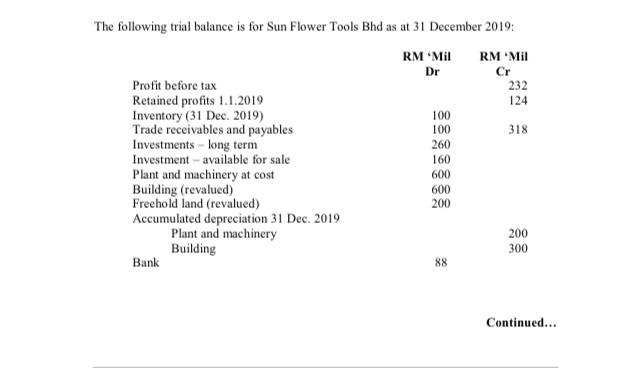

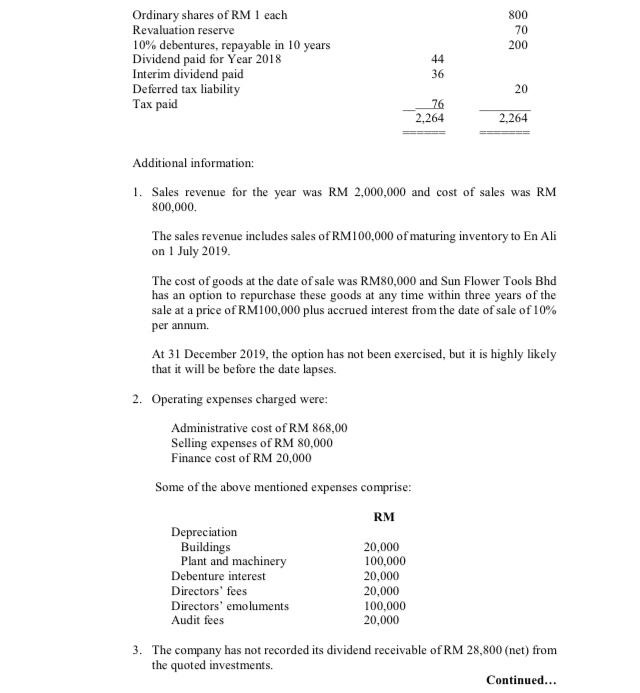

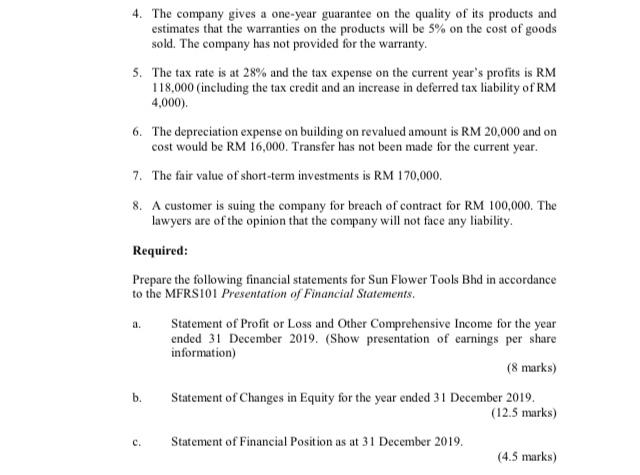

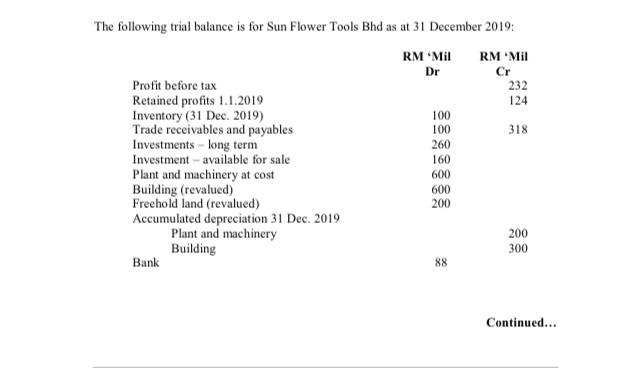

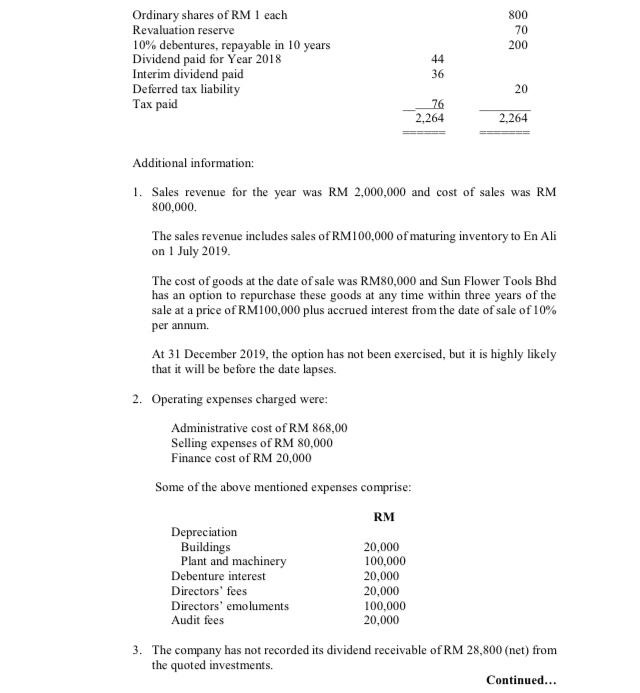

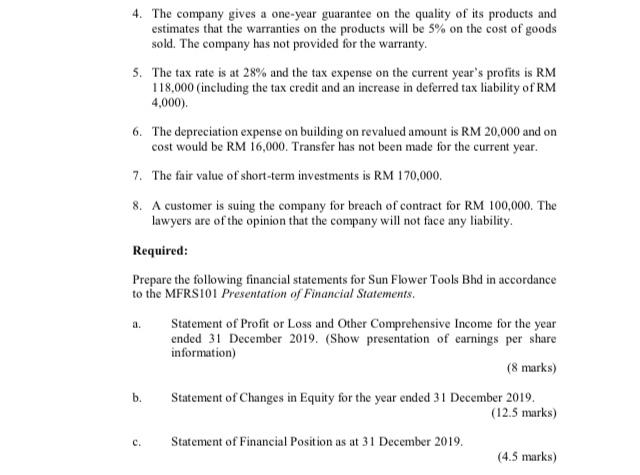

Dr The following trial balance is for Sun Flower Tools Bhd as at 31 December 2019: RM Mil RM Mil Cr Profit before tax 232 Retained profits 1.1.2019 124 Inventory (31 Dec. 2019) 100 Trade receivables and payables 100 318 Investments - long term 260 Investment - available for sale 160 Plant and machinery at cost 600 Building (revalued) 600 Freehold land (revalued) 200 Accumulated depreciation 31 Dec. 2019 Plant and machinery 200 Building 300 Bank 88 Continued... 800 70 200 Ordinary shares of RM 1 each Revaluation reserve 10% debentures, repayable in 10 years Dividend paid for Year 2018 Interim dividend paid Deferred tax liability Tax paid 44 36 20 76 2,264 2.264 Additional information: 1. Sales revenue for the year was RM 2,000,000 and cost of sales was RM 800,000. The sales revenue includes sales of RM100,000 of maturing inventory to En Ali on 1 July 2019. The cost of goods at the date of sale was RM80,000 and Sun Flower Tools Bhd has an option to repurchase these goods at any time within three years of the sale at a price of RM100,000 plus accrued interest from the date of sale of 10% per annum At 31 December 2019, the option has not been exercised, but it is highly likely that it will be before the date lapses. 2. Operating expenses charged were: Administrative cost of RM 868,00 Selling expenses of RM 80,000 Finance cost of RM 20,000 Some of the above mentioned expenses comprise: RM Depreciation Buildings 20,000 Plant and machinery 100,000 Debenture interest 20,000 Directors' fees 20,000 Directors' emoluments 100,000 Audit fees 20,000 3. The company has not recorded its dividend receivable of RM 28,800 (net) from the quoted investments. Continued... 