Question

Dragon Corporation has three types of debt outstanding, even though it has plenty of cash. Coupons are paid on March 1. Bond P is

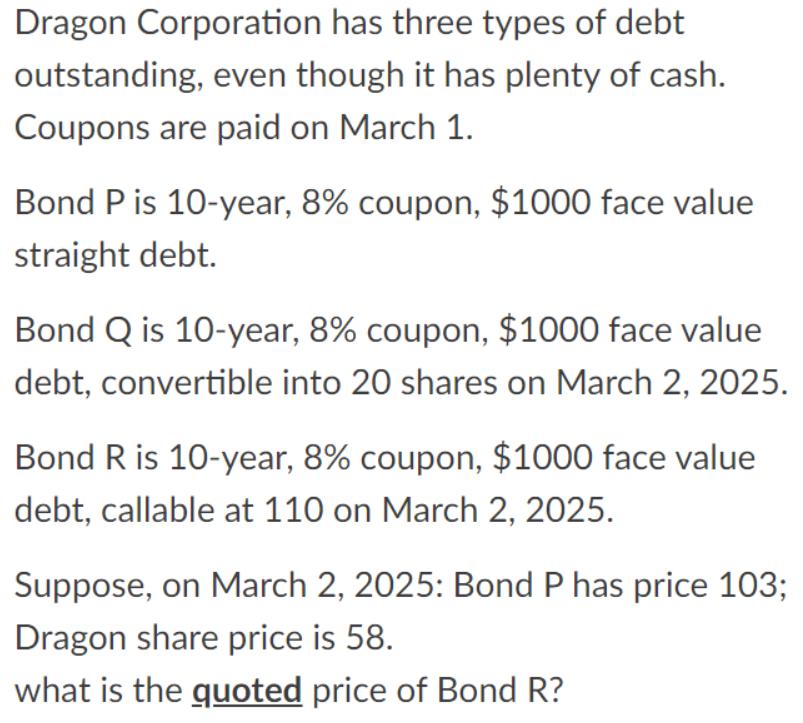

Dragon Corporation has three types of debt outstanding, even though it has plenty of cash. Coupons are paid on March 1. Bond P is 10-year, 8% coupon, $1000 face value straight debt. Bond Q is 10-year, 8% coupon, $1000 face value debt, convertible into 20 shares on March 2, 2025. Bond R is 10-year, 8% coupon, $1000 face value debt, callable at 110 on March 2, 2025. Suppose, on March 2, 2025: Bond P has price 103; Dragon share price is 58. what is the quoted price of Bond R?

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the quoted price of Bond R we need to calculate its yield to maturity taking into account the fact that it is callable at 110 on March 2 2025 The yield to maturity is the discoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Concepts In Federal Taxation

Authors: Kevin E. Murphy, Mark Higgins, Tonya K. Flesher

19th Edition

978-0324379556, 324379552, 978-1111579876

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App