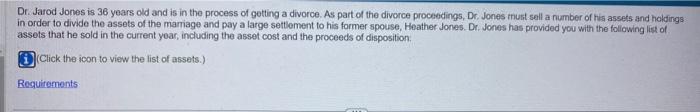

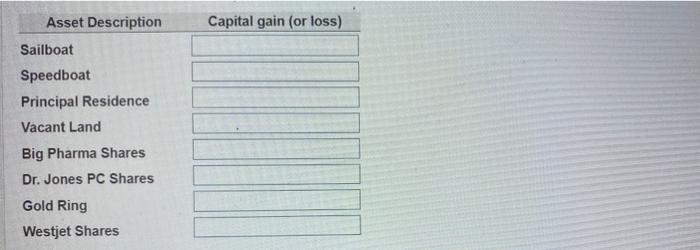

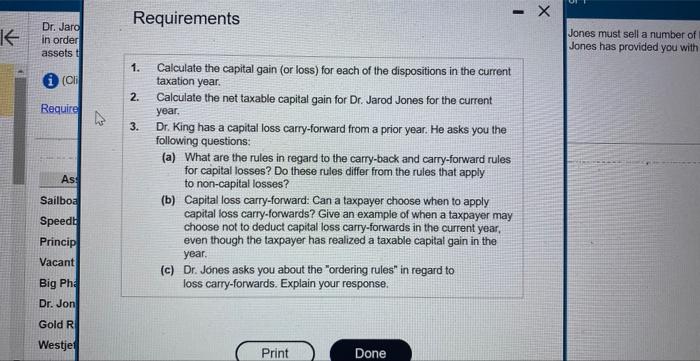

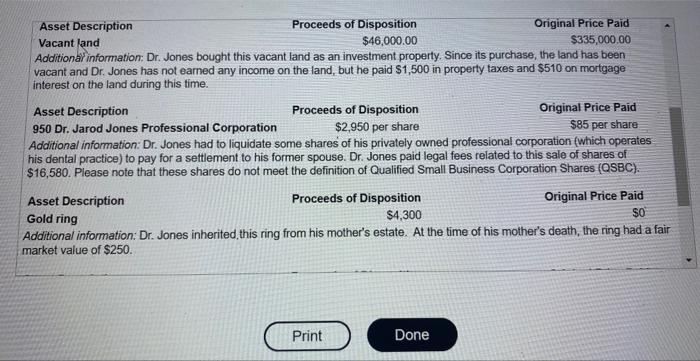

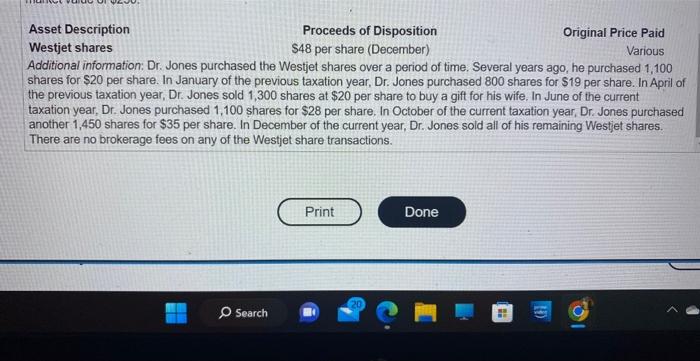

Dr. Jarod Jones is 36 years old and is in the process of getting a divorce. As part of the divorce proceedings, Dr. Jones must sell a number of his assets and holdings in order to divide the assets of the marriage and pay a large settlement to his former spouse. Heather Jones. Dr. Jones has provided you with the folliowing list of assets that he sold in the current yoar, including the asset cost and the proceeds of disposition. (Click the jcon to view the list of assets.) Asset Description Capital gain (or loss) Sailboat Speedboat Principal Residence Vacant Land Big Pharma Shares Dr. Jones PC Shares Gold Ring Westjet Shares Jones must sell a number of Jones has provided you with 1. Calculate the capital gain (or loss) for each of the dispositions in the current taxation year. 2. Calculate the net taxable capital gain for Dr. Jarod Jones for the current year. 3. Dr. King has a capital loss carry-forward from a prior year. He asks you the following questions: (a) What are the rules in regard to the carry-back and carry-forward rules for capital losses? Do these rules differ from the rules that apply to non-capital losses? (b) Capital loss carry-forward: Can a taxpayer choose when to apply capital loss carry-forwards? Give an example of when a taxpayer may choose not to deduct capital loss carry-forwards in the current year, even though the taxpayer has realized a taxable capital gain in the year. (c) Dr. Jones asks you about the "ordering rules" in regard to loss carry-forwards. Explain your response. List of assets 4dditional information: The home was the principal residence for Dr. Jones and his former spouse for 10 years, ending in the current faxation year. Last year, Dr. Jones sold his cabin at the lake, which he claimed as his principal residence for two taxation rears (the cabin at the lake was designated as Dr. Jones's principal residence for the two most recent taxation years.) Therefore, his home cannot be claimed as Dr. Jones's principal residence for those years. Asset Description Proceeds of Disposition Original Price Paid Vacant land Additionarinformation: Dr. Jones bought this vacant land as an investment property. Since its purchase, the land has been vacant and Dr. Jones has not earned any income on the land, but he paid $1,500 in property taxes and $510 on mortgage interest on the land during this time. Asset Description Proceeds of Disposition Original Price Paid 950 Dr. Jarod Jones Professional Corporation _ $2,950 per share $85 per share Additional information: Dr. Jones had to liquidate some shares of his privately owned professional corporation fwhich operates his dental practice) to pay for a settlement to his former spouse. Dr. Jones paid legal fees related to this sale of shares of $16,580. Please note that these shares do not meet the definition of Qualified Small Business Corporation Shares (QSBC). Asset Description Proceeds of Disposition Original Price Paid Gold ring $4,300 50 Additional information: Dr. Jones inherited, this ring from his mother's estate. At the time of his mother's death, the ring had a fair market value of $250. Asset Description Proceeds of Disposition Original Price Paid Westjet shares $48 per share (December) Various Additional information: Dr. Jones purchased the Westjet shares over a period of time. Several years ago, he purchased 1,100 shares for $20 per share. In January of the previous taxation year, Dr. Jones purchased 800 shares for $19 per share. In April of the previous taxation year, Dr. Jones sold 1,300 shares at $20 per share to buy a gift for his wife, In June of the current taxation year, Dr. Jones purchased 1,100 shares for $28 per share. In October of the current taxation year, Dr. Jones purchased another 1,450 shares for $35 per share. In December of the current year, Dr. Jones sold