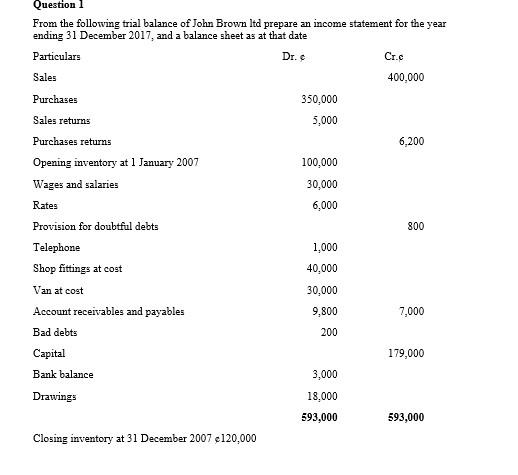

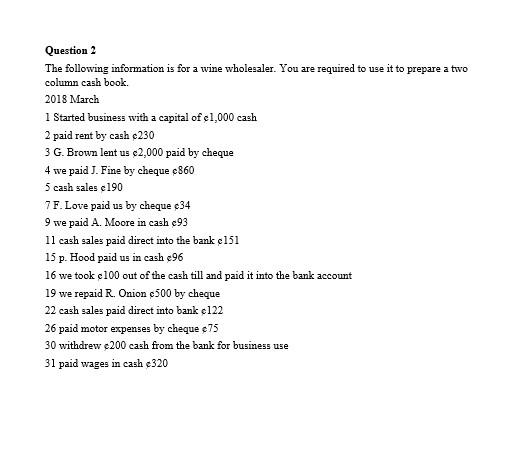

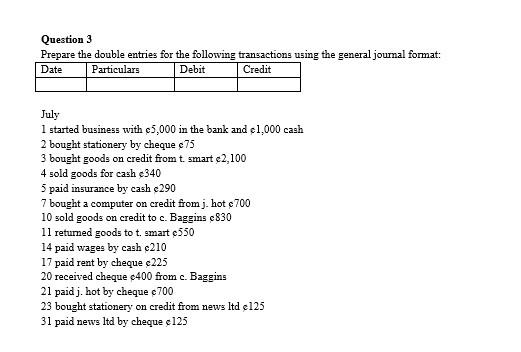

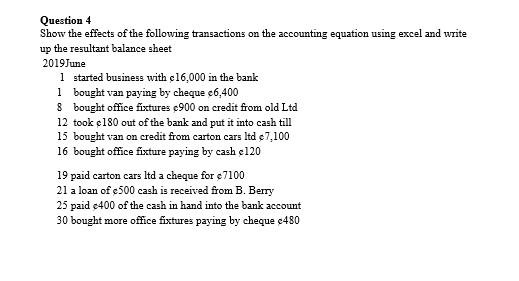

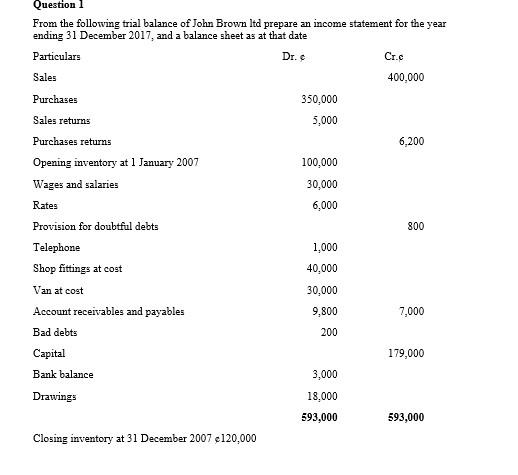

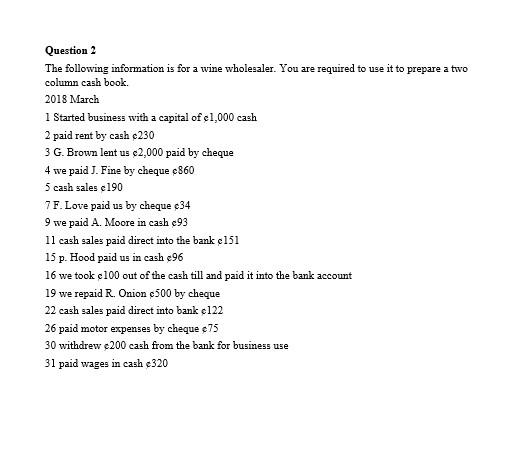

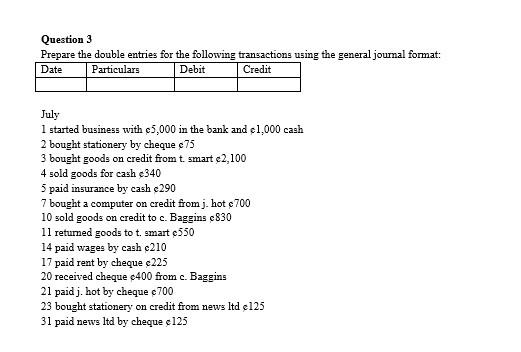

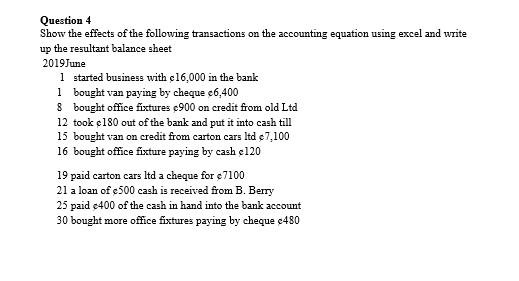

Dr. Question 1 From the following trial balance of John Brown ltd prepare an income statement for the year ending 31 December 2017, and a balance sheet as at that date Particulars Cr.c Sales 400,000 Purchases 350,000 Sales returns 5,000 Purchases returns 6,200 Opening inventory at 1 January 2007 100,000 Wages and salaries 30,000 Rates 6,000 Provision for doubtful debts 800 Telephone 1,000 Shop fittings at cost 40,000 Van at cost 30,000 Account receivables and payables 9,800 7,000 Bad debts 200 Capital 179,000 Bank balance 3,000 Drawings 18,000 593,000 593,000 Closing inventory at 31 December 2007 e 120,000 Question 2 The following information is for a wine wholesaler. You are required to use it to prepare a two column cash book 2018 March 1 Started business with a capital of 1,000 cash 2 paid rent by cash c230 3 G. Brown lent us $2,000 paid by cheque 4 we paid J. Fine by cheque c860 5 cash sales c190 7 F. Love paid us by cheque c34 9 we paid A. Moore in cash c93 11 cash sales paid direct into the bank 151 15 p. Hood paid us in cash 496 16 we took c100 out of the cash till and paid it into the bank account 19 we