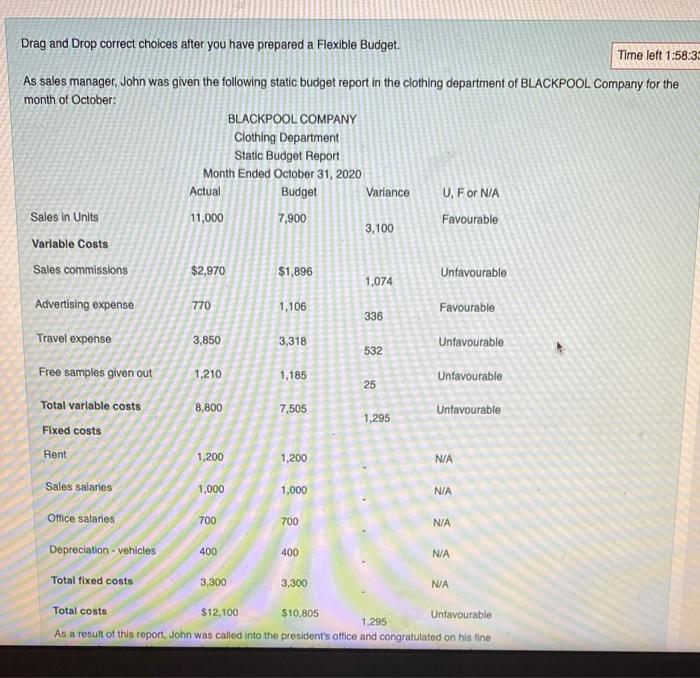

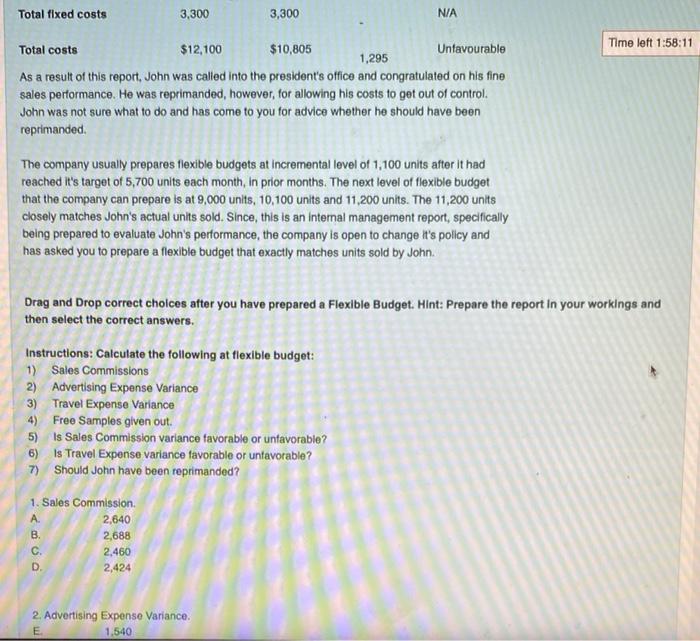

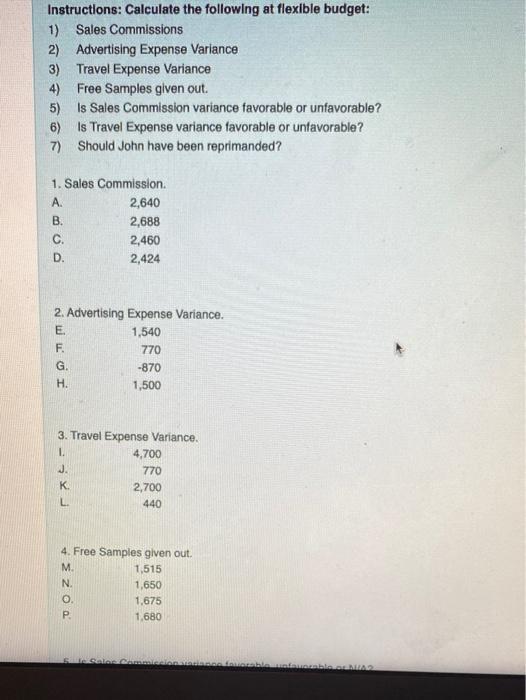

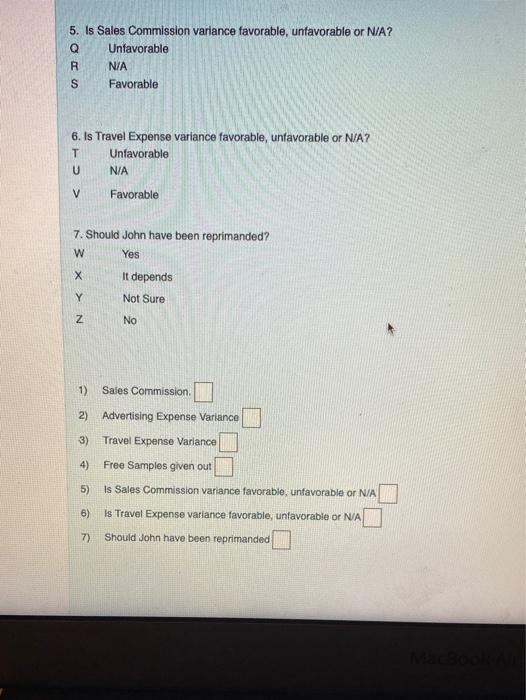

Drag and Drop correct choices after you have prepared a Flexible Budget. Time left 1:58:33 As sales manager, John was given the following static budget report in the clothing department of BLACKPOOL Company for the month of October: BLACKPOOL COMPANY Clothing Department Static Budget Report Month Ended October 31, 2020 Actual Budget Variance U, For NA Sales in Units 11,000 7,900 Favourable 3,100 Variable Costs Sales commissions $2,970 $1,896 Unfavourable 1,074 Advertising expense 770 1,106 Favourable 336 Travel expense 3,850 3,318 Unfavourable 532 Free samples given out 1,210 1,185 Unfavourable 25 Total varlable costs 8,800 7,505 Unfavourable 1.295 Fixed costs Rent 1,200 1,200 N/A Sales salaries 1,000 1,000 N/A Office salaries 700 700 N/A Depreciation - vehicles 400 400 N/A Total fixed costs 3,300 3,300 N/A $10,805 Unfavourable Total costs $12,100 As a result of this report, John was called into the president's office and congratulated on his line 1,295 Total fixed costs 3,300 3,300 N/A Time left 1:58:11 Total costs $12,100 $10,805 Untavourable 1,295 As a result of this report, John was called into the president's office and congratulated on his fine sales performance. He was reprimanded, however, for allowing his costs to get out of control. John was not sure what to do and has come to you for advice whether he should have been reprimanded The company usually prepares flexible budgets at incremental level of 1,100 units after it had reached It's target of 5,700 units each month, In prior months. The next level of flexible budget that the company can prepare is at 9,000 units, 10,100 units and 11,200 units. The 11,200 units closely matches John's actual units sold. Since