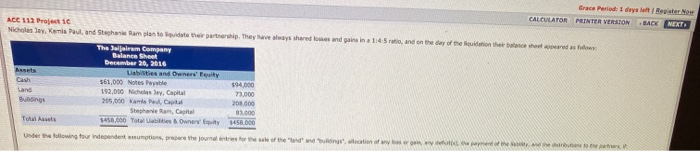

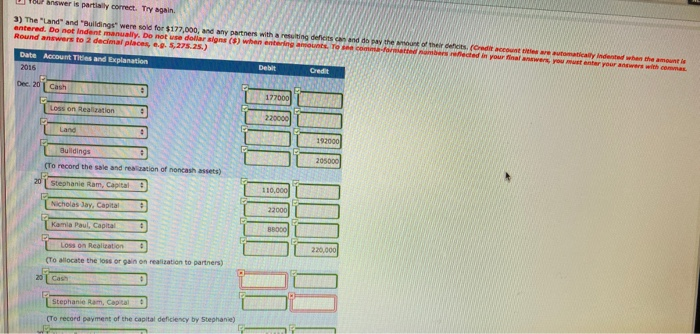

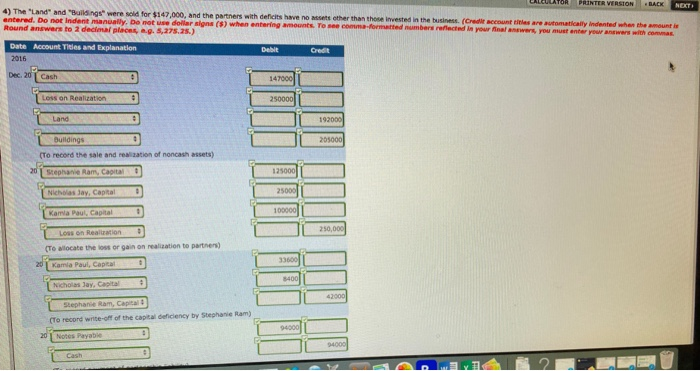

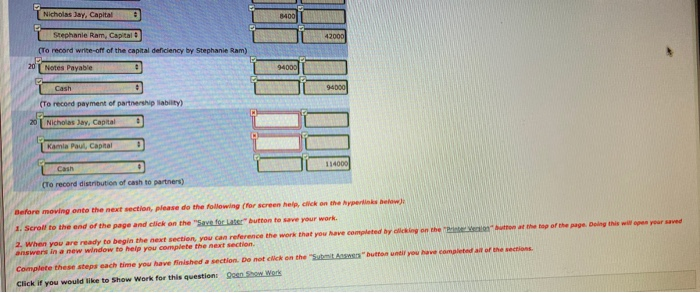

drace Period 1 days left 1 Repister Now CALCULATOR PRINTER VERsION MEXT BACK ACC 112 Project 1c Nicholes Jay, Kamia Paul, and Stephanie Ram plan to quidate their partnership. They have aleays shared losses and gains in a 1:4 5 rtio, and en the day of the ouideion their balance theet appeared as fdows The Jaijairam Company Balance Sheet December 20, 2016 Liabisties and Owners Equity Assets Cash $61,000 Notes Payable 192,000 Nicholas ay, Capital 205,000 Kamle Pel, Capital Stephanie Ram, Capital $458,000 Total Uabilities&Ownery Equity $94,000 73,000 Land Budings 208,00 83000 $458 000 Total Assets Under e fullowing four independent assumptions, prepare the jounal entries for the sale of the "land and udngs allcation of any los r ge wry defot(L e payen of he abity ae he dtrbuars fo Ee patr 1our answer is partlaly cornect Try again 3) The "Land" and "Buildings" were sold for $177,000, and any partners with a resuiting deficits can and do pay the anount of their defcits. (Credit aceount ttles are automaticaly indented when the amount is antered. Do not Indent manually. De not use dolliar aigns ($) when entering amounts, To see comma-formatted nambers nelected in your inal anwers, you must anter your ancwers wth cemmas Round answers to 2 decimal places, e.- 5,275.25) Date Account Titles and Explanation Debit Credit 2016 Dec. 201 Cash 177000 Loss on Realization 220000 Land 192000 Buldings 205000 (To record the sale and realization of noncash assets) Stephanie Ram, Capital 110.000 22000 Nicholas Jay, Capital 88000 Kamia Paul, Capital 220,000 Loss on Realization (To allocate the loss or gain on realization to partners) 20 Cash Stephanie Ram, Capital (To record payment of the capital deficlency by Stephanie) PRINTER VIERSION BACK NEXT 4) The "Land" and "Buildings" were sold for $147,000, and the partners with deficits have no assets other than those invested in the business. (Credit account tinles are automatically indented when the amount is entered. Do not Indent manually, Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your Anal anwers, you must enter your answers with commas Round answers to 2 decimal places, a.g. 5,275.25.) Date Account Titles and Explanation Debit Credit 2016 Dec. 201 Cash 147000 Loss on Realization 250000 Land 192000 205000 Buildings (To record the sale and realiaation of noncash assets) 125000 201 Stephanie Ram, Capital 25000 Nicholas Jay, Capital D 100000 Kamla Paul, Capital 250,000 Loss on Realization (To allocate the loss or gain on realization to partners) 33600 Kamia Paul, Captal 8400 Nicholas Jay, Capital 42000 Stephanie Ram, Capital (To record wnte-off of the capital deficiency by Stephanie Ram) 94000 201 Notes Payable 94000 Cash