4. The company gives a one-year guarantee on the quality of its products and estimates that the warranties on the products will be 5% on the cost of goods sold. The company has not provided for the warranty. 5. The tax rate is at 28% and the tax expense on the current year's profits is RM 118,000 (including the tax credit and an increase in deferred tax liability of RM 4,000). 6. The depreciation expense on building on revalued amount is RM 20,000 and on cost would be RM 16,000. Transfer has not been made for the current year. 7. The fair value of short-term investments is RM 170,000. 8. A customer is suing the company for breach of contract for RM 100,000. The lawyers are of the opinion that the company will not face any liability Required: Prepare the following financial statements for Sun Flower Tools Bhd in accordance to the MFRSIOT Presentation of Financial Statements. Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2019. (Show presentation of earnings per share information) (8 marks) Statement of Changes in Equity for the year ended 31 December 2019. (12.5 marks) Statement of Financial Position as at 31 December 2019. (4.5 marks) b. Dr The following trial balance is for Sun Flower Tools Bhd as at 31 December 2019: RM Mil RM Mil Cr Profit before tax 232 Retained profits 1.1.2019 124 Inventory (31 Dec. 2019) 100 Trade receivables and payables 100 318 Investments - long term 260 Investment - available for sale 160 Plant and machinery at cost 600 Building (revalued) 600 Freehold land (revalued) 200 Accumulated depreciation 31 Dec. 2019 Plant and machinery 200 Building 300 Bank 88 Continued... 800 70 200 Ordinary shares of RM 1 each Revaluation reserve 10% debentures, repayable in 10 years Dividend paid for Year 2018 Interim dividend paid Deferred tax liability Tax paid 44 36 20 76 2,264 2.264 Additional information: 1. Sales revenue for the year was RM 2,000,000 and cost of sales was RM 800,000. The sales revenue includes sales of RM100,000 of maturing inventory to En Ali on 1 July 