repaid R. Onion 500 by cheque 22 cash sales paid direct into bank 6122 26 paid motor expenses by cheque e75 30 withdrew c200 cash from the bank for business use 31 paid wages in cash 320 Question 3 Prepare the double entries for the following transactions using the general journal format: Date Particulars Debit Credit July 1 started business with 65,000 in the bank and 1,000 cash 2 bought stationery by cheque 475 3 bought goods on credit from t smart (2,100 4 sold goods for cash c340 5 paid insurance by cash 290 7 bought a computer on credit from j. hot 700 10 sold goods on credit to c. Baggins 830 11 returned goods to t. smart 4550 14 paid wages by cash c210 17 paid rent by cheque e225 20 received cheque c400 from c. Baggins 21 paidj, hot by cheque 0700 23 bought stationery on credit from news Itd el25 31 paid news ltd by cheque 125 Question + Show the effects of the following transactions on the accounting equation using excel and write up the resultant balance sheet 2019 June I started business with 16,000 in the bank I bought van paying by cheque 6,400 8 bought office fixtures 900 on credit from old Ltd 12 took 180 out of the bank and put it into cash till 15 bought van on credit from carton cars ltd 7,100 16 bought office fixture paying by cash el20 19 paid carton cars ltd a cheque for e7100 21 a loan of 500 cash is received from B. Berry 25 paid 400 of the cash in hand into the bank account 30 bought more office fixtures paying by cheque e480