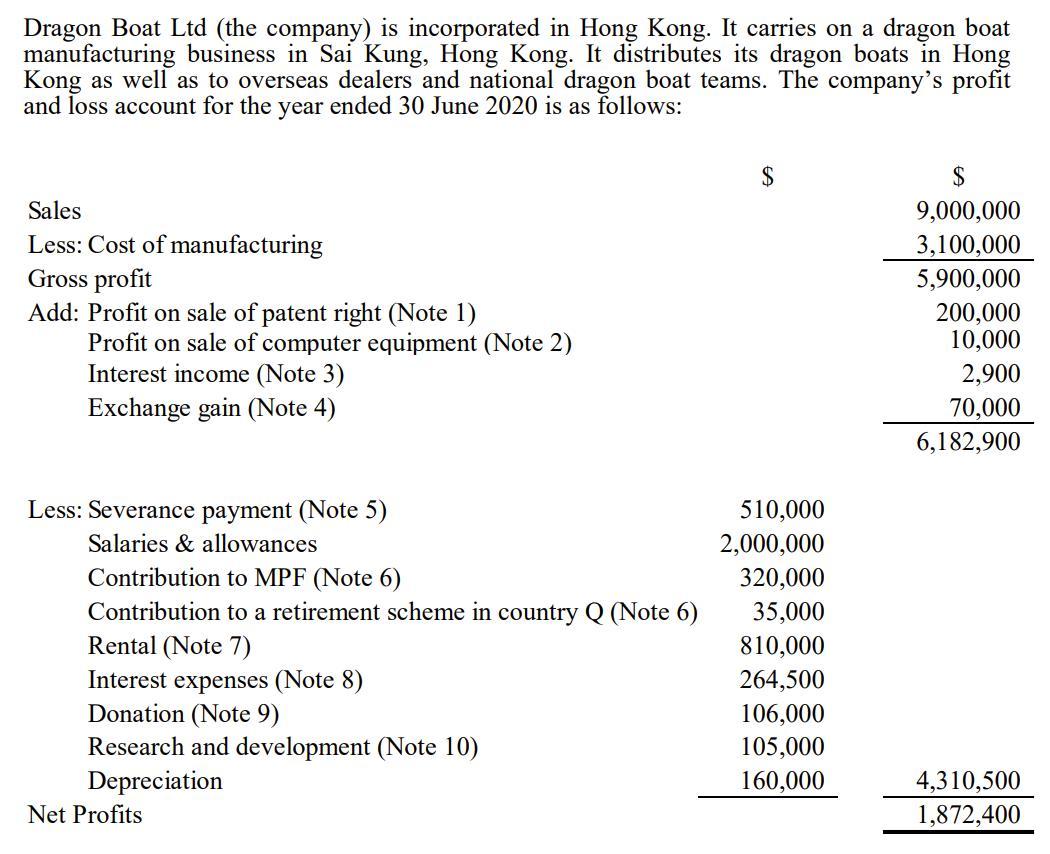

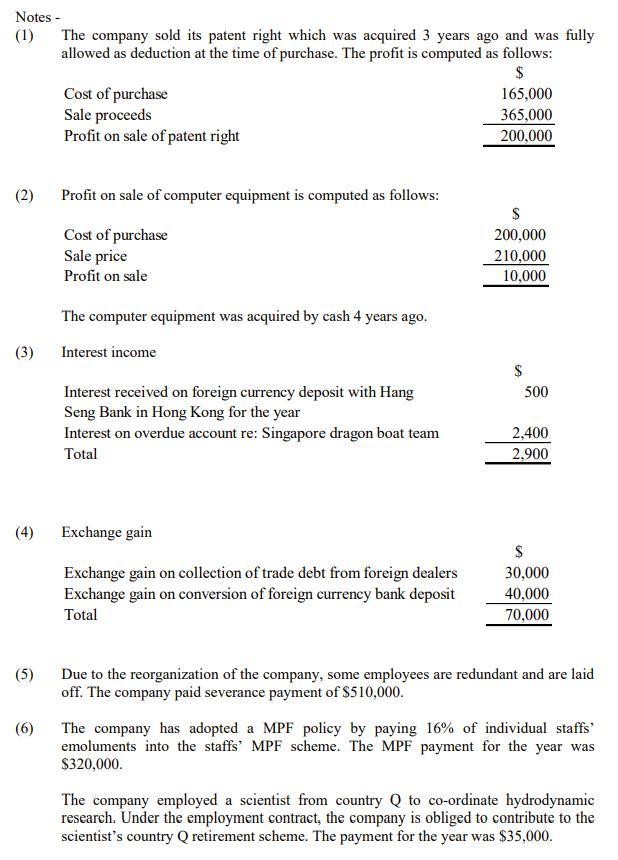

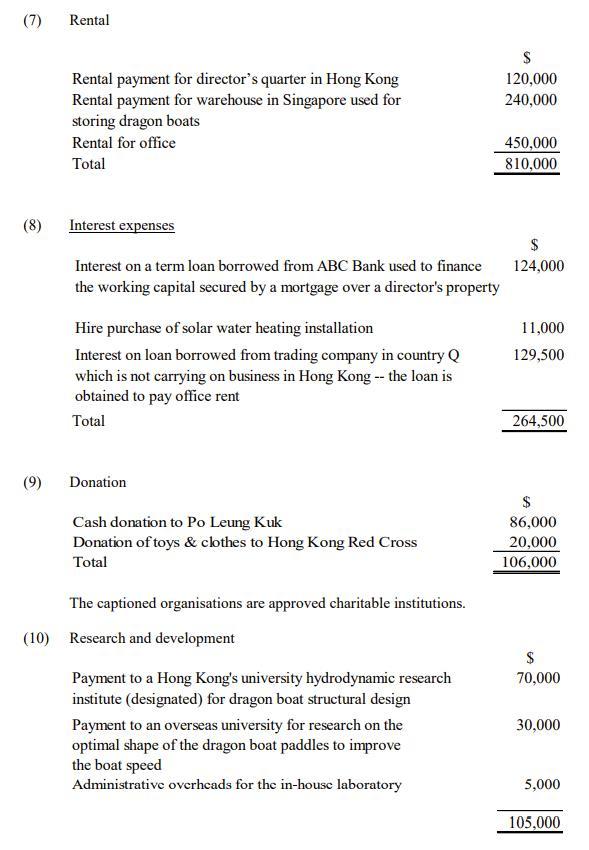

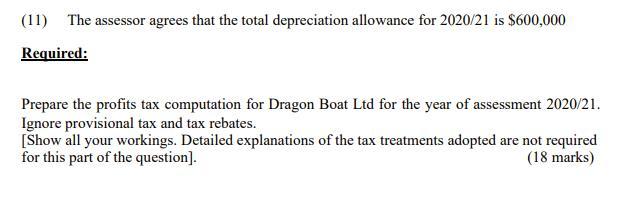

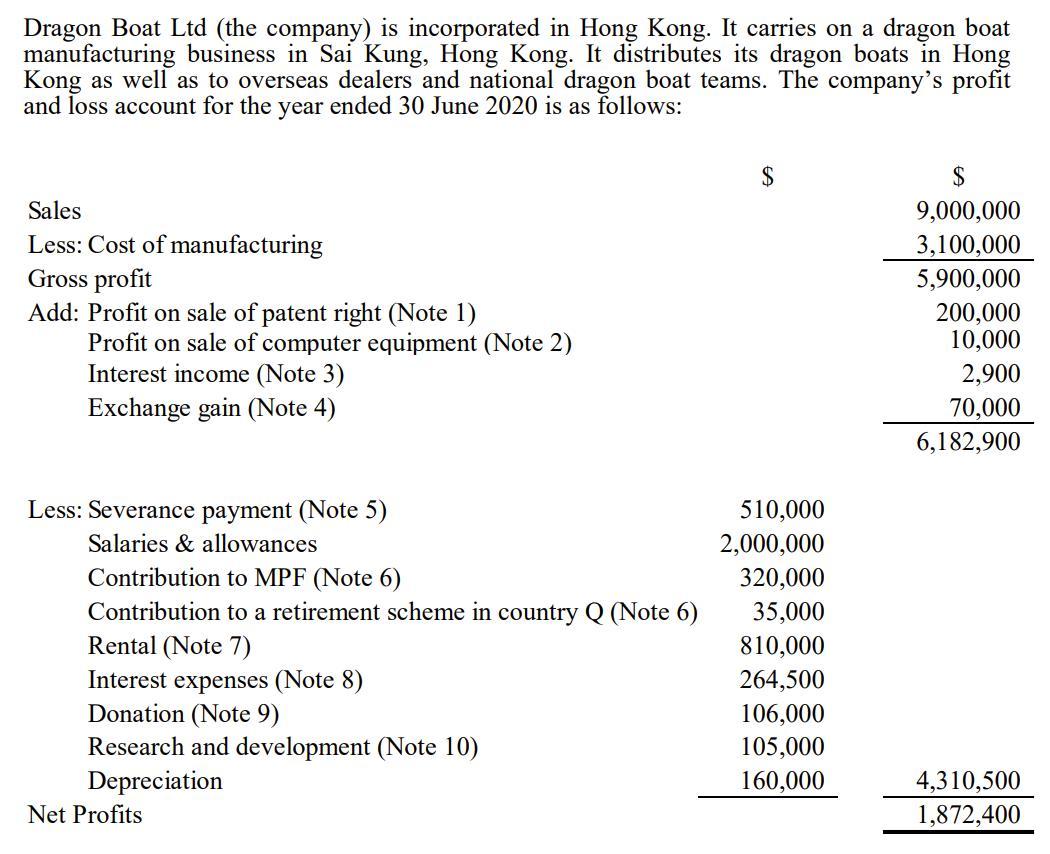

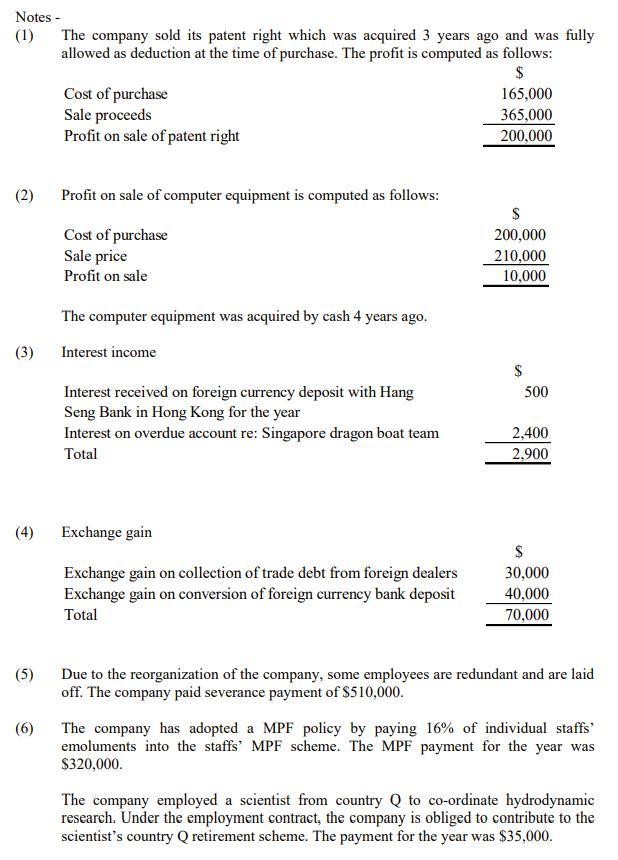

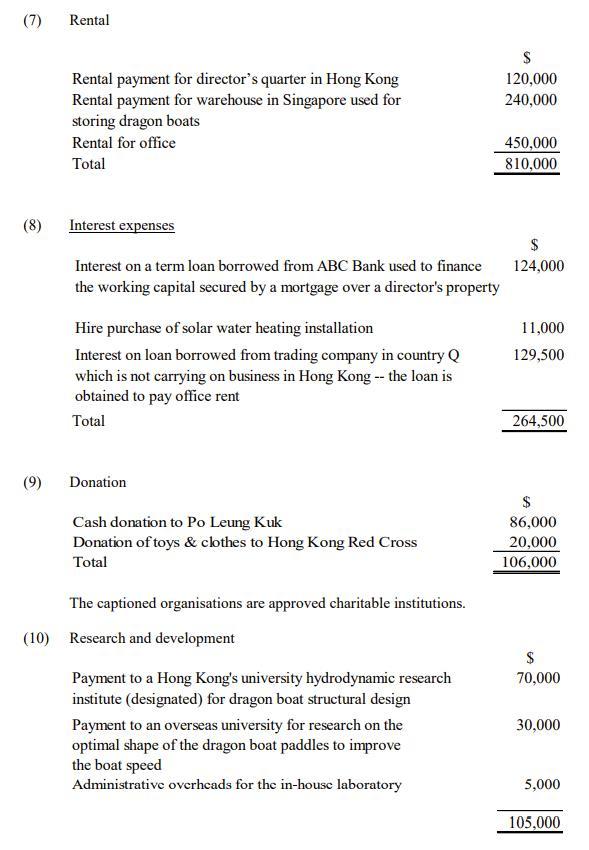

Dragon Boat Ltd (the company) is incorporated in Hong Kong. It carries on a dragon boat manufacturing business in Sai Kung, Hong Kong. It distributes its dragon boats in Hong Kong as well as to overseas dealers and national dragon boat teams. The company's profit and loss account for the year ended 30 June 2020 is as follows: $ Sales Less: Cost of manufacturing Gross profit Add: Profit on sale of patent right (Note 1) Profit on sale of computer equipment (Note 2) Interest income (Note 3) Exchange gain (Note 4) $ 9,000,000 3,100,000 5,900,000 200,000 10,000 2,900 70,000 6,182,900 Less: Severance payment (Note 5) Salaries & allowances Contribution to MPF (Note 6) Contribution to a retirement scheme in country Q (Note 6) Rental (Note 7) Interest expenses (Note 8) Donation (Note 9) Research and development (Note 10) Depreciation Net Profits 510,000 2,000,000 320,000 35,000 810,000 264,500 106,000 105,000 160,000 4,310,500 1,872,400 Notes - (1) The company sold its patent right which was acquired 3 years ago and was fully allowed as deduction at the time of purchase. The profit is computed as follows: $ Cost of purchase 165,000 Sale proceeds 365,000 Profit on sale of patent right 200,000 (2) Profit on sale of computer equipment is computed as follows: Cost of