Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dr. Evita Pajanustan, a CPA and PHD graduate of Harvard University, USA opened a consultancy firm on March 1 by leasing an office space.

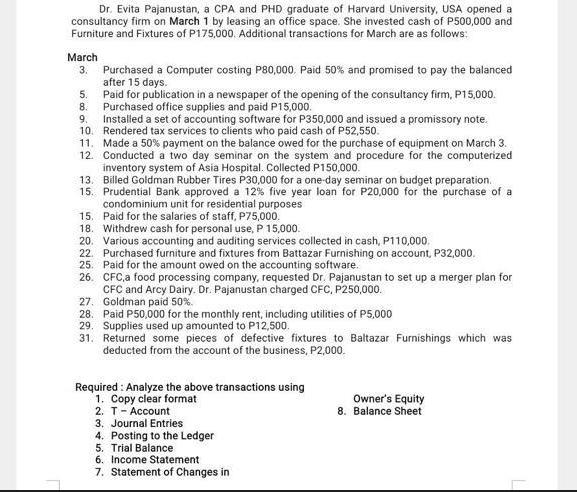

Dr. Evita Pajanustan, a CPA and PHD graduate of Harvard University, USA opened a consultancy firm on March 1 by leasing an office space. She invested cash of P500,000 and Furniture and Fixtures of P175,000. Additional transactions for March are as follows: March 3. Purchased a Computer costing P80,000, Paid 50% and promised to pay the balanced after 15 days. 5. Paid for publication in a newspaper of the opening of the consultancy firm, P15,000. Purchased office supplies and paid P15,000. 8. 9. Installed a set of accounting software for P350,000 and issued a promissory note. 10. Rendered tax services to clients who paid cash of P52,550. 11. Made a 50% payment on the balance owed for the purchase of equipment on March 3. 12. Conducted a two day seminar on the system and procedure for the computerized inventory system of Asia Hospital. Collected P150,000. 13. Billed Goldman Rubber Tires P30,000 for a one-day seminar on budget preparation. 15. Prudential Bank approved a 12% five year loan for P20,000 for the purchase of a condominium unit for residential purposes 15. Paid for the salaries of staff, P75,000. 18. Withdrew cash for personal use, P 15,000. 20. Various accounting and auditing services collected in cash, P110,000. 22. Purchased furniture and fixtures from Battazar Furnishing on account, P32,000. 25. Paid for the amount owed on the accounting software. 26. CFC,a food processing company, requested Dr. Pajanustan to set up a merger plan for CFC and Arcy Dairy. Dr. Pajanustan charged CFC, P250,000. Goldman paid 50%. 27. 28. Paid P50,000 for the monthly rent, including utilities of P5,000 29. Supplies used up amounted to P12,500. 31. Returned some pieces of defective fixtures to Baltazar Furnishings which was deducted from the account of the business, P2,000. Required: Analyze the above transactions using 1. Copy clear format 2. T - Account 3. Journal Entries 4. Posting to the Ledger 5. Trial Balance 6. Income Statement 7. Statement of Changes in Owner's Equity 8. Balance Sheet

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the given transactions we will perform the following steps 1 Prepare the Owners Equity Statement 2 Prepare the TAccounts 3 Prepare the Journal Entries 4 Post the Journal Entries to the Ledg...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started