this is an Internal management report, specifically being prepared to evaluate John's performance, the company is open to change it's policy and has asked you to prepare a flexible budget that exactly matches units sold by John. Drag and Drop correct choices after you have prepared a Flexible Budget. Hint: Prepare the report In your workings and then select the correct answers. Instructions: Calculate the following at flexible budget: 1) Sales Commissions 2) Advertising Expense Variance 3) Travel Expense Variance 4) Free Samples given out 5) Is Sales Commission variance favorable or unfavorable? 6) Is Travel Expense variance favorable or untavorable? 7) Should John have been reprimanded? 1. Sales Commission . 2,640 B 2,688 C 2.460 D. 2,424 2. Advertising Expense Variance. E 1.540 Instructions: Calculate the following at flexible budget: 1) Sales Commissions 2) Advertising Expense Variance 3) Travel Expense Variance 4) Free Samples given out. 5) Is Sales Commission variance favorable or unfavorable? 6) Is Travel Expense variance favorable or unfavorable? 7) Should John have been reprimanded? 1. Sales Commission A. 2,640 B. 2,688 C. 2,460 D. 2,424 2. Advertising Expense Variance. E 1,540 770 -870 H 1,500 3. Travel Expense Variance. I. 4,700 J. 770 K. 2,700 L. 440 + zoa 4. Free Samples given out. M. 1,515 1,650 1.675 . 1,680 Relea blo 5. Is Sales Commission variance favorable, unfavorable or N/A? Q Unfavorable N/A Favorable 6. Is Travel Expense variance favorable, unfavorable or N/A? T Unfavorable U N/A V Favorable 7. Should John have been reprimanded? W Yes It depends Y Not Sure No 1) Sales Commission 2) Advertising Expense Variance 3) Travel Expense Variance 4) Free Samples given out 5) Is Sales Commission variance favorable, unfavorable or N/A 6) Is Travel Expense variance favorable, unfavorable or NA 7) Should John have been reprimanded