2019. The cost of goods at the date of sale was RM80,000 and Sun Flower Tools Bhd has an option to repurchase these goods at any time within three years of the sale at a price of RM100,000 plus accrued interest from the date of sale of 10% per annum At 31 December 2019, the option has not been exercised, but it is highly likely that it will be before the date lapses. 2. Operating expenses charged were: Administrative cost of RM 868,00 Selling expenses of RM 80,000 Finance cost of RM 20,000 Some of the above mentioned expenses comprise: RM Depreciation Buildings 20,000 Plant and machinery 100,000 Debenture interest 20,000 Directors' fees 20,000 Directors' emoluments 100,000 Audit fees 20,000 3. The company has not recorded its dividend receivable of RM 28,800 (net) from the quoted investments. Continued... 4. The company gives a one-year guarantee on the quality of its products and estimates that the warranties on the products will be 5% on the cost of goods sold. The company has not provided for the warranty. 5. The tax rate is at 28% and the tax expense on the current year's profits is RM 118,000 (including the tax credit and an increase in deferred tax liability of RM 4,000). 6. The depreciation expense on building on revalued amount is RM 20,000 and on cost would be RM 16,000. Transfer has not been made for the current year. 7. The fair value of short-term investments is RM 170,000. 8. A customer is suing the company for breach of contract for RM 100,000. The lawyers are of the opinion that the company will not face any liability Required: Prepare the following financial statements for Sun Flower Tools Bhd in accordance to the MFRSIOT Presentation of Financial Statements. Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2019. (Show presentation of earnings per share information) (8 marks) Statement of Changes in Equity for the year ended 31 December 2019. (12.5 marks) Statement of Financial Position as at 31 December 2019. (4.5 marks) b