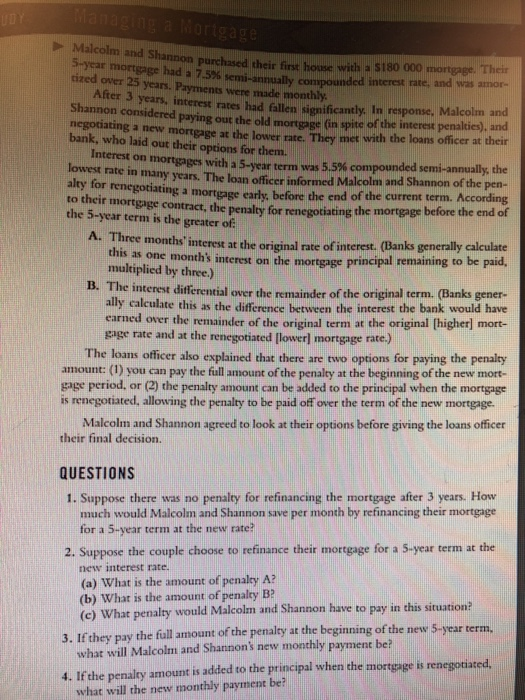

Dr Malcolm and Shannon 5-year mortgage had 75% semi-annually compounded interest tized over 25 years. Payments were made monthly purchased their first house with - $180 000 mortgage. Their rate, and was amor- After 3 years, interest rates had fallen significantly. In response. Malcolm and Shannon considered paying out the old monggs Gn spite of the intere penaltie), and negotiating a new mortgage at the lower rate. They met With t bank, who laid out their options for them. he loans officer at their Interest on mortgages with a 5-year term was 5.5% compounded semi-annually, the alty for renegotiating to their mortgage the 5-year term is the greater of lowest rate in many years. The loan officer informed Malcolm and Shannon of the pern- a mortgage early, before the end of the current term. According contract, the penalty for renegotiating the mortgage before the end of A. Three months interest at the original rate of interest. (Banks generally calculate this as one months interest on the mortgage principal remaining to multiplied by three.) B. Th e interest differential over the remainder of the original term. (Banks gener- ally calculate this as the difference between the interest the bank would have earned over the remainder of the original term at the original [higher] mort- gage rate and at the renegotiated llowerl mortgage rate) The loans officer aso explained that there are two options for paying the penalty amount: (1) you can pay the full amount of the penalty at the beginning of the new mort- gage period, or (2) the penalty amount can be added to the principal when the mortgage is renegotiated, allowing the penalty to be paid off over the term of che new mortege. Malcolm and Shannon agreed to look at their options before giving the loans officer their final decision. QUESTIONS 1. Suppose there was no penalty for refinancing the mortgage after 3 years. How much would Malcolm and Shannon save per month by refinancing their mortgage for a 5-year term at the new rate? 2. Suppose the couple choose to refinance their mortgage for a 5-year term at the new interest rate. (a) What is the amount of penalry A? (b) What is the amount of penalty B? (c) What penalty would Malcolm and Shannon have to pay in this situation? 3. If they pay the fall amount of the penalty at the beginning of the new S-year term. what will Malcolm and Shannon's new monthly payment be? 4. If the penalty amount is added to the principal when the mortgage is renegotiated, what will the new monthly payment be? Dr Malcolm and Shannon 5-year mortgage had 75% semi-annually compounded interest tized over 25 years. Payments were made monthly purchased their first house with - $180 000 mortgage. Their rate, and was amor- After 3 years, interest rates had fallen significantly. In response. Malcolm and Shannon considered paying out the old monggs Gn spite of the intere penaltie), and negotiating a new mortgage at the lower rate. They met With t bank, who laid out their options for them. he loans officer at their Interest on mortgages with a 5-year term was 5.5% compounded semi-annually, the alty for renegotiating to their mortgage the 5-year term is the greater of lowest rate in many years. The loan officer informed Malcolm and Shannon of the pern- a mortgage early, before the end of the current term. According contract, the penalty for renegotiating the mortgage before the end of A. Three months interest at the original rate of interest. (Banks generally calculate this as one months interest on the mortgage principal remaining to multiplied by three.) B. Th e interest differential over the remainder of the original term. (Banks gener- ally calculate this as the difference between the interest the bank would have earned over the remainder of the original term at the original [higher] mort- gage rate and at the renegotiated llowerl mortgage rate) The loans officer aso explained that there are two options for paying the penalty amount: (1) you can pay the full amount of the penalty at the beginning of the new mort- gage period, or (2) the penalty amount can be added to the principal when the mortgage is renegotiated, allowing the penalty to be paid off over the term of che new mortege. Malcolm and Shannon agreed to look at their options before giving the loans officer their final decision. QUESTIONS 1. Suppose there was no penalty for refinancing the mortgage after 3 years. How much would Malcolm and Shannon save per month by refinancing their mortgage for a 5-year term at the new rate? 2. Suppose the couple choose to refinance their mortgage for a 5-year term at the new interest rate. (a) What is the amount of penalry A? (b) What is the amount of penalty B? (c) What penalty would Malcolm and Shannon have to pay in this situation? 3. If they pay the fall amount of the penalty at the beginning of the new S-year term. what will Malcolm and Shannon's new monthly payment be? 4. If the penalty amount is added to the principal when the mortgage is renegotiated, what will the new monthly payment be