Draft the Five-year NPV ( Net Present Value) and Briefly explain all your findings

You allowed making any realistic assumption related to growth rate, WACC.....

Please do not spam, do not Copy and Paste previous answers.

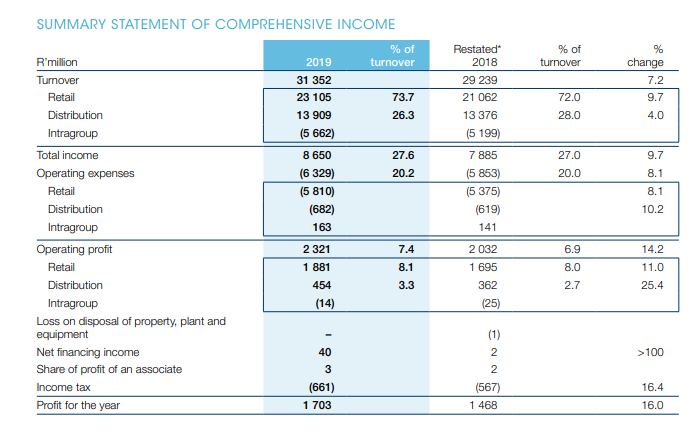

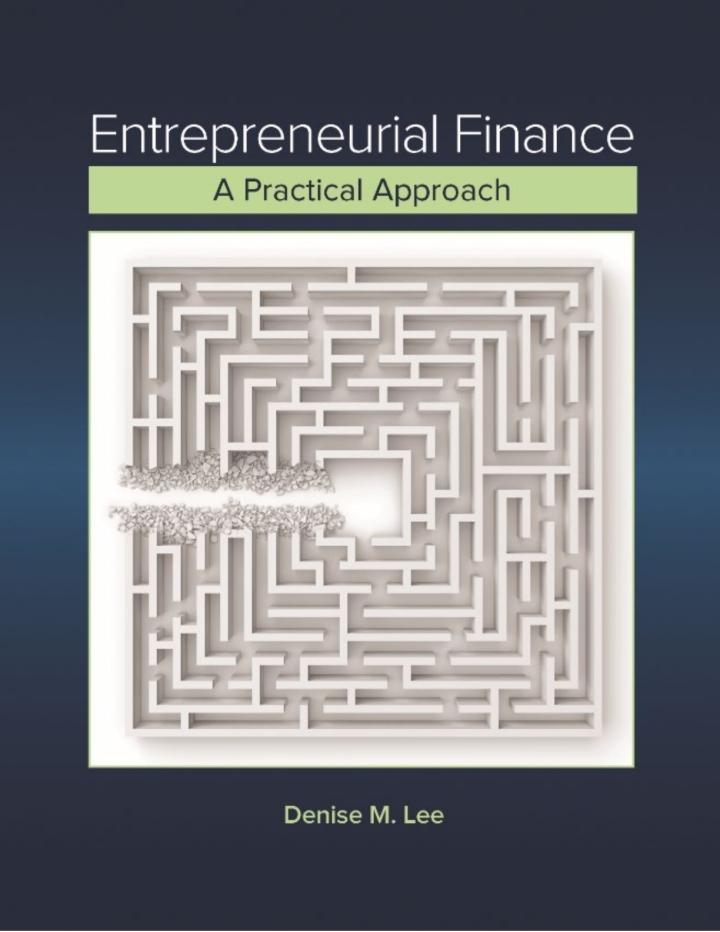

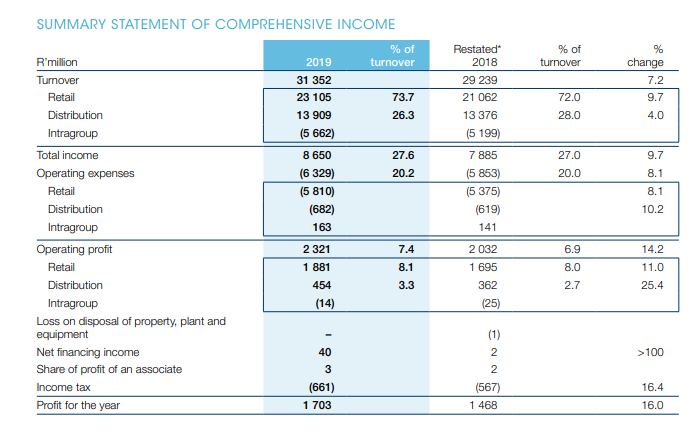

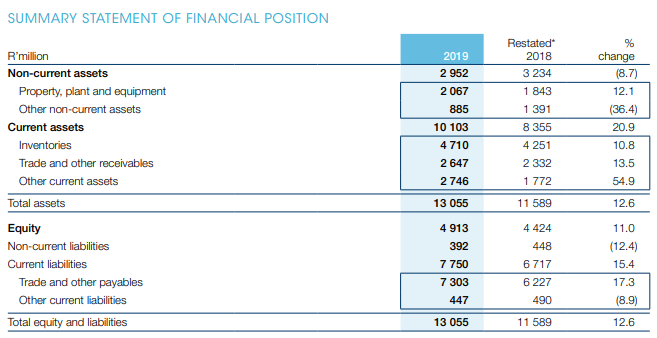

SUMMARY STATEMENT OF COMPREHENSIVE INCOME % of turnover % of turnover change 7.2 9.7 73.7 26.3 72.0 28.0 4.0 2019 31 352 23 105 13 909 (5 662) 8 650 (6 329) (5 810) (682) 163 Restated 2018 29 239 21 062 13 376 (5 199) 7 885 (5 853) (5 375) (619) 141 27.0 9.7 27.6 20.2 20.0 8.1 8.1 10.2 R'million Turnover Retail Distribution Intragroup Total income Operating expenses Retail Distribution Intragroup Operating profit Retail Distribution Intragroup Loss on disposal of property, plant and equipment Net financing income Share of profit of an associate Income tax Profit for the year 2 321 2 032 6.9 14.2 1 881 454 (14) 7.4 8.1 3.3 1 695 362 8.0 2.7 11.0 25.4 (25) >100 40 3 (1) 2 2 (567) 1 468 16.4 (661) 1 703 16.0 SUMMARY STATEMENT OF FINANCIAL POSITION 2019 2 952 2 067 885 Restated 2018 3 234 1 843 % change (8.7) 12.1 (36.4) 20.9 1 391 8 355 10.8 10 103 4 710 2 647 2 746 4 251 2 332 13.5 54.9 1 772 Rimillion Non-current assets Property, plant and equipment Other non-current assets Current assets Inventories Trade and other receivables Other current assets Total assets Equity Non-current liabilities Current liabilities