purchase Sale price Profit on sale $ 200,000 210,000 10,000 The computer equipment was acquired by cash 4 years ago. Interest income (3) $ 500 Interest received on foreign currency deposit with Hang Seng Bank in Hong Kong for the year Interest on overdue account re: Singapore dragon boat team Total 2,400 2,900 Exchange gain Exchange gain on collection of trade debt from foreign dealers Exchange gain on conversion of foreign currency bank deposit Total $ 30,000 40,000 70,000 (5) Due to the reorganization of the company, some employees are redundant and are laid off. The company paid severance payment of $510,000. The company has adopted a MPF policy by paying 16% of individual staffs emoluments into the staffs' MPF scheme. The MPF payment for the year was $320,000. (6) The company employed a scientist from country Q to co-ordinate hydrodynamic research. Under the employment contract, the company is obliged to contribute to the scientist's country Q retirement scheme. The payment for the year was $35,000. ( (7) Rental S 120,000 240,000 Rental payment for director's quarter in Hong Kong Rental payment for warehouse in Singapore used for storing dragon boats Rental for office Total 450,000 810,000 (8) Interest expenses $ 124,000 Interest on a term loan borrowed from ABC Bank used to finance the working capital secured by a mortgage over a director's property 11,000 129,500 Hire purchase of solar water heating installation Interest on loan borrowed from trading company in country Q which is not carrying on business in Hong Kong -- the loan is obtained to