Answered step by step

Verified Expert Solution

Question

1 Approved Answer

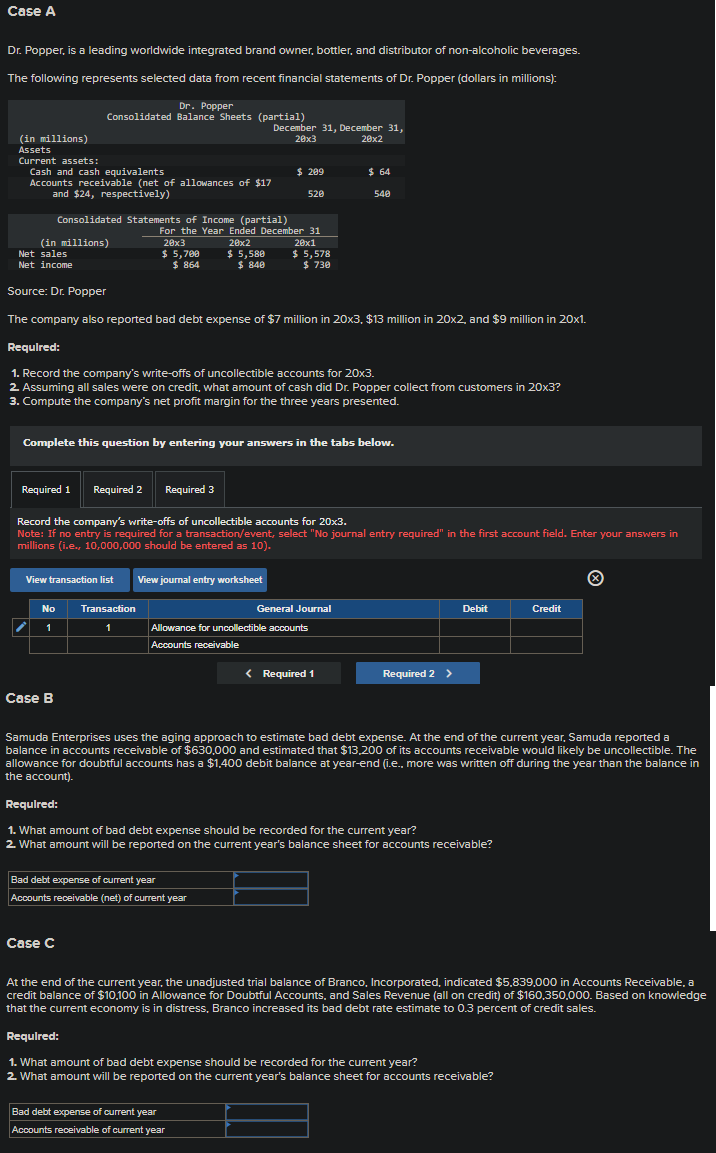

Dr . Popper, is a leading worldwide integrated brand owner, bottler, and distributor of non - alcoholic beverages. The following represents selected data from recent

Dr Popper, is a leading worldwide integrated brand owner, bottler, and distributor of nonalcoholic beverages.

The following represents selected data from recent financial statements of Dr Popper dollars in millions:

Source: Dr Popper

The company also reported bad debt expense of $ million in $ million in and $ million in

Requlred:

Record the company's writeoffs of uncollectible accounts for

Assuming all sales were on credit, what amount of cash did Dr Popper collect from customers in x

Compute the company's net profit margin for the three years presented.

Complete this question by entering your answers in the tabs below.

Required

Required

Record the company's writeoffs of uncollectible accounts for

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Enter your answers in

millions ie should be entered as

Case B

Samuda Enterprises uses the aging approach to estimate bad debt expense. At the end of the current year, Samuda reported a

balance in accounts receivable of $ and estimated that $ of its accounts receivable would likely be uncollectible. The

allowance for doubtful accounts has a $ debit balance at yearend ie more was written off during the year than the balance in

the account

Requlred:

What amount of bad debt expense should be recorded for the current year?

What amount will be reported on the current year's balance sheet for accounts receivable?

Case C

At the end of the current year, the unadjusted trial balance of Branco, Incorporated, indicated $ in Accounts Receivable, a

credit balance of $ in Allowance for Doubtful Accounts, and Sales Revenue all on credit of $ Based on knowledge

that the current economy is in distress, Branco increased its bad debt rate estimate to percent of credit sales.

Requlred:

What amount of bad debt expense should be recorded for the current year?

What amount will be reported on the current year's balance sheet for accounts receivable?

Bad debt expense of current year

Accounts receivable of current year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started