Trade and other payables Other current liabilities Total equity and liabilities 13 055 11 589 12.6 4 424 4 913 392 7 750 7 303 447 448 6717 11.0 (12.4) 15.4 17.3 (8.9) 6 227 490 13 055 11 589 12.6 SUMMARY STATEMENT OF COMPREHENSIVE INCOME % of turnover % of turnover change 7.2 9.7 73.7 26.3 72.0 28.0 4.0 2019 31 352 23 105 13 909 (5 662) 8 650 (6 329) (5 810) (682) 163 Restated 2018 29 239 21 062 13 376 (5 199) 7 885 (5 853) (5 375) (619) 141 27.0 9.7 27.6 20.2 20.0 8.1 8.1 10.2 R'million Turnover Retail Distribution Intragroup Total income Operating expenses Retail Distribution Intragroup Operating profit Retail Distribution Intragroup Loss on disposal of property, plant and equipment Net financing income Share of profit of an associate Income tax Profit for the year 2 321 2 032 6.9 14.2 1 881 454 (14) 7.4 8.1 3.3 1 695 362 8.0 2.7 11.0 25.4 (25) >100 40 3 (1) 2 2 (567) 1 468 16.4 (661) 1 703 16.0 SUMMARY STATEMENT OF FINANCIAL POSITION 2019 2 952 2 067 885 Restated 2018 3 234 1 843 % change (8.7) 12.1 (36.4) 20.9 1 391 8 355 10.8 10 103 4 710 2 647 2 746 4 251 2 332 13.5 54.9 1 772 Rimillion Non-current assets Property, plant and equipment Other non-current assets Current assets Inventories Trade and other receivables Other current assets Total assets Equity Non-current liabilities Current liabilities Trade and other payables Other current liabilities Total equity and liabilities 13 055 11 589 12.6 4 424 4 913 392 7 750 7 303 447 448 6717 11.0 (12.4) 15.4 17.3 (8.9) 6 227 490 13 055 11 589 12.6