pay office rent Total 264,500 (9) Donation Cash donation to Po Leung Kuk Donation of toys & clothes to Hong Kong Red Cross Total $ 86,000 20,000 106,000 The captioned organisations are approved charitable institutions. (10) Research and development $ 70,000 Payment to a Hong Kong's university hydrodynamic research institute (designated) for dragon boat structural design Payment to an overseas university for research on the optimal shape of the dragon boat paddles to improve the boat speed Administrative overheads for the in-house laboratory 30,000 5,000 105,000 (11) The assessor agrees that the total depreciation allowance for 2020/21 is $600,000 Required: Prepare the profits tax computation for Dragon Boat Ltd for the year of assessment 2020/21. Ignore provisional tax and tax rebates. [Show all your workings. Detailed explanations of the tax treatments adopted are not required for this part of the question). (18 marks) Dragon Boat Ltd (the company) is incorporated in Hong Kong. It carries on a dragon boat manufacturing business in Sai Kung, Hong Kong. It distributes its dragon boats in Hong Kong as well as to overseas dealers and national dragon boat teams. The company's profit and loss account for the year ended 30 June 2020 is as follows: $ Sales Less: Cost of manufacturing Gross profit Add: Profit on sale of patent right (Note 1) Profit on sale of computer equipment (Note 2) Interest income (Note 3) Exchange gain (Note 4) $ 9,000,000 3,100,000 5,900,000 200,000 10,000 2,900 70,000 6,182,900 Less: Severance payment (Note 5) Salaries & allowances