Question

Dr. Fahad Mehmood, a 32-year old was working at a leading private university in the country. While he enjoyed his job, he was concerned about

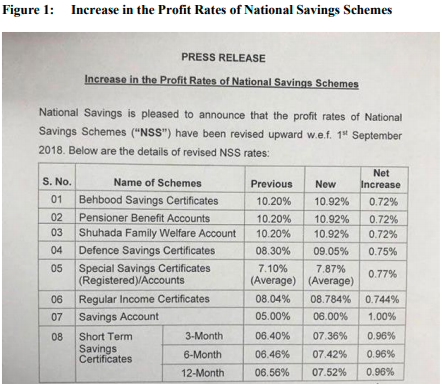

Dr. Fahad Mehmood, a 32-year old was working at a leading private university in the country. While he enjoyed his job, he was concerned about his post-retirement life since his private sector job did not offer housing or pension benefits. After much contemplation, he had approached Raza, a couple of weeks ago, for guidance on how to manage his finances. Dr. Fahad had always wished for early retirement in order to be able to spend some quality time with his family. He had recently inherited a small fortune, and his dream of retiring early seemed more achievable now. He planned to invest his money in relatively safe assets, so as to be able to have enough funds for a comfortable retirement. He was intrigued by his some of his friends boasting about fantastic returns they had recently made by investing in stocks. He was wondering how much of his fortune he should save and how much could be invested in suitable assets. In this regard, he had informed Raza during their meeting that he had ideally planned to work till the age of 50. Following retirement, he wanted to build a house in Rawalpindi, for which he has already made a down payment in Bahria Town worth PKR 5 million for 2 plots of 500 square yards each. He had to pay another PKR 8 million over the next 5 years in equal installments, and expected the construction of his house to cost around PKR 30 million at that time. Upon his retirement, he planned to sell 500 square yards of his land for PKR 15 million, and use the proceeds towards funding construction of his house. Dr. Fahad had recently come across advertisements for increased profit rates offered through Behbood Certificates

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started