Answered step by step

Verified Expert Solution

Question

1 Approved Answer

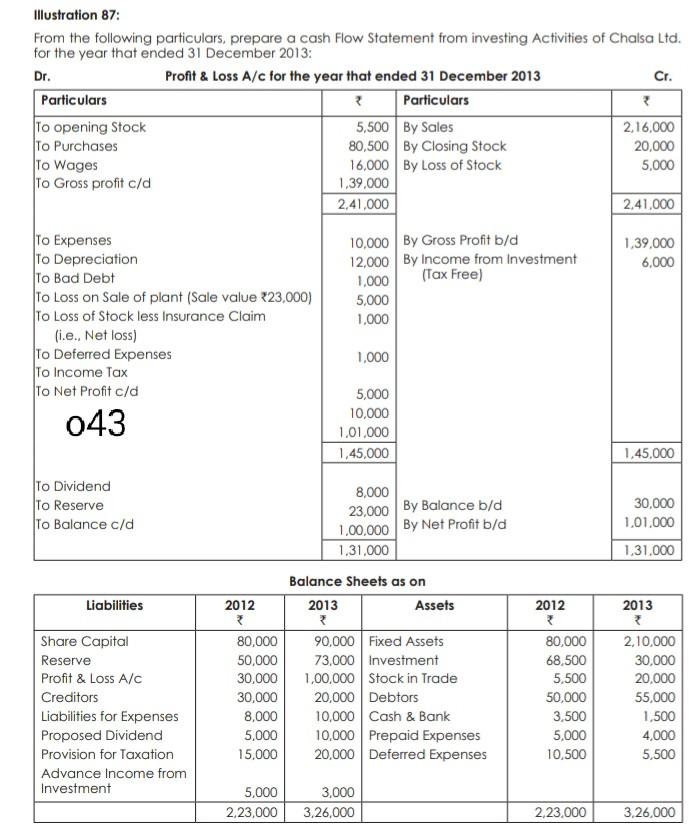

Dr. Illustration 87: From the following particulars, prepare a cash Flow Statement from investing Activities of Chalsa Ltd. for the year that ended 31 December

Dr. Illustration 87: From the following particulars, prepare a cash Flow Statement from investing Activities of Chalsa Ltd. for the year that ended 31 December 2013: Profit & Loss A/c for the year that ended 31 December 2013 Cr. Particulars ? Particulars To opening Stock 5,500 By Sales 2,16,000 To Purchases 80,500 By Closing Stock 20,000 To Wages 16,000 By Loss of Stock 5,000 To Gross profit c/d 1.39,000 2,41,000 2.41,000 1,39,000 6,000 10,000 By Gross Profit b/d 12,000 By Income from Investment 1.000 (Tax Free) 5,000 1.000 To Expenses To Depreciation To Bad Debt To Loss on Sale of plant (Sale value 223,000) To Loss of Stock less Insurance Claim (i.e.. Net loss) To Deferred Expenses To Income Tax To Net Profit c/d 043 1.000 5,000 10,000 1,01,000 1,45,000 1,45.000 To Dividend To Reserve To Balance c/d 30,000 1,01,000 1.31.000 Liabilities 8,000 23,000 By Balance b/d 1,00,000 By Net Profit b/d 1.31,000 Balance Sheets as on 2013 Assets 90,000 Fixed Assets 73,000 Investment 1,00,000 Stock in Trade 20,000 Debtors 10,000 Cash & Bank 10.000 Prepaid Expenses 20,000 Deferred Expenses 2012 2 80,000 50,000 30,000 30,000 8,000 5,000 15.000 Share Capital Reserve Profit & Loss A/C Creditors Liabilities for Expenses Proposed Dividend Provision for Taxation Advance Income from Investment 2012 80,000 68,500 5,500 50,000 3.500 5,000 10,500 2013 2.10,000 30,000 20,000 55,000 1,500 4,000 5,500 5,000 2,23,000 3,000 3,26,000 2,23,000 3,26,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started