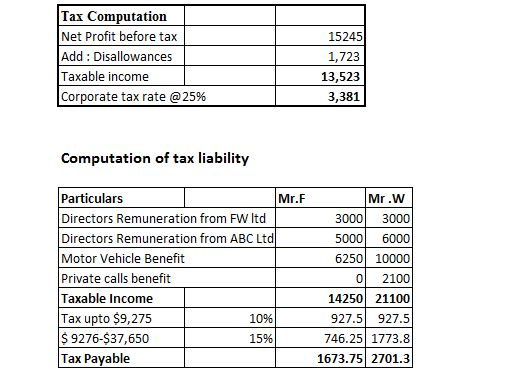

2. Compute the tax payable for Mr. F and Mr. W for the year of assessment 2009

Two persons answered the above question but I am confused.

See answers below:

ANSWER #1: (by chegg expert)

For the first answer provided, what comprises Disallowances of $1723 under Tax Computation calculation (second table in answer to question)

Which figure for Director's remuneration is correct? From first answer: Director's remuneration of 6000 different from that in answer 2

Preference share, ordinary share and debenture - are they not relevant in answering the question?

ANSWER #2: (Answered by chegg expert)

FW limited

Profit and Loss Account

| Sales Revenue | |||

| Sales | 98200 | ||

| Net Sales Revenue | 98200 | ||

| Cost of Goods Sold | |||

| Inventory, Jan 1, 2009 | 22690 | ||

| Purchases | 53910 | ||

| Carriage Inward | 1620 | 55530 | |

| Merchandise available for sale | 78220 | ||

| less: Inventory, Dec 31, 2009 | 27220 | ||

| Cost of Goods Sold | 51000 | ||

| Gross Profit on Sales | 47200 | ||

| Operating Expenses | |||

| Salaries & Wages | 9240 | ||

| Motor Expenses (8120 * 0.95) | 7714 | ||

| Rates & Insurance | 2930 | ||

| General Expenses | 560 | ||

| Debenture Interest (1500 + 1500) | 3000 | ||

| Director's Remuneration (6300+3500+406) | 10206 | ||

| Depreciation - Motors | 3000 | ||

| Depreciation - Equipment | 1200 | ||

| Goodwill Written off | 3000 | ||

| Allowance for Bad Debt | 2792 | 43642 | |

| Income from Operations | 3558 | ||

| Income Tax @ 25% | 890 | ||

| Net Income for the year | 2668 | ||

| Earnings per common share | 0.38 |

| Director's Remuneration (6300+3500+406) | 10206 |

The amount for Director's remuneration is different in the first answer.

In the secnd answer, calculations from "Income from Operations" is confusing.

Grateful if you could guide me. Thank you in advance.

To FW LTD. PROFIT AND LOSS ACCOUNT FOR THE YEAR DECEMBER 31 2009 Particulars Amounts Particular Amount Opening stock 22,690 By Purcha 153910 Closing stoc 27.220 CarriaEe inward 1,620 Gross Profit 47 200 1.25.420 1.25.420 11,730 Motor expens 7,714 Rates and insurances 1208 General expense 560 Debenture inter 3000 4200 Depreciation Wear And tear 5000 2.5%) Bullidings 2,375 Motor vehic el1720012.5% 612 1,075 800 Equipment 8000 1096 Goodwill written off 3000 Bad Debts 2,792 Donation for cultural activities and 1.550 Donation to political partyl1380 12 173 Tax Payable 3,381 Net Profit(b/F) 11,864 Total 58,930 Total 58,930 To FW LTD. PROFIT AND LOSS ACCOUNT FOR THE YEAR DECEMBER 31 2009 Particulars Amounts Particular Amount Opening stock 22,690 By Purcha 153910 Closing stoc 27.220 CarriaEe inward 1,620 Gross Profit 47 200 1.25.420 1.25.420 11,730 Motor expens 7,714 Rates and insurances 1208 General expense 560 Debenture inter 3000 4200 Depreciation Wear And tear 5000 2.5%) Bullidings 2,375 Motor vehic el1720012.5% 612 1,075 800 Equipment 8000 1096 Goodwill written off 3000 Bad Debts 2,792 Donation for cultural activities and 1.550 Donation to political partyl1380 12 173 Tax Payable 3,381 Net Profit(b/F) 11,864 Total 58,930 Total 58,930Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started