Dr Joe Medic, a lecturer in Medicine at Adelaide University, took leave on 8 March 2020 to attend a three-day conference in London. While

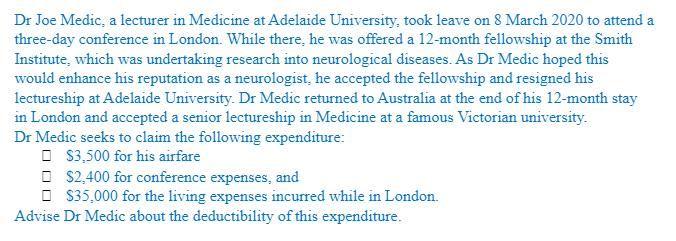

Dr Joe Medic, a lecturer in Medicine at Adelaide University, took leave on 8 March 2020 to attend a three-day conference in London. While there, he was offered a 12-month fellowship at the Smith Institute, which was undertaking research into neurological diseases. As Dr Medic hoped this would enhance his reputation as a neurologist, he accepted the fellowship and resigned his lectureship at Adelaide University. Dr Medic returned to Australia at the end of his 12-month stay in London and accepted a senior lectureship in Medicine at a famous Victorian university. Dr Medic seeks to claim the following expenditure: $3,500 for his airfare $2,400 for conference expenses, and $35,000 for the living expenses incurred while in London. Advise Dr Medic about the deductibility of this expenditure.

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The airfare and conference expenses are deductible as they are necessary expenses incurred ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started