Contribution to MPF (Note 6) Contribution to a retirement scheme in country Q (Note 6) Rental (Note 7) Interest expenses (Note 8) Donation (Note 9) Research and development (Note 10) Depreciation Net Profits 510,000 2,000,000 320,000 35,000 810,000 264,500 106,000 105,000 160,000 4,310,500 1,872,400 Notes - (1) The company sold its patent right which was acquired 3 years ago and was fully allowed as deduction at the time of purchase. The profit is computed as follows: $ Cost of purchase 165,000 Sale proceeds 365,000 Profit on sale of patent right 200,000 (2) Profit on sale of computer equipment is computed as follows: Cost of purchase Sale price Profit on sale $ 200,000 210,000 10,000 The computer equipment was acquired by cash 4 years ago. Interest income (3) $ 500 Interest received on foreign currency deposit with Hang Seng Bank in Hong Kong for the year Interest on overdue account re: Singapore dragon boat team Total 2,400 2,900 Exchange gain Exchange gain on collection of trade debt from foreign dealers Exchange gain on conversion of foreign currency bank deposit Total $ 30,000 40,000 70,000 (5) Due to the reorganization of the company, some employees are redundant and are laid off. The company paid severance payment of $510,000. The company has adopted a MPF policy by paying 16% of individual staffs emoluments into the staffs' MPF scheme. The MPF payment for the year was $320,000. (6) The company employed a scientist from country Q to co-ordinate hydrodynamic research. Under the employment contract, the company is obliged to contribute to