all of his remaining Westiet shares. There are no brokerage fees on any of the Westjet share transactions. Dr. Jarod Jones is 36 years old and is in the process of getting a divorce. As part of the divorce proceedings, Dr. Jones must sell a number of his assets and holdings in order to divide the assets of the marriage and pay a large settlement to his former spouse. Heather Jones. Dr. Jones has provided you with the folliowing list of assets that he sold in the current yoar, including the asset cost and the proceeds of disposition. (Click the jcon to view the list of assets.) Asset Description Capital gain (or loss) Sailboat Speedboat Principal Residence Vacant Land Big Pharma Shares Dr. Jones PC Shares Gold Ring Westjet Shares Jones must sell a number of Jones has provided you with 1. Calculate the capital gain (or loss) for each of the dispositions in the current taxation year. 2. Calculate the net taxable capital gain for Dr. Jarod Jones for the current year. 3. Dr. King has a capital loss carry-forward from a prior year. He asks you the following questions: (a) What are the rules in regard to the carry-back and carry-forward rules for capital losses? Do these rules differ from the rules that apply to non-capital losses? (b) Capital loss carry-forward: Can a taxpayer choose when to apply capital loss carry-forwards? Give an example of when a taxpayer may choose not to deduct capital loss carry-forwards in the current year, even though the taxpayer has realized a taxable capital gain in the year. (c) Dr. Jones asks you about the "ordering rules" in regard to loss carry-forwards. Explain your response. List of assets 4dditional information: The home was the principal residence for Dr. Jones and his former spouse for 10 years, ending in the current faxation year. Last year, Dr. Jones sold his cabin at the lake, which he claimed as his principal residence for two taxation rears (the cabin at the lake was designated as Dr. Jones's principal residence for the two most recent taxation years.) Therefore, his home cannot be claimed as Dr. Jones's principal residence for those years. Asset Description Proceeds of Disposition Original Price Paid Vacant land Additionarinformation: Dr. Jones bought this vacant land as an investment property. Since its purchase, the land has been vacant and Dr. Jones has not earned any income on the land, but he paid $1,500 in property taxes and $510 on mortgage interest on the land during this time. Asset Description Proceeds of Disposition Original Price Paid 950 Dr. Jarod Jones Professional Corporation _ $2,950 per share $85 per share Additional information: Dr. Jones had to liquidate some shares of his privately owned professional corporation fwhich operates his dental practice) to pay for a settlement to his former spouse. Dr. Jones paid legal fees related to this sale of shares of $16,580. Please note that these shares do not meet the definition of Qualified Small Business Corporation Shares (QSBC). Asset Description Proceeds of Disposition Original Price Paid Gold ring $4,300 50 Additional information: Dr. Jones inherited, this ring from his mother's estate. At the time of his mother's death, the ring had a fair market value of $250. Asset Description Proceeds of Disposition Original Price Paid Westjet shares $48 per share (December) Various Additional information: Dr. Jones purchased the Westjet shares over a period of time. Several years ago, he purchased 1,100 shares for $20 per share. In January of the previous taxation year, Dr. Jones purchased 800 shares for $19 per share. In April of the previous taxation year, Dr. Jones sold 1,300 shares at $20 per share to buy a gift for his wife, In June of the current taxation year, Dr. Jones purchased 1,100 shares for $28 per share. In October of the current taxation year, Dr. Jones purchased another 1,450 shares for $35 per share. In December of the current year, Dr. Jones sold all of his remaining Westiet shares. There are no brokerage fees on any of the Westjet share transactions