the scientist's country Q retirement scheme. The payment for the year was $35,000. ( (7) Rental S 120,000 240,000 Rental payment for director's quarter in Hong Kong Rental payment for warehouse in Singapore used for storing dragon boats Rental for office Total 450,000 810,000 (8) Interest expenses $ 124,000 Interest on a term loan borrowed from ABC Bank used to finance the working capital secured by a mortgage over a director's property 11,000 129,500 Hire purchase of solar water heating installation Interest on loan borrowed from trading company in country Q which is not carrying on business in Hong Kong -- the loan is obtained to pay office rent Total 264,500 (9) Donation Cash donation to Po Leung Kuk Donation of toys & clothes to Hong Kong Red Cross Total $ 86,000 20,000 106,000 The captioned organisations are approved charitable institutions. (10) Research and development $ 70,000 Payment to a Hong Kong's university hydrodynamic research institute (designated) for dragon boat structural design Payment to an overseas university for research on the optimal shape of the dragon boat paddles to improve the boat speed Administrative overheads for the in-house laboratory 30,000 5,000 105,000 (11) The assessor agrees that the total depreciation allowance for 2020/21 is $600,000 Required: Prepare the profits tax computation for Dragon Boat Ltd for the year of assessment 2020/21. Ignore provisional tax and tax rebates. [Show all your workings. Detailed explanations of the tax treatments adopted are not required for this part of the question). (18 marks)